The present research aims to study peer to peer insurance as an alternative for traditional forms of Insurance. To achieve this aim the research will conduct a secondary research into Demand and Alternatives for Traditional insurance. Based on the secondary research the report presents the factors affecting g the demand for Peer to peer insurance

As purported by Damian and Ralf (2016), insurance is a tool for security from financial loss. It is a kind of risk management basically used to protect from the risk of a conditional, unknown loss. The insured individual enters into a contract called the insurance bond, in which the details of the conditions and situations are mentioned according to which the insured will be compensated. Insurance includes collection of funds from number of insured individuals to for the damages which are faced by some. The insured individuals are thus secured from risk for an amount given by them, which depends on the regularity and sternness of the occurring event.

According to Darrach (2014), Insurance is very valuable for the society in many ways but the general cognizance of the insurance contribution for the economy and society is lower. Once the loss has been suffered and compensation is anticipated then only common public, policy-makers and policy-holders begin evaluating insurance. The most important contribution of the insurance for the society is the facility of risk-sharing, risk collection and risk transferring capabilities and prevention procedures as they are involved in the insurance corporate model and essential for working of economy smoothly but are generally unnoticed. Insurance draws a borderline between the insured individual as market player and the countries part in assuring social-welfare. When the risks are not insured the state has to interfere but when these risks are insured it does not have to worry. Thus insurance works in coordination with the state in loss avoidance and in loss-compensation. It is a very wrong perception about insurance that it only provides peace of mind but it also gives a contribution to the GDP and under management assets.

According to Dorfman (2008), there are several ways to cover the risk but by taking commercial insurance costly premiums are incurred. Thinking about level of these premiums, people are starting to surprise if such insurance coverage is appropriate at all stages as the security system in people is increasing day by day. And the result is that people are switching from their commercial insurance loan process to share the responsibility for certain risks between the Borrower and Lender. This has given way to the introduction of shared liability agreements. The other system for risk coverage is a state indemnity scheme. Under this system the government supports the organization of major demonstrations by a share of risk liability from the organizer.

Aas stated by Gollier (2013), Indemnity agreement significantly cut down the financial load of an exhibition, as the organizer does not have to take insurance or only have to limited risk insurance. Besides this indemnity agreement assures the lender that it will get compensation if anything occurs to his property. This gives reduced margin in the lending of objects. At last, an indemnity agreement helps in raising institutional standards, as the state will place some requirements on the exhibition holder.

However there are criticizations leveled against this system, The claiming reports published in the last survey in Europe on indemnity schemes speaks the truth: the number of officially reported claims was 7 out of 5,605 applications got during 2003-2008 in 18 European countries. The total compensation given was very low it was only 79,981. These data show that insurers over valuated risks, that in turn are bound to lead a high insurance premium. Moreover, the statistics also show that it is completely worthy for a state to think about introducing indemnity scheme, if it is not having one or if an scheme in already existing, to amend it for the benefit at broadest possible way (Kiiru, 2012).

The smooth functioning of the scheme can be best possible by recognizing the responsibilities of the main actors in the indemnity chain like shipper, lender, borrower and the state and. By cutting down the areas of risks to lowest, while keeping the actors to control the objects.

Studies shows that the contribution of the insurance is nearly 15% in the budget of the people who use loans so, it is surprising that people adopt for chances to cut down the costs of insurance premiums. In several cases it is done by adopting indemnity scheme. Though the 100% damage compensation is not guaranteed by the government always (Mwangi, 2012). Almost every scheme is particularly have some exclusion for some specific risks like kind of people, periods or kind of loans. Mutual liability is an agreement between two parties with the aim of collective as far as possible in order to involved specific risks in loan transactions. The lender and the borrower sign an agreement knowing the fact that the borrower should have certain freedom to decide if he wants to insure his part of liability. Thus it makes a mutual relationship between the borrower and lender which is based on the trust. These people are considered as the mutual partners who use equivalent standards with respect to the exhibitions of organization. The two parties also enter into a agreement that the objects of the museum, by definition, are unique and they are not part of the economic trade (Thorpe, 2011)..

According to Wanyungu (2015), with the emergence of peer to peer insurance, A new wave started. Presently the P2P organizations are extended into a large range of finance markets comprising funding of equity crowd, financing mortgage as well as the insurance market.

Insurance firms particularly carriers of insurance are facing a huge amount of rules at the national, state and local levels and need to have a huge amount of capital for backing policies so there is nothing to be surprised if P2P has taken some time more for penetrating this sector.

Whereas several consider that the sector of insurance is ready for new model of business which is capable of bringing new operational potential that was considered before a overfed, technical industry having soaring costs. We can broadly divide insurance business P2P players into insurance movers and insurance brokers. Brokers try to bring the insurance cost down through pooling of policy-holders in little groups online. By this people having less claims could reduce their premiums as carriers of P2P really guarantee insurance policies of their own. In the recent years near about a dozen of firms for P2P insurance brokerage emerged all over the world comprising PeerCover, Guevara, InsPeer, Bought By Many, Friendsurance (Wanyungu, 2015).

The first USA based P2P organization to announce officially the plans for operating like a insurance carrier is Lemonade, lately in the previous year this Chicago based firm applied for becoming a authorized provider of insurance in New York.

The cofounders of Lemonade Shai Winninger and Daniel Schreiber stated that they selected this name of the firm as it turns the insurance experience which is considered as lemon into sweet lemonade.

