d. Office Building Project Feasibility Process

f. Calculating Effective Rental Rate

o. Building Permits vs. Case-Schiller Home Price Index

4. US Office Market Real Estate Outlook

b. Economic Growth Impact to Office Asset Class

c. Historical Events in the US Office Market Landscape

a. Demographics & Technology Trends

b. Absorption Trends: Suburbs vs. CBD

n. Top US Office Deals Q4, 2016

6. South Florida Office Market Trends

a. Absorption Trends: Suburbs vs. CBD

b. Absorption Trends: By Building Class

i. South Florida Office – Select Deliveries FY 2010

j. South Florida Office – Under Construction Projects

k. Top South Florida Office Deals FY2016

e. Standby and Forward Commitments

h. Capex (Implication for ROI)

i. National Income & Expense Trends

j. National Income & Expense Summary by Region, Size, Age, Rental Range in Select Cities

k. National Income & Expense Trends in Graphical Format

l. National Income & Expense Breakdown

m. Metropolitan Miami Income & Expense Breakdown

n. National Office Building Type of Ownership Analysis

The investment climate entering 2017 has shifted from last year, mostly after the election of President Trump in November. Trump’s election set in motion a rapid rise in interest rates, and opened numerous questions about what investors should expect as far as fiscal, tax, monetary, trade, immigration and regulatory policies. Expectations of steady economic and employment growth offer investors a positive outlook, particularly for office assets, which have enjoyed six years of gains.

The economic cycle appears to be well into the seventh year of growth. During this time, more than 15 million jobs have been created and more than 460 million square feet of office space was absorbed. Many believe that the length of the cycle is indicative of a slowdown in the economy. However, few signs of a slowdown are evident. Hiring remains strong, with employers adding between 2.0 – 2.5 million jobs to the economy each year, while the unemployment rate has held below 5.0 percent range. These trends is driving new demand for office space during a period of slow office construction and will continue to drive down the office vacancy rates.

Suburban properties, often overshadowed by the Downtowns will continue to record gains and offer investors good alternative options. New leasing activity driven by professional and other technology companies are taking place. Class A rents in most markets are holding firm or growing but at a reduced pace. Almost 75 percent of the metro office markets are seeing an increase in asking rents. Construction of new office space is driven by pre-leasing contracts. But speculative development is occurring in select pockets due to perceived shortage of modern and prime assets.

The investment climate is likely to remain vibrant as buyers looking for stable returns make acquisitions from property owners ready to cash out on recent gains. Liquidity remains positive due to the shortage of inventory and high demand for office space. Investors are chasing high returns in suburban assets and institutional as well as cross-border investors are still attracted to trophy central business district assets with high-credit, long-term income stream clients.

Miami, one of the top primary markets, rents are expected to rise at or above 5 percent this year. Miami ranks in the top ten of the high-yield markets as its Class A institutional assets seldom trade, causing the high volume of Class B/C properties to skew the yield.

The dynamics point to an engaging year of investment activity with a wide range of buyers and sellers repositioning portfolios as they re-assess their strategies ahead of the anticipated changes the new president will bring. There will be many uncertainties along the way for investors in the coming year, with prospects of steady economic growth offsetting a rising interest rate environment and a potentially more aggressive Federal Reserve.

Per, the Building Owners Management Association (BOMA), “office space is classified into three classes and in accordance with one of two alternative bases: metropolitan and international. These classes represent a quality rating which indicates the ability of buildings to attract similar types of tenants. The metropolitan base is for use within an office space market and the international base is for use primarily by investors among many metropolitan markets.

A combination of factors such as rent, building finishes, system standards and efficiency, building amenities, location/accessibility and market perception are used as relative measures. Building amenities include food facilities, copying services, express mail collection, physical fitness centers or child care centers.

As a rule, amenities are those services provided within a building. The term also includes such issues as the quality of materials used, hardware and finishes, architectural design and detailing and elevator system performance.” (BOMA, 2017)

Metropolitan Base Definition

Class A – The most prestigious buildings competing for premier office users with rents above average for the area. Buildings have high quality standard finishes, state of the art systems, exceptional accessibility and a definite market presence.

Class B – Buildings competing for a wide range of users with rents in the average range for the area. Building finishes are fair to good for the area. Building finishes are fair to good for the area and systems are adequate, but the building does not compete with Class A at the same price.

Class C- Buildings competing for tenants requiring functional space at rents below the average for the area. (BOMA, 2017)

International Base Definition

Investment- Investment quality properties are those that are unique in their location in the best metropolitan markets in the world, their design and construction quality, the profile of tenants, the tenant markets that they serve and the top-notch management. These properties stand out as leaders not only within their own metropolitan areas but also within the international investment community.

Institutional- Institutional grade properties are those of sufficient size and stature that can command attention by large national or international investors. These properties are of good design and construction, but they are not monumental in design and will not use the best construction materials. They will have a very stable tenant base. (BOMA, 2017)

Speculative properties usually will conform to popular design, but also will not use the best construction methods and materials. The design and construction of these properties emphasizes functionality instead of image and do not carry the name of any particular tenant. (BOMA, 2017)

Four major office building types are widely used for categorizing purpose:

Office buildings can also be classified by their use and owners. Building can be single- or multiple-occupant structures.

In most urban areas, at least four distinct types of office hubs can be found:

First step in the process is to conduct a market analysis to determine if a market exist for the office product. It also it provides direction for site selection and design by indicating the type of space and amenities that office users are looking for.

Market analysis is a study of demand and supply which is used to determine vacancy rates, cap rate, and property values. Developers must keep in mind the reasons why companies look for new space and attempt to fulfill those demands.

Market analysis also provide critical input to the financial analysis which will ultimately be used to demonstrate the feasibility of the project to investors and lenders.

(Peiser, 243)

It is important to look at subleases when assessing supply because, although technically leased, it is often available, formally or informally, and is thus part of the market competition.

