In this paper, I will compare the economic content of three companies in different fields – Google, Lenovo, and AT&T. I will focus on type of good served, market structure, market power and author discussion.

Body

Google was founded in 1998 by two students from Stanford University, which was starting as a search engine only. Now, more than 70% of world online search requests are handled by Google, placing it at the heart of most Internet users’ experience. Although Google began as an online search firm, it now offers more than 50internet services and products, frome-mailand online document creation tosoftwarefor mobile phones,tablet and computers.Also, Google is building their own infrastructure-Fiber, which cost $84 million, and providingbroadband internetandcable televisionto a small and slowly increasing number of locations, which will be cheaper than traditional carriers.

Lenovo was founded in 1984 by ChuanZhi Liu. It is a Chinesemultinationalcomputer technology company. In December 2004, Lenovo acquired the personal computer division of the US-based IT giant IBM, which was a breaking news for the world. The purchasing made Lenovo Group get an annual revenue exceeding 10 billion US dollars.

AT&T is a multinationaltelecommunicationscorporation, which is the second large provider of mobile phone and the largest provider of fixed phone in United States. AT&T was founded in 1876 by Alexander Graham Bell, and named as “Bell Telephone Company”. There are more than 120 million customers in wireless business segment and 90% United States which has been covered by AT&T 4G LTE. Customers can use AT&T’s service in 225 countries around the world.

Google provides all kinds of type of good:

Nexus is a category products of mobile device and tablet from Google, which is private good belong to its owner. It’s in the perfectly competitive market that there are enormous sellers and buyers in the same market. Also, Google has Google glasses, which is popular wearable device. Wearable devices are disruptive innovation, which means improvement that threatens to displace the old product or industry. Obviously, Google glasses is an outstanding one in the market. Now Google makes glasses not only an accessory, but a smart wearable device: people can take pictures and research online via this pair of glasses. According to Schumpeter’s point, Cycle of Creative Destruction is the dynamic innovation process inherent in a free market economy that creates technological advances, new products and industries, triggering old existing technologies and industries to wither away and become obsolete. The innovative winners of this creative destruction process scale up to dominate their market. Eventually they become vulnerable to the next generation of innovators. Here I think Google Glass is a destructive innovation stuff in recent years, and the similar product will be produced to compete with Google Glass if the customer accept it. During this period, according to Brynjolfsson and McAfee’s point for tangible goods that when there are brick and mortar plant capacity constraints or significant transportation costs, the best seller in a market can only satisfy a small fraction of the global market. So, the Google Glass will not be in the monopoly market even though it is a descriptive innovation right now. Wearable device, like Google Glass, as an innovation product of 21 century is beating with the traditional industry, but in future, other production which is cooler than Google Glass will appear and compete with Google Glass.

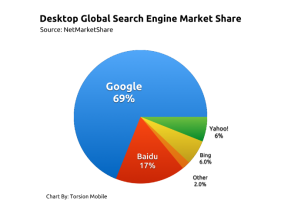

Google’s search engine organize the world’s information and nearly know everything in the world, so that helping google attracting massive users and collecting unlimited intangible data set. These personal data can be transformed by combining data sets to create a “digital identity” for online consumers, which has huge demand in the market to study customer preference. Google use data mining technology to scratch what their users are looking for, what they want to buy, and then Google push their clients’ advertisings to the top of result list. This is Google Ads, the top revenue resource of Google right now. The search engine is free, but users are paying for this service with their eyes and when they purchase a good that is advertised on research engine.  In search engine global market, the HHI is 5122.2. It means this is a high concentration market and oligopoly market in global. There are few suppliers in market, but unlimited users are using them around the world.

In search engine global market, the HHI is 5122.2. It means this is a high concentration market and oligopoly market in global. There are few suppliers in market, but unlimited users are using them around the world.

Applications in play stores are public goods with weak rivalry and weak exclusion, which means anyone can use applications but this does not limit the application available to anyone else. Due to the network effect, the more users in the market, the more applications in store. Applications are also in the completely competition market. Rosenberg mentioned Google open some sources for developers, which means releasing and actively supporting code that helps grow the Internet, to encourage more innovations. For example, Google’s “copy left” is a way to incentive innovation, which is a special strategy compared with other companies. The copy left attracts more users in every corner of the world to fulfill various needs in different functions, since the more users in their pool, the more revenue they earn in future. Copy left is a positive action for customers, developers and Google, which is also the meaning of network effect. It also becomes Google’s market power and that’s also why Rosenberg believes that Google’s future depends on the Internet staying an open system. Google is combining a public good, the open source application with advertising, creating an information compliment.

Fiber is infrastructure belong to impeded public goods, which are created through legislation, licenses, standards and regulations. Google builds the infrastructure and charges consumers for their choice of Internet access, TV and Phone, which is a new ISP in U.S market. Here Fiber is in an oligopoly market and becoming a real ISP now. There are few sellers, but lot of buyers in market; the entry barrier is high because the initial input is high; seller is the price setter; they get long term profit in maximum. Google input the fixed cost in building data centers; purchasing fiber optic backbone; and building out FTTH ISP service in selected cities. Google fiber is a good interposition for the current U.S internet service market, where users are paying almost the highest fee, but only owning the middle level of download speed. Google want to provide better user experience, but charge the same or even less fee which is trying to decrease the deadweight loss. So, Google is looking at 150 megahertz of spectrum in the 3.5 gigahertz band that traditional carriers are not interested in it because signals are only good for delivering heavy loads of data in city wide, but not a long distance service.