Winning informed the Insurance Journal at the $ 13 million A Series funding announcement in December that how Lemonade has challenged the manner in which the insurance firms operate having a peer to peer theory of business backed by self serving technique (Mwindi, 2014).

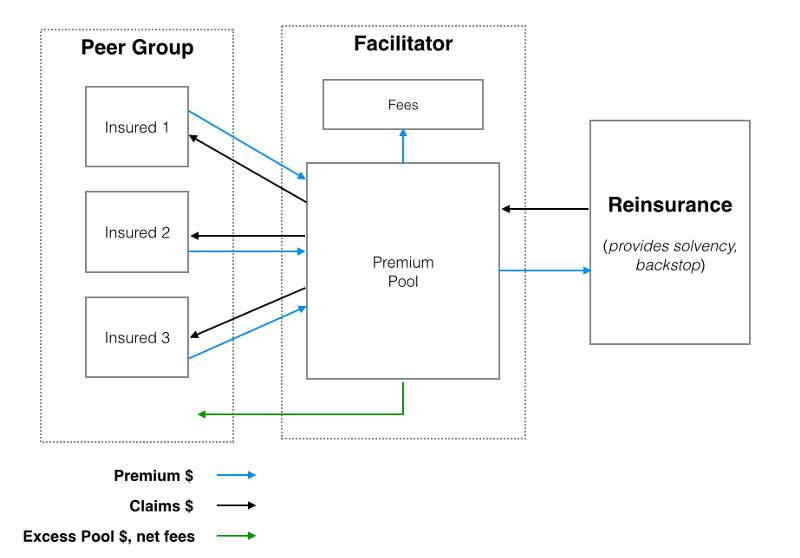

P2p insurance model

B(2013) created a model for exactly what a P2P insurance looks like.

Figure 1: P2P insurance mode

Source: Browne(2013)

These policies are pooled into groups and spread that receives the policyholders premiums.

As you’ll see, some peer-to-peer insurance services are similar to models that have been around a long time, for example, mutual insurance and reciprocal inter-insurance exchanges. But, peer-to-peer insurance services are differentiate from traditional models by a number of factors, such as:

As purported by Manning and Marquis (2014), from longtime there has been a similarity between few peer to peer insurance services theories such as reciprocal inter insurance exchange and mutual insurance. Traditional theories of insurance service can be distinguished from peer to peer services of insurance by several factors like:

• Dependence on technique.

• Focusing on the consumer

• Part of social media and social groups.

As found out by Damian and Ralf (2016) that cofounder of InsPeer, Louis de Broglie said that they showed their model to authorities of France and they need not insurance license. As it was a platform for crowd funding for insurance thus it is the subject matter for French financial regulatory. Similarly Teambrella made its point they are not subject for regulation very clearly .

Moreover responding to a query about why a individual will like to get insurance from Teambrella, as it claims that it is a regulation immune it argues that for the resolution of conflicts regulation are applied but the way of the firm for resolving the conflicts is different and it is through lining up interests. This is in favor of your teammates to do anything they consider fair and by doing that they will set the benchmark which will be used on them if a incident happens. Chris Finney the solicitor of UK and a shareholder at Cooley LLP is a advisor for European and UK regulatory matters of insurance considers that in many authorities the interest of regulators will be on the medium that is engaging in activities of P2P insurance and is not authorized knowing that it is a only a medium and all the things are done by the help of phone applications and websites etc (Kiiru, 2012)..

It is noted by Finney that when peer to peer crowd funding and lending were launched in UK it was a surprise for P2P operators that they were involved in regulation activities as they thought that regulators will not take any interest in their operations. But it was a wrong perception said Finney. The law may predate these platforms but it is applicable for them. Running a business that is regulated in UK and not authorizing it is a crime in UK. If it is proved then imprisonment or fines may be charged and it will be the end of the firm. Moreover all the contracts which you have entered in cannot be enforced and there is a possibility of enforcing them upon you these incidents are occurring in the insurance industry but the angle by which companies see and define themselves is complicated with regulatory bodies (Mwindi, 2014).

Finney adds, “some peer-to-peer insurers and peer-to-peer insurance platforms are acting as insurers, while others are really acting as insurance brokers or distributors but calling themselves peer-to-peer insurers. But the broad effect is the same. The platform needs to be authorized as an insurer, if it’s entering into insurance contracts and accepting the insurance risks; or as a broker/distributor; if the platform/system allows people who want to buy insurance to buy in from 3rd party insurers who are willing to sell it; or exempt from the obligation to be authorized. Again, the law predates these business models/ideas, but it still applies in the same way that it applies to any other insurer, or broker/distributor, regardless of the way in which the business organizes or structures itself, and regardless of how automated the business’ processes are.” Further Finny argued that any specific speeches, rules of regulatory and consultation papers are not noticed by him which connect to P2P insurance industry possibly it is due to, it being a new concept in the market. But it does not help the idea that regulators are not interested in that or the common law is not applicable on them. Indeed my idea is that it will not make any change in UK or in any other place (Browne, 2013).

Aims and Objectives

The present research aims to study peer to peer insurance as an alternative for traditional forms of Insurance.

With regards to this aim, the objectives of the present research are:

A Major number of researchers have found that difference between mutual companies and stock, basically as they recount to capability of operations and taking risk. Also, many studies inspect the initial and successive pricing and performance of IPOs demutualization.