Shadow space is a leased space for which a tenant pays rent but it is vacant or not fully occupied and it is not yet available for sublease. It is a potential threat to a building’s rental stability and market recovery during a down cycle because an increase indicates tenant contraction, which can eventually increase vacancy if the trend continues. Shadow space is inefficient to landlords because it cannot be considered stable income and the space could be offered on the market with a better return. Unfortunately, none of the published resources track shadow space and assessment can only be done by talking to area property managers. (Peiser, 246)

An important distinction in office market analysis is the difference between quoted (face) rent and effective rents. Property owners sometimes use incentives to maintain the appearance of certain rent levels while effectively reducing rent for certain times or tenants.

Typically, lenders determine a specific rent and preleasing threshold as a

condition of funding or for releasing of the developers’ personal guarantee on the construction loan. To meet these conditions in a soft market, developers may offer tenants concessions in the form of free rent for a specified period, an extra allowance for tenant improvement, or moving expenses, if the rent meets the lenders requirements.

Concessions such as Tenant improvements are market driven, by lease type, property type, and location. Rental concessions are harder for market analysts to identify than asking rents because brokers tend to understate concessions due to the negative influence on their commission. Concessions is a common practice across markets and there are several factors influencing the numbers and amounts of concessions. Lenders generally use effective rent rate in their analysis before funding a loan. (Peiser, 246)

Site selection is crucial part of project feasibility analysis because it affects the rent and occupancy levels. Developers must compare location access, physical attributes, zoning, development potential, and rents and occupancy of comparable buildings and sites to identify the right opportunities and obstacles.

In general, office use can support the highest rents of any land use type and thus is often located on the highest-priced land. This factor should not deter developers because a high price is usually indicative of site desirability. Similarly, developers choosing sites based on lower prices can find themselves unable to compete in the market, even at lower rates.

Th site should be able to accommodate an effective building design and in accordance to local demands.

Primary consideration in site selection should be convenient access to regional transportation systems. Public transportation system is important in urban locations. Developers should look for sites highway and transit access and check with transportation authorities before proceeding.

Lastly, office buildings should be in a site that offers a sense of place. Where synergy exists between office buildings ad activities such as restaurants, shopping, entertainment, hotels, and residential uses. (Peiser, 247)

Per Peiser, the key to successful office design is to address area market and building codes and offer an efficient building at an appropriate price. Among the major design decisions, are the shape of the building, interior design, bay depths, type of exterior, and lobby design, all of which create an image and identify the structure. (Peiser, 251)

Office buildings also need to be adaptable and flexible to meet the shifting demands of tenants. Today’s workplaces are different from those of the past. Formerly, executive offices were on the perimeter with several workstations around them. Poor acoustics, limited flexibility and views, and a lack of meeting space was common.

Now, the walls are coming down because of the changing work styles, mobility, and the growing presence of Millennials.

“More than ever, we see young companies owned or dominated by Millennials moving toward historic downtown buildings, where they’re installing sustainable, laid-back interiors with clean furniture systems and high finish quality.” (BCNETWORK, 2017)

“With 72 percent of corporate real estate executives tasked by the responsibility of productivity improvements, decision makers are putting emphasis on modifying their facilities to support creativity, focus, and teamwork. In some high-tech companies run by Millennials, nonconventional workspaces are the thing. “Millennials are collaborators, and they don’t like to isolate themselves,” says Marlyn Zucosky, IIDA, Partner and Director of Interior Design with JZA+D “Providing more open places for informal meetings is a successful strategy. And Millennials in general have a lower demand for privacy than Baby Boomers.” High-tech companies are amplifying this trend, according to a workplace experts. (BCNETWORK, 2017)

“Hierarchy, tenure, and seniority are no longer the key factors in design, and flexible work zones are displacing high, opaque walls.

With workers spending more time away from their workstations, workplace density is on the rise. Per the global technology research firm Gartner Group, knowledge workers typically spend just 40 percent of their time at their desks, and non-group tasks have decreased to about 20 percent of the working day. Thus, personal workspaces decreasing 30–40 percent.” (BCNETWORK, 2017)

In 2001, an average of 300 SQF was allotted per worker. By 2010, space allocation was down to 225 SQF––and in 2012, it dropped to 176 SQF per person. Per CoreNET Global (A Corporate Real Estate Association) the metric could go as low as 100 SQF per person within a few years. In part, the trend is the result of moving casual meetings from the cubicle or office to a huddle area. (BCNETWORK, 2017)

Before we get into into the world of national and local office asset data, statistics, and metrics, we must first examine the state of the US economy as this is going to provide the rational for the current as well as future Office Market behavior.