Manning and MS Marquis (2014)., calculated the relative capability of mutual PC and stock insurers through methods of nonparametric border efficiency. Study of Cross frontier estimates the efficiency related to each form of organization by calculating the capability of each stock company relative to a set of reference which consist of all mutual companies. The theoretic hypotheses of the authors test agency about form organization, taking the managerial choice and expense preference theories. The results show that mutual and stocks are functioning on different cost frontiers and production so they represent distinct techniques. Based on the managerial choice theory, mutual technology for generating mutual outputs is dominated by the stock technology and the mutual technique dominates the stock technology in producing mutual outcomes. Though, consistent theory of the expense preference, the stock price frontier takes over the mutual price frontier. These conclusions are not consistent with the previous study done by B (2008), found that mutual insurers and stock are equally capable with control over firm size.

Browne (2013), studied the efficiency changes of life insurers of US after and before the 1980s and 1990s demutualization. The authors used two edge approaches –the value- based approach and the financial intermediate approach—to calculate the efficiency changes. The results of the value based approach shows that demutualized life insurers enhanced their capability before demutualization. On the other side, the proof using the financial intermediary method shows the efficacy of the demutualized life insurers comparative to mutual control insurers depreciates before demutualization and advances after alteration. The variance in the results between the two methods is due to the statistic that the financial intermediary method reflects financial conditions. The outcomes of both approaches recommend that there is no efficiency enhancement after demutualization comparative to stock control insurers. There is, yet, efficiency development relative to mutual control insurers when the financial intermediate approach is applied.

According to Gollier, (2013), the insurance demand is of two kinds. There is choice for the consumers to buy the insurance and the amount of cover of they want to have. Consumers can cut down their premium by selecting a higher-deductible or by lowering the sum insured. On the other hand we hope a risk averse individual who prefers to cut down their premium through a deductible, a worrying concern is that many of households are not insured in conditions of the sum insured.

Mwangi (2012) purported that the economists have been attracted towards the demand theory of the insurance and the starting is to anticipate the risk averseness of the individuals which is, they would like to take a risk that assures them the same output on average. Three researchers have found out why the demand for insurance deviate across a range of magnitudes taking income and wealth, kinds of insurance-loading and risk-aversion levels from these basic conclusions about consumer behavior. The theoretical studies have concluded that when a full insurance is bought at practically fair prices then a risk opposed individual will insure himself fully against all risks. In his famous study Mossin 1968 assumed that part coverage (through deductible) would be minimum, if there is a positive relative loading. (as happens with taxes created on amount of premium ). This prediction has got a lot of attention as it is generally predicted that many people buy full cover. On the other hand some researchers have discussed that full cover may be minimum if there is a premium will be fixed (in case if there are fixed administration amount) or when a approach to portfolio risk is taken. In this study the length of cover as taken by the level of premium brought was analyzed (Mwindi, 2014),.

Other aspect of interest is that the level to which the demand of insurance is changing with income and wealth. The basic studies have suggested that insurance is an inferior commodity as the rich having big funds are likely to be insured and take less insurance coverage. Many other reasons are related to insurance demand other than income and wealth. As for example richer people have big assets at risk and because of their lifestyle incur different types of risks. They may also have approaches for risk and different kind of education for insurance and risk. Though the connection between insurance demand and money is an field of very pragmatic interest which is researched in this study.

The experimental studies on insurance have been growing in number. However most of them are based on the health and life insurance and very few have focused on property insurance taking that of house and subjects. In a large study done in UK on noninsurance the authors concluded that about 20% households of the UK were not having insurance of contents. This study was not based on the impacts of price on insurance demand and it examined the extent at that non-insurance was attached to demographic reasons particularly with income and financial need. Eventually they concluded that half of the uninsured households had at one level got insured but discontinued them because of financial problems (Kiiru, 2012).

The relationship between demand of insurance and income has been explored by two other studies. Ehrlich et al (1972) held a study in 12 countries for 12 years. They calculated long run income ups and down of more than one stating insurance of property liability a better one.

Pauly (1994) examined data of the US Consumer spending survey from 1987 to find out the effect of the age, income and household traits on total insurance spending. Surprisingly they concluded that insurance spending to be related to age, income and household size and that the less importance of income to be more for smaller households.

There has been relatively less analysis of the effect of price on insurance demand. This is perhaps because of difficulties in finding a proxy for price. Ehrlich et al. (1972) took the approach of using the market share of foreign insurers in a country as a proxy for price assuming that the presence of foreign firms would indicate a greater level of competition and thus lower prices. They found some support for this as foreign insurer presence was positively and significantly related to general liability insurance demand. The reverse however was also found in the case of motor vehicle insurance demand. A possible explanation is that foreign insurers would stay away from a market due to an existing highly competitive market.

The other substitute for price can be taken out by comparing premiums to claims. This system was followed by Thorpe (2011) to calculate a price flexibility for disaster4 and non-disaster home insurance spending in Florida and NewYork. They found a price flexibility for home-owners insurance of about 1 but may be to their surprise the catastrophe insurance demand was more price flexible to insurance of non-catastrophe.

Thorpe (2011) conducted analysis of property causality insurance all over the country (as estimated by per capita premiums). However their area of interest was significance of legal rights and the factors of including price effect (as anticipated by the loss ratio inverse). They explored a sign of small negative flexibility of price in demand.

There are many links with non-insurance which are mentioned in Dorfman (2008), “The non-insured: Who, Why and Trends”. This report differentiated the key links of the taking up of the insurance as related to kind of house and period, financial status, stage of life and other demographic features. In this study there were conclusions consistent with taxes of state showing negative impact on the taking up of the insurance but the attempt was not made to estimate the statistical importance of these results.

Maximum products and services deliver or are likely to provide ex-post profits. Insurance, in difference, delivers ex-post benefits only when low possibility events occur. Consequently, the value of insurance to clients may not be as perfect as the value of other goods or services. Hence, studies have examined the value and need for insurance.

Dorfman (2008) claimed that insurance decreases doubt about future wealth and so permits insured’s to make improved decisions about investment and consumption. This informational worth of insurance does not need consumer risk dislike. Outlines of insurance with lengthier resolution periods should influence relatively more conclusions and have developed informational value. Experimental tests with data from the property liability insurance market recommend that the readiness to pay per dollar of coverage (as calculated by relative market need through lines of insurance) is larger for lines of insurance with lengthier resolution periods constant with an encouraging informational value of insurance. Pauly (1994), observed the factors of life insurance consumption in OECD nations. Constant with earlier results, the study discovers a noteworthy optimistic income elasticity for demand of life insurance. Demand also rises with the amount of dependents and level of learning, and declines with life probability and social security outflow. The state’s level of financial progress and its insurance market’s grade of competition seem to excite life insurance sales, although high inflation and actual interest rates incline to cut consumption. Total, life insurance demand is better clarified when the product marketplace and socioeconomic causes are jointly measured.

Browne (2013), examined the factors of intra industry trade (IIT) in insurance services. The article examines and measures the scale of IIT in insurance facilities for the US. The experimental results of the factors of IIT specify that foreign (FDI) in insurance services is an important contributor to the size of trade in insurance services. These empirical results confirm the new theoretic trade models that, contrasting the outmoded trade model that measured trade and FDI in insurance services as replacements, trade and FDI balance each other and therefore international insurance companies are funding to an increase in the size of trade in insurance services. Moreover, this study shows that trade concentration between the US and its trading associate’s hints to product variation in insurance services and therefore a rise in consumer welfare.

Pauly (1994), developed a model of price resolve in insurance markets. Insurance is given by firms that are question to default risk. Demand for insurance is in reverse connected to insurer default risk and is incorrectly price elastic as information irregularities and private data in insurance markets. The model expects that the value of insurance, measured by the proportion of premiums to cut-rate losses, is inversely linked to insurer default risk and that insurers have optimum capital structures. Price could increase or decline succeeding a loss shock that reduces the insurer’s principal, depending on reasons such as the outcome of the shock on the value elasticity of demand. Experimental tests using fixed-level data support the theory that the price of insurance is in reverse connected to insurer default risk and provide indication that prices dropped in response to the loss shocks of the middle 1980s.

Previous research suggested that the happening of a catastrophe could lead to rises in risk awareness, risk extenuation, and insurance buying behavior. Known the general damage that often is imposed by natural calamities, such an occurrence is instinctive for property risks. Likewise, Mwindi (2014) suggested that the happening of catastrophes also might be related with an amplified demand for coverage for death risk. Centered on US state level data for the period 1994 through 2004, the authors deliver evidence of a substantial relationship between calamities and life insurance demand, both for states straightly affected by the incident and for adjoining states. By the Survey of Consumer Finances, B (2007), show that the life cycle demand for dissimilar types of life insurance. Precisely, the authors test if consumers’ aversion to income instability resulting from the demise of a household’s wage earner disturbs their buying of life insurance. They grow a financial susceptibility index to control for the risk to the family, and study the life cycle demand for a number of categories of life insurance. In difference to earlier research, the authors discover that there is a association between financial vulnerability and the quantity of term life or total life insurance bought. Moreover, they find that (1) grown-up consumers use fewer life insurance to defend a positive level of financial vulnerability than younger customers, (2) life insurance demand is mutually determined as part of a family’s portfolio, and (3) families take into account the value of family members’ non monetary input in their insurance buying Kiiru (2012).

Adversative selection in insurance is the trend of individuals and corporations with higher than normal potential for claims to search to get insurance coverage to a larger degree than low risk persons or companies. For instance, people with severe health difficulties have strong causes to buy health insurance, and companies engaging workers in unsafe occupations may be chiefly tending to purchase workers’ compensation coverage. To fight adversative selection, insurers involve in careful underwriting and alter premiums for risk factors (e.g., setting high life insurance premiums for smokers). Ethical hazard in insurance recounts to the tendency of insured’s to involve in more risky actions than they would if they had no insurance. It also states to the possibility that insured’s may intentionally cause an insured incident or pretend that such an incident happened to gain insurance payments. Ethical hazard worries are lessened through careful underwriting (e.g., moral individuals, flourishing business, and occupied properties), insurance deductibles, policy omissions, conditional pricing, and other methods. In next several studies dealing with adverse selection and moral hazard in insurance

Wanyungu (2015) discussed the perseverance of adverse selection in the auto insurance market. The major set of models recognized were the single-period economical models that encourage policy-holders to sort into risk modules by selecting from a menu of agreements. In these models, each of the agreements in the menu offered to policyholders is well-defined both with respect to the quantity of coverage and the value per unit of coverage. The basic instrument of these models is simple. The policyholder is requested to tell his risk class and is then offered a multi-period compulsory insurance bond that is priced primarily according to his reply. Though, the pricing of consecutive renewals of the agreement is based on the collected loss experience up to the day of that renewal. In difference with the price-quantity agreements, which are hardly observed, knowledge related agreements are pretty common in insurance markets. Auto insurance, group life and group health insurance classically are experience linked. Self-selection can be encouraged in which decent risks select an experience-valued, multi-period agreement that is compulsory only on the insurer. Bad risks select single period agreements that are not experience valued.