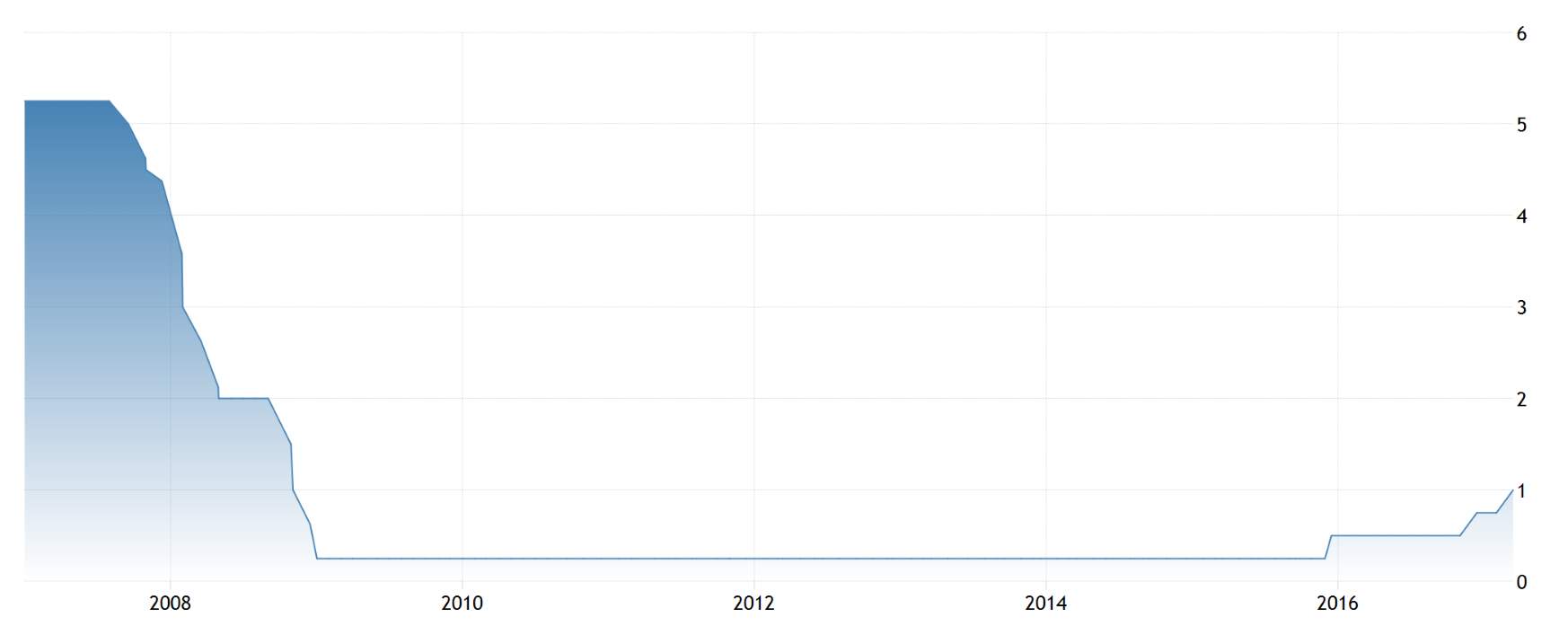

The Federal Reserve raised the target range for its federal funds by 25 base points from 0.75 percent to 1 percent during its March 2017 meeting. The decision came in line with market expectations as the labor market strengthened and economic activity continued to expand. Interest rate forecasts point to another two rate hikes this year. In the Fed’s view, the economy is growing quickly enough and should not overheat. However, the increase to the target rate is minor and all types of interest rates remain very low. An increase in interest rate, tends to trigger a slow-down in barrowing which in turn slows own the economy. (Tradingeconomics, 2017)

Figure 1 US Fed Funds Rate (Source: Tradingeconomics.com | US Bureau of Economics)

Per international brokerage firm Marcus & Millichap, strength in the overall domestic economy, tightening monetary policy and expanding government spending will continue to drive interest rates and the US dollar. The upside is that higher interest rates in the US could attract more foreign investment, at the expense of American exports which could become more expensive, imposing difficulty for US manufacturers. The central bank anticipates raising the Fed Funds rate three more times this year. (Marcus & Millichap, 2017)