Dorfman (2008) discussed the market for long term care insurance. There are three main risks for insurers that offer long term care insurance: risk of mounting costs, risk of contrary selection and risk of moral hazard. In spite of these risks, the long term care insurance is a possibly growing market for insurance businesses able to originate and design products tailor-made to this very detailed demand. According to B (2009), adverse selection or ethical hazard could be encouraged by rate parameter, which bans insurance companies from allowing for some qualities of drivers in setting premiums. By a specific data set from a greatly regulated auto insurance market, the authors discover no indication of adverse selection or ethical hazard: risk and coverage are not statistically reliant. This discovery supports the opinion that the adverse selection occurrence exists only to a very restricted degree in this market

Mwindi (2014), provided new indication on moral hazard in insurance marketplaces by examining the occurrence of automobile physical injury liability (BIL) claims. The authors conducted cross sectional reversions of countrywide BIL claims occurrence rates on variables signifying state economic, demographic, and legal features that affect the minimal costs and profits of filing claims. As a pointer of moral hazard, the authors use survey data on customer outlooks toward several types of unfair behavior connecting to insurance claims. The outcomes provide solid support for the theory that attitudes toward unfair behavior are connected to BIL claims frequency, and therefore provided evidence of major moral hazard in auto insurance markets.

Browne (2013), same as the case with the several new services and products the matter of various peer to peer insurance sectors are liable to rules of government is not sorted out yet. Due to this one would find many inventive descriptions in these sectors. They are very careful in guiding descriptors clearly as well the names which might activate regulators and people for thinking that they are giving insurance. Few of the firms are following the rules either as a broker or a insurer such as Gather, Guevera, Friendsurance and Limonade. However other consider that they are not on the radar of regulations as they only providing market, medium , portals and have a belief that their operations are not regulation subject. You must be aware of that when the Uber was started in Canada the same type of case was made that it is only a technology firm and its application help people in arranging and scheduling their rides. Now it is quite clear that several firms in the peer to peer insurance industry are considering the issues of regulatory. For instance Chris Logan while making PeerCover discussed the regulators of NewZealand to look out that if it is subject matter of regulatory schemes. As this concept of peer to peer insurance is very novel so the regulators suggested Logan to have legal expert advice. Same he did and depending on that as well as on present rules and regulations now he is very confident that his firm is not an insurer.

As Pauly (1994), states that in number of nations the insurance is considered as the assurance for providing indemnity and payment that is based on unknown future incidents. PeerCover is little bit different as it never gives guarantee but it is a non discretionary trust. Consumers’ just gives instruction to PeerCover for depositing their money in a single non interest earning bank and to claims share so by this nobody incurs loss in their group. Share and cover is based on individual’s balance and the total balance of the group.” Other measure which PeerCover took for fulfilling the needs of regulatory is the recognition as PeerCover is giving fiscal services under the law of country and it has registration for that. For satisfying the needs as a finance service provider, the firm has a strong process for complaints for the people not satisfied by the service they are getting. First the complaints go through the firm’s internal process of complaints and if the consumer is not getting satisfaction by the response then he can he take the matter to be referred for Financial Service Complaint Limited (FSCL) which is a free body for resolution of disputes.

Accoring to PwC Digital Prize, consumers are using social media heavily to search out the products of insurance and what are the others rate for the services. A very good public platform is also provided by the social media to voice any kind of dissatisfaction. [16] Keeping in mind the significant traits the insurance sector is well aware of the part of social-groups and media are the chief factors in many peer to peer insurance theories in many different ways. For instance Besure, defines itself as a medium which connect the social network power (Damian and Ralf, 2016)

Several peer to peer theories of insurance industry are focused on the concept the consumers would try social media for engaging and recruiting friends, members of family or others having same interest and the resources that they desire to secure for making a group such as Besure and Friendsurance. However, above the digital making of groups various others consider the customers groups that know one another like a group of family members or those who have similar passions and qualities such as cycling fans group have a feeling of liability and shared obligations which result in the benefit of the group. Herfuth and Frirendsurance considers that peer to peer groups of insurance could decrease the fraud as usually people never cheat their buddies moreover the members of groups are less likely to involve in dangerous behavior (Damian and Ralf, 2016)

.The cofounder of the InsPeer Emmanuelle Mury considers that the plus of peer to peer theory is that if a individual makes group with his community that makes behavior more moral for example a decreased rate of claims. It is only possible when a feeling of community is there. If the customers are really leaned to promote social relations through becoming a element of the group that is made for peer to peer insurance is not yet not cleared. As argued in the Business Review article of Harvard the concept of sharing economy have nothing about sharing. Professors of marketing Fleura Bardhi and Giana M. Eckhardt purported that if a firm is a mediator between customers not knowing one another this is an exchange of economics and customers are after effective instead of social values. [c] Rather than developing relations with the firms or other customers’ consumers are largely interested in low costs and ease. Indeed Bardhi and Eckhard preferring the phrase “ the access economy” state that their study presents that customers just desire to do purchases confidently and the companies of access economy which focus on price and ease over capability for developing links would have a edge in competition. Companies which tried for facilitating the direct links between customers found lower level of faith between strangers at the time when there was no mediation in market(Damian and Ralf, 2016)

.

The present report uses secondary research techniques and is based entirely on secondary resources. According to Saunders et al (2007), secondary research is particularly useful in subject or issues that are relatively new since participant may not have enough knowledge or experience about the subject or theme. A peer to peer insurance is relatively a new concept, therefore the researcher has adopted secondary research method.

The research will be carried out by analysis of the current peer to peer sector and trends prevailing in the sector. For this purpose, the researcher will study various factors associated with the sector, the methods and procedures carried out in the sector. The researcher will also study the performance of some major companies in the sector.

.

Friendsurance

After set up in 2010 this Germany based company is working with more than 60 German insurance companies and now it is going to be moved in Australia, connecting strangers searching for similar kind of insurance. This company has more than 100,000 consumers.

This company is acting as a broker, gives cash back bonuses every year to claim less, putting customers into small groups, and utilizing discounts in group insurance for spreading the load. It gives home contents, private liability, and legal expense insurance, as well as large number of people as a result you pay less.

Guevara

As this company is also acting as a broker is a UK based company but the difference is that here the group is made of the people you choose like trusted acquaintances, family, friends, or other users, for adding to groups made of five individual or more for insuring car. The premium goes for the group covering with discounts given to those having lower claims.

The investement in this company is made by Mosaic Ventures and it has won Wired Money’s startup pitch competition in 2014 later after just 48 hours they sold more than £100,000 premiums using a flat fee system giving of caps on the price of premiums that changes up to 100 percent for your group’s premium for the first year and premiums can drop down to 30 percent of rate of market. It means that you are aware of the limits that may exist in top and bottom.

Lemonade

It is US company landing US$13 million for seed funding (Aleph and Sequoia Capital), and it is going to set up license in Newyork for underwriting and offering policies by own, rather than depending upon other insurers acting as a broker. Other information is scanty as it’s launching is not very far.

Inspeer

It is a France based general insurance company is acting as a kind of excess insurance for family members and friends small groups. The idea behind this is to divide the excess cost, so that excess amount could be raised getting discount on insurance.

Higher the excess lower will be the premiums so when you make a claim the group members are alerted for paying their share and company cuts 10 percent of final claim to be paid out. A individual can be the member of as many groups as he desires, but maximum he can pay for each claim for any participant is €100 and across the platform €1,500.

PeerCover

This is a New Zealand company starting up with founders originated from the crypto occupancy space. It permits insurance groups to be made. Since this a actual social network so this systems looks some more complex and truly more social compared to others.

Advantages of Peer to Peer insurance over traditional Insurance

P2P firms are focused on anything from automation applications and claim process, telematics, to platforms which assist in forming the groups coming together to share the risks or seeking special coverage.

These enhanced products and platforms in the peer to peer insurance segments keep the consumer at the focus and in doing so focusing on various themes as following:

• Empowering

• simplicity

• Digital

• Cost effectiveness

Empowerment

People who are involved in the peer to peer insurance industry for them consumer empowerment is above all the things. For example including specification of products according to the need of particular group because customers are no longer interested in common products. Now they want costumed products and experience reflecting a better understanding for their risks and requirements. [8] as stated by CEO and cofounder of Bought by many, Steven Mendel. It is a UK based brokerage which focuses at overhauling of the insurance sector and give strong message to the insurance firms to treat the people as individual entity [9]

Claiming itself as the first peer to peer insurance provider backed by Bitcoin, Teambrella is on the edge of the empowerment. However, it has been not launched till now. It is based on the model in which individuals will form a team these team members will cover one another. All the features for the insurance transactions involving whether and the amount to be paid on a claim made by a team member will be decided by the team members.

Transparency

It is yet another very important feature to focus on a customer above framing policies suitable for the requirements of a individual and personalization of coverage as well as circumstances. Regarding consumers’ assurance to understand the terms of the policy and to make him clear that cost determined is supreme. The expansion of transparency also includes the factors such as to the identity of all the group members, their capability for tracking, online, the performance of group of that you are member related to claims. There is high overhead cost in insurance industry, and a large part of premiums is spent on cost in spite of loss covering, as stated Nimani.

This model of business also gives investors a chance for participating into different pools by investing money for making capital reserve requirement.

The company and the investors just divide the remaining funds of the premium pool when all claims are being paid. If there is no suffiecient cash from the premiums by the poo then investor funds will be covering the additional claims.

In addition to that if investors could lose only their original investments. Uvamo is covering all the claims beyond and above the total pool amount.

This business model of P2P insurance enhances the purchasing power of groups taking the benefit of leverage for providing the low premiums for those searching same cover of insurance.

It has been claimed by Brought By Many that they are averaging about a 20 percent of decrease in premiums in their groups.

This firms is also making coverage given to customers , beyond the savings , who are marginalized or shutting down of traditiolal markets of insurance.

For example, from long period of time the pet owners had been demanding a more comprehensive policy, covering particular problems of health that are unique to a specific breed. Cashing this opportunity Bought By Many offered over 100 various groups for pet insurance.

For providing under served insurance customers correct policy desired by them at a suitable price the o nline P2P model and group buying power is giving the potential for creating a broad range of particular groups to them.

Digital Only

To many in the traditional insurance industry, when they talk about the impact of digital on consumers, they’re referring to digital sales channels. Those in the peer-to-peer insurance sector, see digital as much more. “The digital revolution has been one of the main catalysts for customers’ ever more exacting expectations,” according to PricewaterhouseCoopers’s (PwC’s) insurance consultancy group in their

For several people in the customary insurance sector the influence of digital on customers means digital sales channels but those who are related to the peer to peer insurance industry consider digital much more than that. As stated by PricewaterhouseCoopers (PwC’s) insurance consultancy group report “Insurance 2020” One of the chief stimulator for consumers never before exact expectations is digital revolution. The consumer connection is being taken to a new level by digital prize. Credit should be given to the digital revolution as consumers are expecting ease , instinct and interaction with digital retail anywhere anytime and now they have the potential to manage the business on their own conditions with the firms as well as at a touch to compare the price of the firms. They also desire to exchange their views through social media and watch that their suggestions are being taken care of.