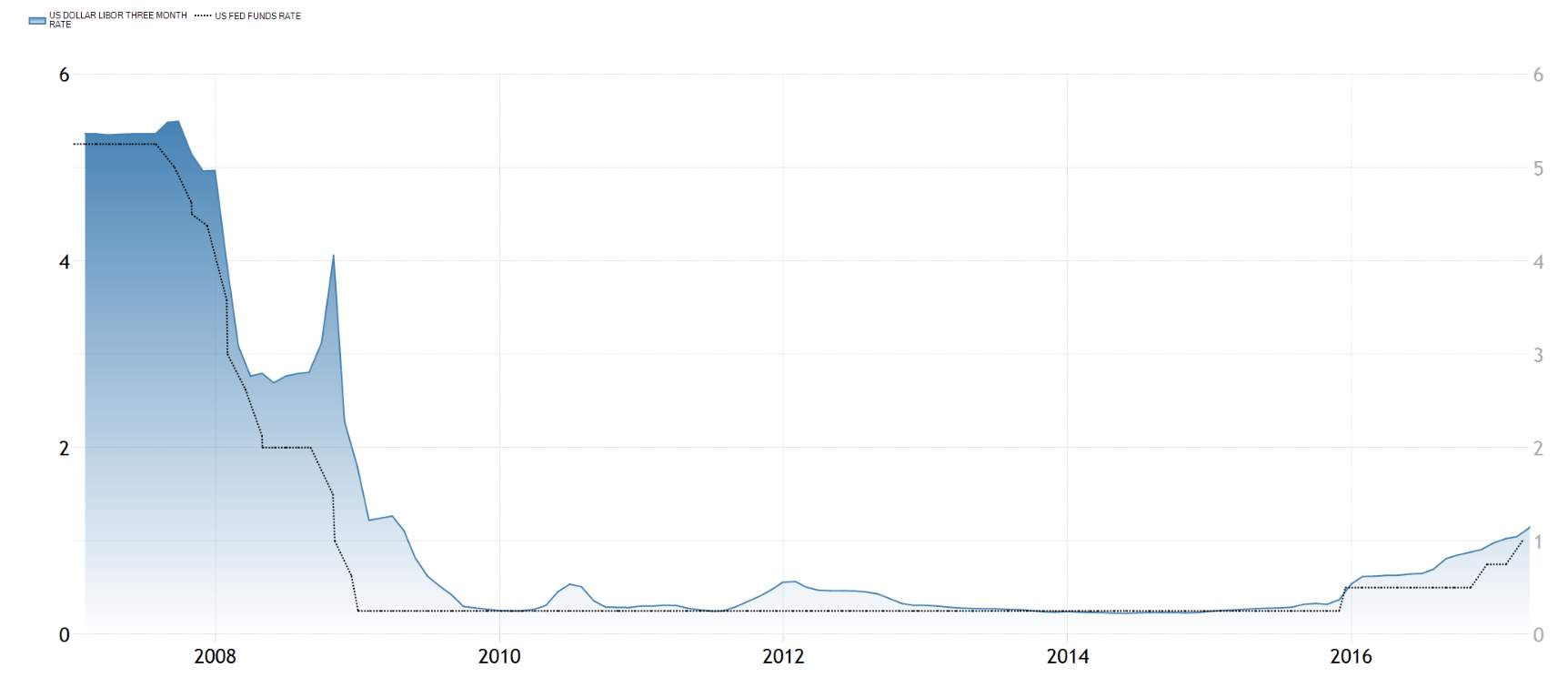

US Dollar LIBOR Three Month Rate was quoted at 1.15 percent on Monday April 3. Interbank Rate in the United States averaged 3.88 percent from 1986 until 2017, reaching an all-time high of 10.63 percent in March of 1989 and a record low of 0.22 percent in May of 2014. LIBOR is a rate that is commonly used in short term, riskier loans as you will see later in this research. Construction loan rates are based on LIBOR for major lenders, while smaller community banks offer rates based on the prime rate. (Tradingeconomics, 2017)

Figure 2 US LIBOR Rate vs. Fed Fund Rate (Source: Tradingeconomics.com)

“The Gross Domestic Product (GDP) in the United States was worth 18036.65 billion US dollars in 2015. The GDP value of the United States represents 29.09 percent of the world economy. GDP averaged 6560.26 USD Billion from 1960 until 2015, reaching an all-time high of 18036.65 USD Billion in 2015 and a record low of 543.30 USD Billion in 1960.+ (Tradingeconomics, 2017).

“The Trump administration is signaling plans to energize domestic economic growth via infrastructure and defense spending, comprehensive tax reform and deregulation. The Republican-led Congress is likely to go along enabling quick resolution to the passage of a budget and a higher debt limit.” (Marcus & Millichap, 2017)

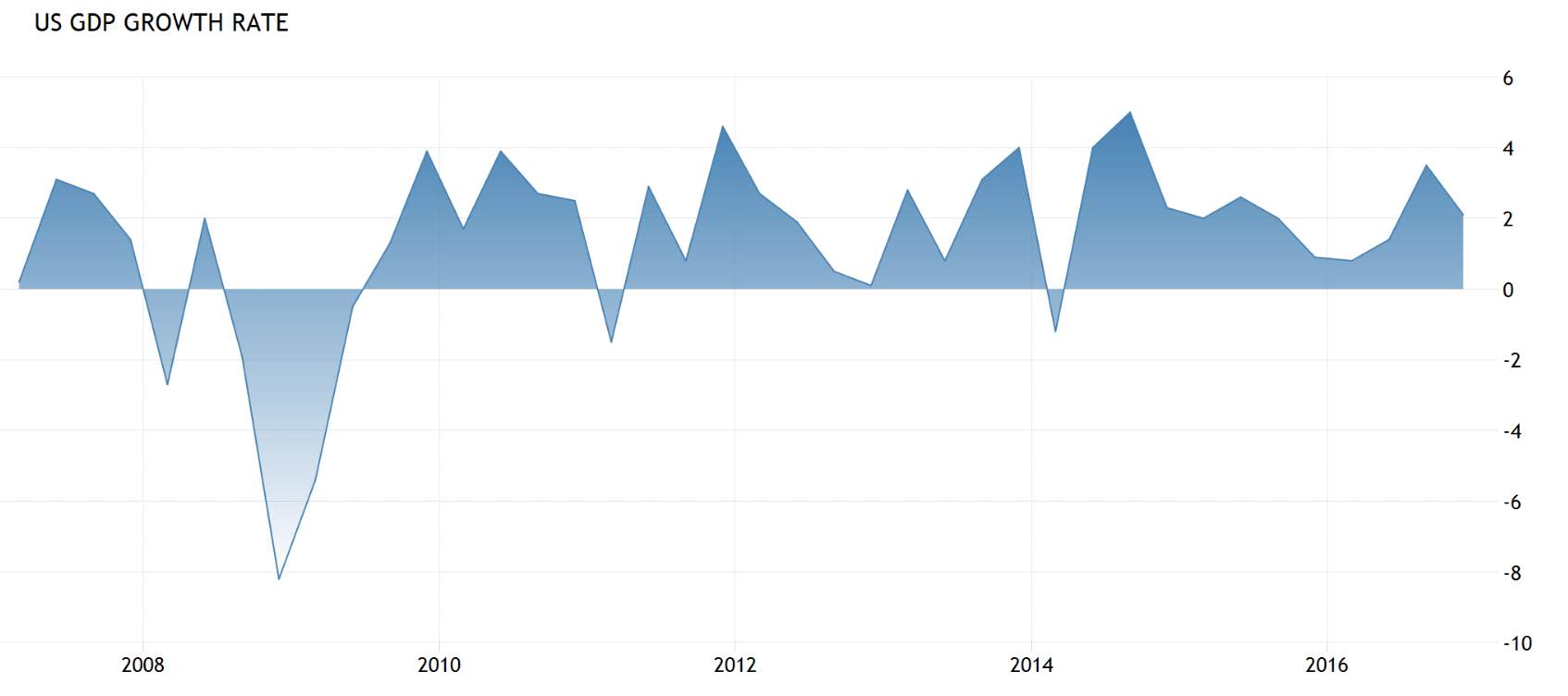

Figure 3 US GDP (Source: Tradingeconomics.com | World Bank)

The US economy grew by 2.7 percent on quarter in the fourth quarter of 2016, higher than previous estimates. Personal consumption expenditures (PCE) increased more than previously estimated. (Tradingeconomics, 2017)

Two issues could mitigate immediate growth: the tightening labor market and the ambiguity of the Trump administration’s proposals regarding fiscal policy and trade. Once the new administration’s policies are more clearly defined, the pace of economic growth could elevate as businesses proceed with greater certainty. (Marcus & Millichap, 2017)