Cost Sensitivity

The other basic factor for the peer to peer insurance industry is the customers’ belief to look for reducing their costs. One of the creator of Friendsurance, Sebastian Herfurth consider that most of the customers get annoyed by paying a big amount for the policy that they hardly use with that they wish that they should be rewarded for having no claims. Consequently, a claim free bonus was offered by Friendsurance.

In the new InsureTech model cost sensitivity and customization both are being addressed including usage centre models such as Metromile that has advanced customer based value proposition instead of risk based for rare drivers which offered a lower base rate charging few cents for every driven mile. With an application which gives tailored driving, diagnostic tips and navigation. The technology being developed by the InsureTech segment also helps traditional insurers in keeping their costs down, making efficacy which supports them in maintaining the margin as well as decreasing the cost for their consumers.

Disadvantages of P2P insurance

But there are some questions still to be asked that what new unexpected challenges would be laid by it and how thay will be faced. Finally, P2P model has capability for disrupting the value preposition of orthodox insurance.

But for that your group should be of trusted people, as it is hoped usually that people will not cheat each other with whom they entered a deal, by any means it not unheard. By including trustworthy people in pool will make it social venture in real sense because you depend heavily on your pool’s good behavior.

Another issue is that it is only working for particular kinds of insurance.

This is being very messy as the insurance companies always has an ongoing war waging that is hardly hidden between customers and insurers because the client is betting on the claim and the company is betting on no claim. This relationship is not usually harmonious and considered as combative, particularly in US as the insurers reputation is consistently poor. The sense of getting a claim is always fight is common all over world, as this oppositional relationship is very clearly paid for and defined.

The other issue is of controlling of members in the group. What will be done if individual in group is claiming more than others? There is possibility of becoming money pot dry and in what situation members should be left with the normal excess fee turning the game for nothing but only to extra administration.

Regulatory challenges with P2P

Till now the public speeches related to P2P model are not made by many regulators of Canada. But there is one exception Quebec’s Autorité des marchés financiers (AMF) a oversight and regulatory body for financial segment of Quebec. A report was issued in April related to P2P platforms by it. However there was not any definite definition or particular examples of models referred by it was clear from the first part of the report that they are discussing about P2P insurance industry of which we are talking in this Paper.

“The AMF has noticed that companies are offering consumers platforms where they can form pools to protect similar property without using an insurer.

It has been in the notice of AMF the firms are providing customers platforms and they can create groups to secure same assets without having any insurer. Customers are required to find out the risks which want to be covered, claims and premiums processing as the group members decide collectively the claim eligibility. The AMF urged Quebecers to “be cautious due to the recent emergence of peer-to-peer risk sharing platforms” and reminded people that:

AMF cautioned Quebecers because of recent launching of P2P sharing models and made people remind that: Any offer made by the products of insurance or services either by website platform or individual from Quebe should have a licence of AMF. The platforms that are available in Quebee through the phone apps or web sometimes permit members to specific risks connected to travel, health, cars, events, homes and loss of jobs. Depending on the presently available information AMF concluded that the sevices and products provided by these firms are same as insurance sector. Still AMG is to make a decision on the fulfillment of these service and products offered by these firms. Initially they are requesting to customers to be careful. Along with that AMF also provided cases which can be confronted by customers such as incurring loss if the members of pool without any reason refused to pay the claim, and if the group is not having sufficient funds. However the report was specifically made to caution the people of risks involved in these platforms, it also got the chance to tell these firms or upcoming firms operating through latest technologies that these individual are required to contact AMF for determining if they are falling in the present framework of regulations.

Micro social risk

According to B (2014), for instance let us consider that the group of self administers is claiming and in case it is not true in that case it is tough to consider that how the P2P model will differ from the traditional model and if any cost of advantage could be eroded significantly. Validity of a claim will be decided by whom or is there any hindrance in the group for accepting the claim. Moreover, are the members having valid claim are reluctant for notifying it due their worries related to social relations.

A long term risk of finance is also there for the group members because here the group is smaller compared to that of a standard insurance firm, the extended period volatility of premium for every member can be too greater, theoriticaly the premiums could be higher offere by a traditional company.

Then there is a macro social risk. For a while let us consider that the risk metioned above are overcome by any means and P2P model turns into market standard reducing the quantity of risk pooled in society as good risks possilbly for richer people who involves themselves in pools related to private risk. It could be arguemented that may be a foul considering gender neutral pricing needs of EU if a group of men is paying low than their wives in some other group. The equivalent of US is redlining. While there is way for constructing P2P insurance with compliant to these rules that are designed for standard insurance model is this the need of the society.

Premium computation and claim verification

By applying P2P platform group members can set their own set of rules for paying claims and insuring risks. Claims and premiums are paid through distributed bitcoin wallets.

After the voting by the members it is decided that claims wii be paid or not, whenever a insured incident happens with a teammate then they are required to notify that to the other members of team through submitting a claim after that they discuss about the claim and then claim submitter gives information about the claim and information. The members of the team are provided with list of votes and a current voting result at the moment when voting is going on. In many days the voting automatically is finished. Ther is every possibility of a outcome where the claim submitter has not been persuading the other members of the team for validity of the claim till that time and voting outcome is not positive for them then if team rules allow the claimant can extend the voting period.