Figure 4 US GDP Growth Rate (Source: Tradingeconomics.com)

Consumer prices in the United States increased 2.7 percent year-on-year in February of 2017, following a 2.5 percent rise in January and in line with market expectations. (Tradingeconomics, 2017)

Figure 5 US Inflation Rate (Source: Tradingeconomics.com | US Bureau of Labor Statistics)

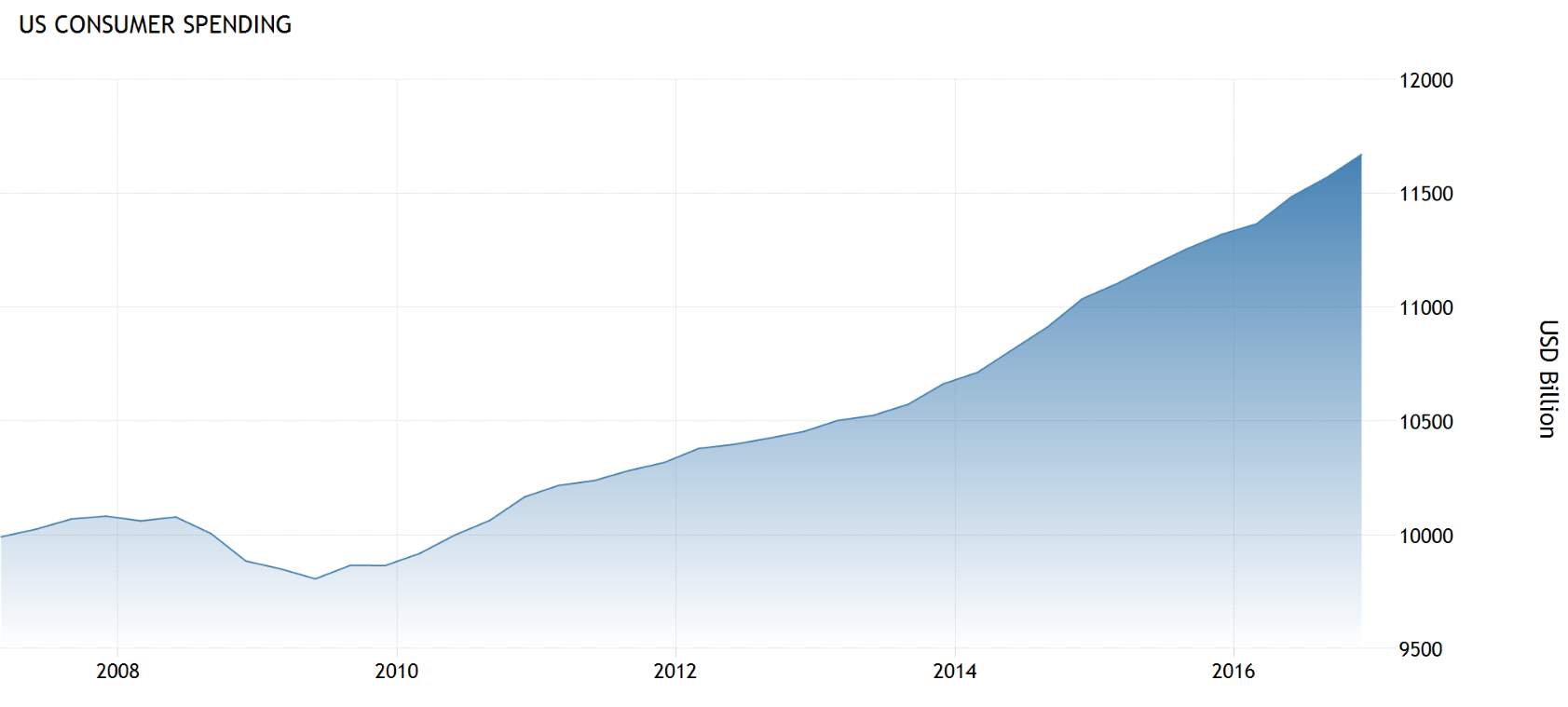

Consumer Spending in the United States increased to 11669.80 USD Billion in the fourth quarter of 2016 from 11569 USD Billion in the third quarter of 2016. (Tradingeconomics, 2017)

Figure 6 Consumer Spending (Source: Tradingeconomics.com | US Bureau of Economic Analysis)

“The Institute for Supply Management’s Manufacturing (ISM) PMI rose to 57.7 in February of 2017 from 56 in January and well above market expectations of 56. It is the highest since August of 2014 amid rising new orders and production while employment eased. Comments from the ISM largely indicate strong sales and demand, and reflect a positive view of business conditions.” (Tradingeconomics, 2017)

Figure 7 Purchasing Managers Index (Source: Tradingeconomics.com | Institute for Supply Management)

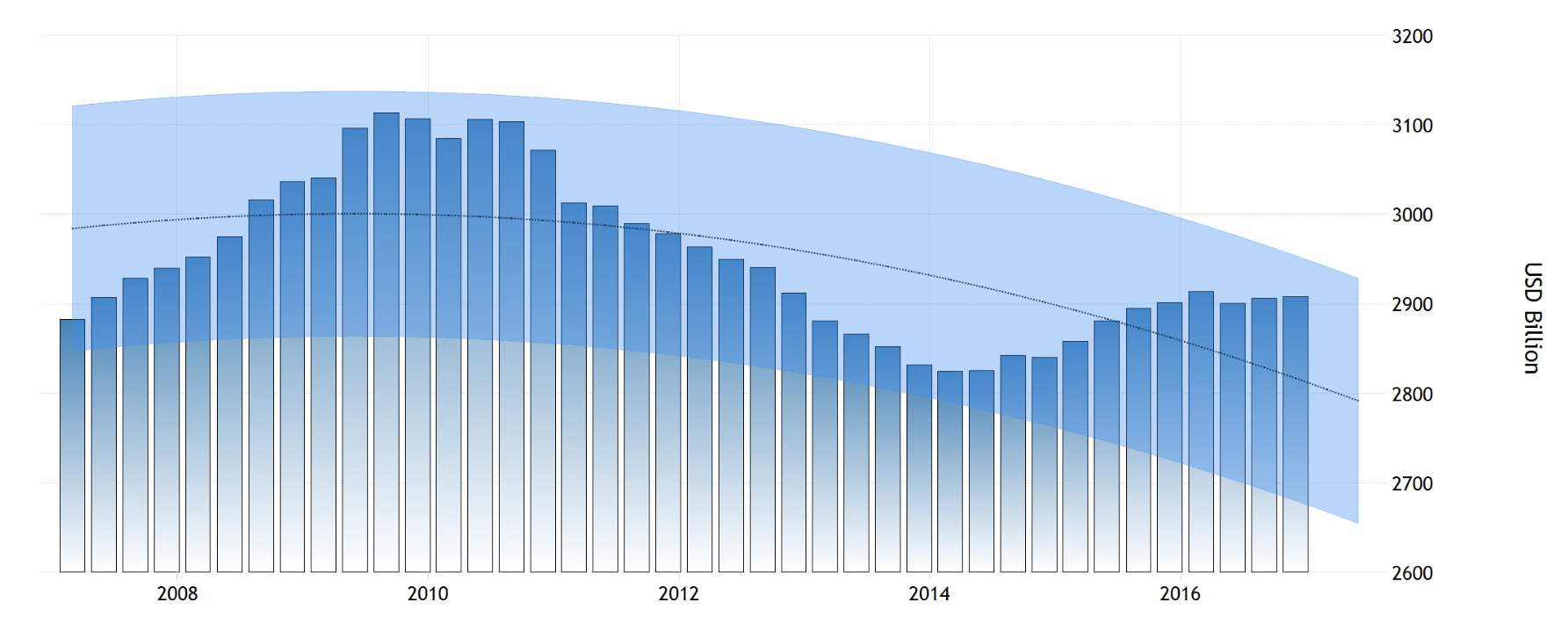

Government Spending in the United States is expected to be 2907.52 USD Billion by the end of this quarter. Analysts estimate Government Spending in the United States to stand at 2910.44 in 12 months’ time. In the long-term, the United States Government Spending is projected to hit around 2913.74 USD Billion in 2020. (Tradingeconomics, 2017)

Figure 8 US Government Spending (Source: Tradingeconomics.com | US Bureau of Economics)

Total exports from the United States rose 0.6 percent month-over-month to USD 192.09 billion in January 2017, the highest value since December 2014. Sales of industrial supplies and materials hit their strongest level since December 2014. On the other hand, total imports to the United States climbed 2.3 percent month-over-month to USD 240.6 billion in January 2017. It was the highest value since December 2014, as petroleum imports were the largest in two years and purchases of automobiles hit a record high. (Tradingeconomics, 2017)

Figure 9 US Exports (Source: Tradingeconomics.com | US Census Bureau)

The goods and services deficit in the United States increased to USD 48.5 billion in January of 2017 from a USD 44.3 billion gap a month earlier and in line with market expectations. It is the highest deficit since March of 2012 as imports jumped 2.3 percent due to consumer goods and oil and exports rose at a slower 0.6 percent. (Tradingeconomics, 2017)

Figure 10 US Balance of Trae (Source: Tradingonomics.com | US Census Burau)

For the whole first quarter of 2017, all major indices showed strong gains, with the S&P increasing by 4.6 percent; the S&P 500 by 5.5 percent; and the Nasdaq by 9.8 percent. (Tradingeconomics, 2017)

Figure 11 Down Jones Industrial Average (Source: Tradingeconomics.com)

Figure 12 S&P 500 Opening April 4, 2017 (Source: Tradingeconomics.com)

US 10 Year Treasury Bill decreased 0.03 percent or 0.03 percent to 2.39 on Friday March 31 from 2.42 in the previous trading session. Historically, the United States Government Bond 10 year reached an all-time high of 15.82 in September of 1981 and a record low of 1.36 in July of 2016. (Tradingeconomics, 2017)

Figure 13 Ten Years US Treasury Bill (Source: Tradingeconomics.com | US Department of Treasury)

It is important to highlight what the perception is on the street with respect to the 10 Year Treasure Bill vs. the S&P 500 Index. Per John Hussman, from the Hussman Fund, “last week, Treasury bill yields rose to 0.75 percent following the Federal Reserve’s quarter-point hike in the target Federal Funds rate, placing the yield on even risk-free liquidity above a 0.6 percent estimate for 12-year prospective S&P 500 annual total returns.” (Hussman, 2017)