The present section will discuss the findings of the report by aligning the findings with the objectives of the research.

The findings of the data analysis indicate that demand for peer to peer insurance is increasing mainly due to factors such as cost effectiveness, risk cover as well as control of individuals. These factors were also supported in the review of literature in which it was discussed that the economists have been attracted towards the demand theory of the insurance and the starting is to anticipate the risk averseness of the individuals which is, they would like to take a risk that assures them the same output on average. Three researchers have found out why the demand for insurance deviate across a range of magnitudes taking income and wealth, kinds of insurance-loading and risk-aversion levels from these basic conclusions about consumer behavior.

The findings of the data analysis indicate that there peer to peer insurance is an alternative form of insurance wherein the companies in the sector are either acting as a broker, or they permits insurance groups to be made through social networks. The main attraction of peer to peer insurance is sharing of risks. This was also found out in the review of literature in which it was discussed that people are switching from their commercial insurance loan process to share the responsibility for certain risks between the Borrower and Lender. This has given way to the introduction of shared liability agreements. The other system for risk coverage is a state indemnity scheme. These schemes to rely on sharing of risks.

The findings of data analysis indicate that companies in the sector are either acting as a broker, that gives cash back bonuses every year to claim less, putting customers into small groups, and utilizing discounts in group insurance for spreading the load or they permits insurance groups to be made through social networks. The social network so this systems looks some more complex and truly more social compared to others. The main advantage and attraction of peer to peer insurance was fpund to be cost effectiveness as well as sharing of the risks.

This was also discussed in the review of literature sharing of risks and costeffectiovess have been the major reasons for people swaying towards other alaternatives of traditional insurance that people are switching from their commercial insurance loan process to share the responsibility for certain risks between the Borrower and Lender. This has given way to the introduction of shared liability agreements. The other system for risk coverage is a state indemnity scheme. These schemes to rely on sharing of risks. Thus peer to peer insurance can be viewed as an alternative to traditional insurance.

P2P deals in better way with small claim policies such as small item insurance or car insurance than big claims as life insurance. Actually, no one has so far taken life PPI, tauma, TPD or for protection of income. In terms of development of concepts crowd based insurance is still in its early period and it is still remaining the very old gain and loss theory of the past guilds. It is a rising business that needs development and attention. No doubt that this is a innovating area in insurance which will followed hopefully by new and more unique worthy models of our attention.

The existing dichotomy between insurers and clients could work out by becoming more harmonious regarding the advantages of the clients with inclination towards insurers benefits. It is the subject of the future that how it will be done but certainly P2P model is a way for fetching good in people for everybody’s mutual benefit. In many ways creating motivation for succeeding, sharing of values is changing the style of doing business and insurance is the business which can take the charge of it. Well I am not convinced that the P2P model can be scalable, but I believe that InsurTech business wave which has harnessed the Communities power as referred by Hughes for providing more tailored insurance service as inferred by advice from claims fulfillment are changing the market. Through really considering the requierements of the consumers this novel wave of community Insur Techs is not only giving present consumers good alternatives for the transitional insurers but also opening new markets. The example cited by the Rick of Lemonade is a fabulous illustration for that as there 80 percent of consumers are completely new for rental insurance and the insurers based on community are under pinned through great technique are scalable eminently.

P2P is a broader picture that is the value chain and insurance market is turning unbundled increasingly and repackaged by many Insur Tech business which are getting specialization in a particular part of value chain or market. Not many entrants are trying for becoming the new future composite insurer. If new entrant tries and becomes that then he would be probably making the legacy of tomorrow.

Certainly P2P is fuel for great driving change in this sector and underwriters and traditional providers will face the music of competition from it. It same the burgeoning in catastrophe bond market, whereas now the capital markets have much direct access in assumption of risk. London and Bermuda which are traditional reinsurance markets are now in competition for controlling that market. Now the customers and investors will have more prospects of participating in insurance than they have now, certainly P2P wii play a key role in that. It will make standard for expectations of customers regarding trust, customer experience and transparency. With the rise of other Insur Tech companies along with P2P will give a traction which P2P could not achieve lonely.

Recently a KPMG Nunwood survey displayed that well insurance firms lagging far behing other finance services firms leaving alone other sectors in overall Customer Experience Excellence 6 pillars. However no one was surprised from that till the recent some challenging alternatives to the status quo. It has shown a mirror to the insurance sector, making them realize the features of the sector which needs to be attached to the roots, with more customer focused and modernized. It is a needed wake up call for the insurers and today there more broader group of incumbants and InsurTech which in a race for winning the pockets and hearts of the consumer and this has left P2P wondering for what next.

You have to be 100% sure of the quality of your product to give a money-back guarantee. This describes us perfectly. Make sure that this guarantee is totally transparent.

Read moreEach paper is composed from scratch, according to your instructions. It is then checked by our plagiarism-detection software. There is no gap where plagiarism could squeeze in.

Read moreThanks to our free revisions, there is no way for you to be unsatisfied. We will work on your paper until you are completely happy with the result.

Read moreYour email is safe, as we store it according to international data protection rules. Your bank details are secure, as we use only reliable payment systems.

Read moreBy sending us your money, you buy the service we provide. Check out our terms and conditions if you prefer business talks to be laid out in official language.

Read more