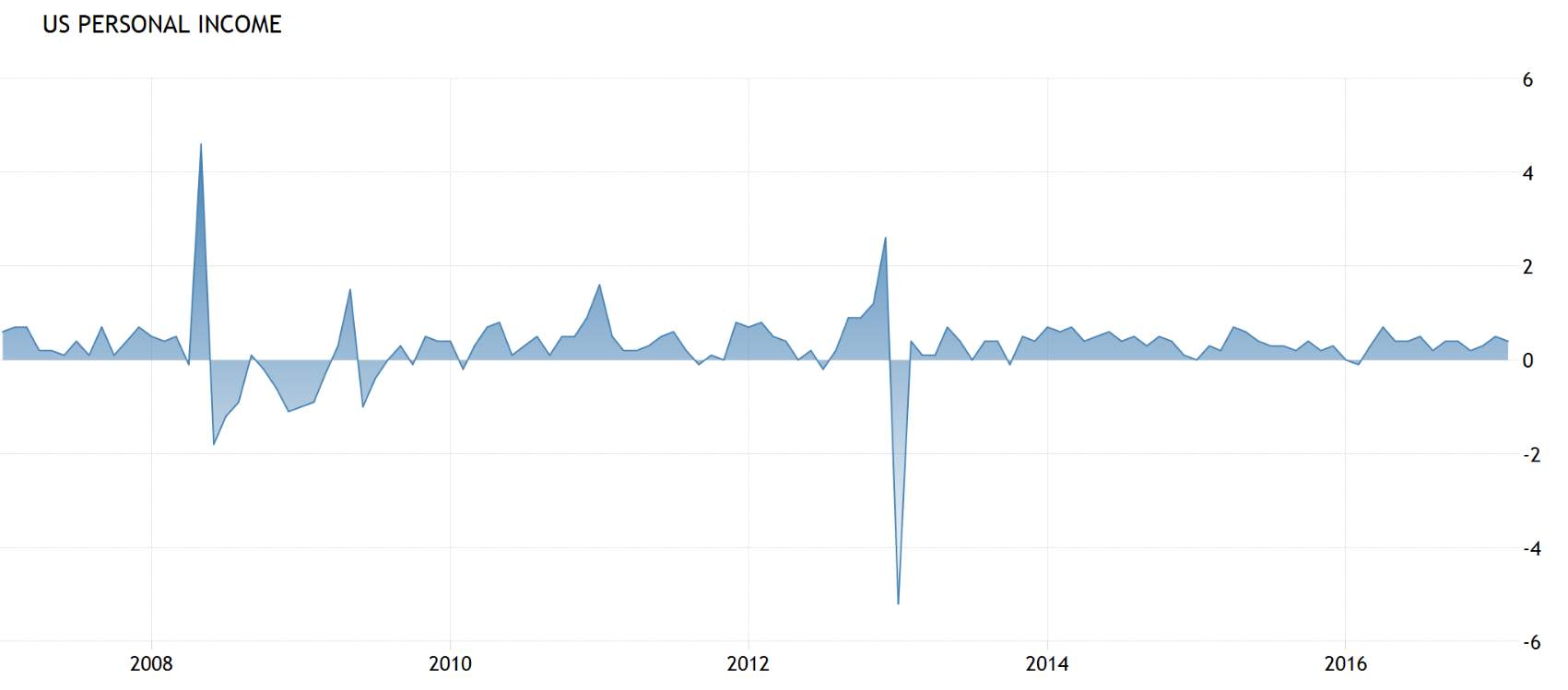

“Personal income in the United States rose by 0.4 percent month-over-month in February 2017, following an upwardly revised 0.5 percent increase in January and in line with market expectations. Wages and salaries went up by 0.5 percent, compared to 0.4 percent increase in January, and personal current transfer receipts rose by 0.2 percent after growing by 1.2 percent in the previous month.” (Tradingeconomics, 2017)

Figure 14US Personal income (Source: Tradeconomics.com US Bureau of Economic Analysis)

US unemployment rate fell to 4.7 percent in February 2017 from 4.8 percent in the previous month, in line with market expectations. The number of unemployed persons was almost unchanged at 7.5 million while the labor force participation rate increased by 0.1 percentage point to 63 percent. (Tradingeconomics, 2017).

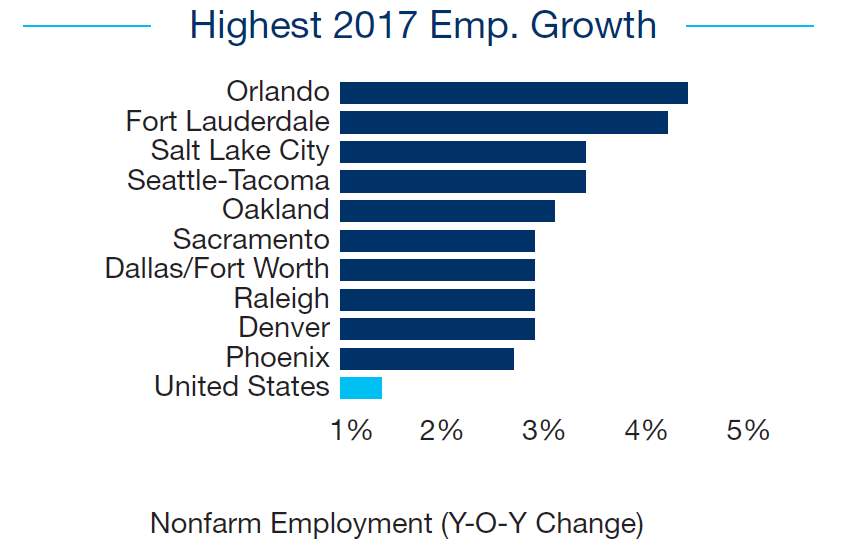

“Per Marcus & Millichap, job creation will moderate as the labor market tightens. After adding roughly 2.2 million jobs in 2016, employers will create 2.0 million

positions this year. The total includes 690,000 workers in office-using employment sectors.” (Marcus & Millichap, 2017)

Figure 15 US Unemployment Rate vs Wages (Source: Tradingeconomics.com | US Bureau of Economics)

Additional job creation within the tight labor market could raise wage pressure. Rising consumer confidence and increasing discretionary income could drive more robust spending leading to moderate economic growth. (Marcus & Millichap, 2017)

Building permits in the United States fell by 6 percent month-over-month to a seasonally adjusted annualized rate of 1,216 thousand in February 2017.

The S&P CoreLogic Case-Shiller composite index of 20 metropolitan areas in the US rose 5.7 percent year-on-year in January of 2017, following a downwardly revised 5.5 percent increase in the previous month. It is the biggest gain since July of 2017, beating market expectations of a 5.6 percent gain. (Tradingeconomics, 2017)

Figure 16 US Building Permits vs. Case-Shiller Home Price Index (Source: Tradingeconomics.com | US Census Bureau)

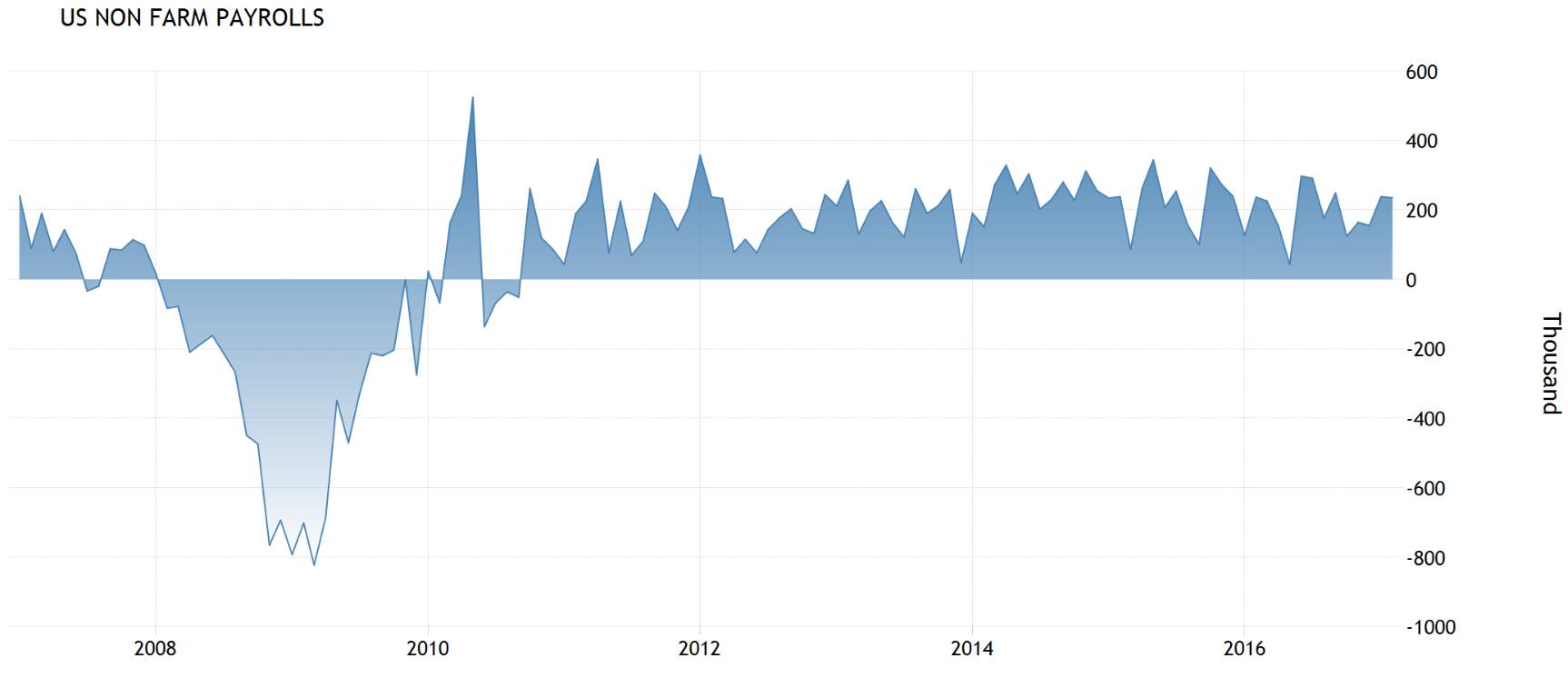

“Non-Farm Payrolls in the United States increased by 235 thousand in February of 2017, lower than upwardly revised 238 thousand in January but above market expectations of 190 thousand. Employment gains occurred in construction, private educational services, manufacturing, health care, and mining.” (Tradingeconomics, 2017)

Figure 17 US Nonfarm Payroll (Source: Tradingeconomics.com | US bureau of Labor Statistics)

“In February, construction employment increased by 58,000, with gains in specialty trade contractors (+36,000) and in heavy and civil engineering construction (+15,000). Construction has added 177,000 jobs over the past 6 months.

Employment in private educational services rose by 29,000 in February, following little change in the prior month (-5,000). Over the year, employment in the industry has grown by 105,000.

Manufacturing added 28,000 jobs in February. Employment rose in food manufacturing (+9,000) and machinery (+7,000) but fell in transportation equipment (-6,000). Over the past 3 months, manufacturing has added 57,000 jobs.

Health care employment rose by 27,000 in February, with a job gain in ambulatory health care services (+18,000). Over the year, health care has added an average of 30,000 jobs per month.

Employment in mining increased by 8,000 in February, with most of the gain occurring in support activities for mining (+6,000). Mining employment has risen by 20,000 since reaching a recent low in October 2016.

Employment in professional and business services continued to trend up in February (+37,000). The industry has added 597,000 jobs over the year.

Retail trade employment went down in February (-26,000), following a gain of 40,000 in the prior month. Job losses occurred in general merchandise stores (-19,000); sporting goods, hobby, book, and music stores (-9,000); and electronics and appliance stores (-8,000).

Employment in other major industries, including wholesale trade, transportation and warehousing, information, financial activities, leisure and hospitality, and government, showed little or no change.”(Tradingeconomics, 2017)

|

You have to be 100% sure of the quality of your product to give a money-back guarantee. This describes us perfectly. Make sure that this guarantee is totally transparent.

Read moreEach paper is composed from scratch, according to your instructions. It is then checked by our plagiarism-detection software. There is no gap where plagiarism could squeeze in.

Read moreThanks to our free revisions, there is no way for you to be unsatisfied. We will work on your paper until you are completely happy with the result.

Read moreYour email is safe, as we store it according to international data protection rules. Your bank details are secure, as we use only reliable payment systems.

Read moreBy sending us your money, you buy the service we provide. Check out our terms and conditions if you prefer business talks to be laid out in official language.

Read more