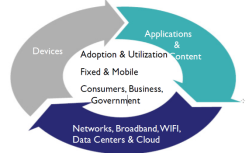

Google is a leader in web Conglomerate. Google acquired the thermostat and smoke alarm developer Nest for $3.24 billion, Waze, a traffic monitor application, for $1 billion, and Motorola’s mobile phone business for $12.5 billion.Google has also developed the product Google Glass for the wearable computing trend.Now, these services provided by Google nearly cover all corner of ICT system, which made Google become a single closed system. According to Wu’s separations principle, we should create a salutary distance between each of the major functions or layers of the information economy: Those who develop information; those who own network infrastructure; those who control the tools or venue of access. So, in Wu’s opinions, this closed ecosystem is unhealthy for ICT economy in long term.

Google is a leader in web Conglomerate. Google acquired the thermostat and smoke alarm developer Nest for $3.24 billion, Waze, a traffic monitor application, for $1 billion, and Motorola’s mobile phone business for $12.5 billion.Google has also developed the product Google Glass for the wearable computing trend.Now, these services provided by Google nearly cover all corner of ICT system, which made Google become a single closed system. According to Wu’s separations principle, we should create a salutary distance between each of the major functions or layers of the information economy: Those who develop information; those who own network infrastructure; those who control the tools or venue of access. So, in Wu’s opinions, this closed ecosystem is unhealthy for ICT economy in long term.

Except network effect which is one of source of market power I mentioned before, Google also has other kinds of market power as IPR and Economies of Scale. Intellectual Property Right includes: Copyright, Patent, Trade secret. Google bought Motorola Mobility mostly to grab its 17,000 patents and 7,000 patent applications. It has also purchased more than 1,000 patents from IBM and picked up others from telephone companies and auto parts. Google says it now controls more than 51,000 patents and patents pending. Economies of scales means a large firm can produce or service a good at a lower unit cost than a small firm. Google has more users than other search engine companies, which decreasing its marginal cost in long term.

Now, the strength of the Google is not only the strong patent portfolio I mentioned in last paragraph, but also the open source products and service and the culture of innovation. As the Google’s mission which is to organize the world’s information and make it universally accessible and useful, they also do that in their products: Google’s products can be used with any OS or mobile device and free. Many unique and interesting products and services are offered by Google every year in their annual I/O conference. In these 20 years innovation development, Google is the second patent creator in the world in 2012 since Google stands its innovative culture as one of its largest competitive advantages and market power for now and future business. But, there are still some weakness in Google’s business model, that the revenue source of Google is solo: More than 90% of Google’s revenue comes from online advertising. So in future, Google should not only provide free innovated products and service, but also develop multiple income sources, for example, Google should do more promotion on Google glasses. Now Google glasses sales volume is lower than the expected number due to the high price. That means Google should pay more attention in changing the customers’ shopping habit what Steve Jobs did 10 years ago: Make customers think Google glasses are the necessary stuffs in their life.

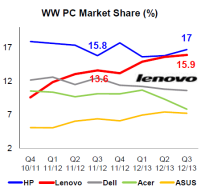

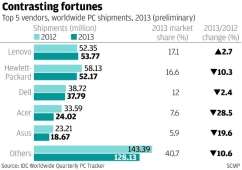

Lenovo is an IT giant Conglomerate in China, but also a main player in global market now. According to the left graph, we find out the market share of Lenovo has exceed that of Dell and Acer in the global market. This success is based on one decision: Lenovo acquiredIBM‘s personal computer business in 2005, including theThinkPadlaptop and tablet lines, which helping Lenovo’s profit climbing sharply. This acquisition is the most important strategy changing in Lenovo’s history and helping them enter the global market, like North America and Europe. Also,  Lenovo acquired Motorola from Google in cash and stock deal in 2014, but Google still retain the ownership of vast majority Motorola’s patents. Motorola already has certain reputation and market share in United States, so Lenovo’s new acquisition decision will help them to open the gate of smartphone market in US, where is the largest smartphone market in world. In recent decade, Lenovo paid a lot of attention and money in acquisition in global market, especially in US. Here I have a graph from Bloomberg to brief what Lenovo did in last decade:

Lenovo acquired Motorola from Google in cash and stock deal in 2014, but Google still retain the ownership of vast majority Motorola’s patents. Motorola already has certain reputation and market share in United States, so Lenovo’s new acquisition decision will help them to open the gate of smartphone market in US, where is the largest smartphone market in world. In recent decade, Lenovo paid a lot of attention and money in acquisition in global market, especially in US. Here I have a graph from Bloomberg to brief what Lenovo did in last decade: Traditionally, Chinese manufacturers make huge numbers of computers and other devices sold by other companies, for example, Foxconn is only the manufacturer of Apple, but Lenovo is

Traditionally, Chinese manufacturers make huge numbers of computers and other devices sold by other companies, for example, Foxconn is only the manufacturer of Apple, but Lenovo is  different because it sells under its own name. To be a manufacturer, Lenovo owns rich patent profile right now, since Lenovo has the DNA of innovation in their blood, which makes it become the first Chinese global consumer brand. According to the statistics, there is a marked increase of the growth of

different because it sells under its own name. To be a manufacturer, Lenovo owns rich patent profile right now, since Lenovo has the DNA of innovation in their blood, which makes it become the first Chinese global consumer brand. According to the statistics, there is a marked increase of the growth of  Lenovo’s patents from being acquired and internally developed which are covered from wireless to cloud in 20 years. Lenovo’s products are mainly in private goods like laptops, tablets and smartphones, but they also provide IT service, which is truly small part in their revenue stream. And these products are mainly in a perfect competition market with clear price information in global, that HHI is lower than 1000, which is a low concentration market. So, Lenovo to be a China based company is trying to transform their brand to a cool innovator rather than a cheaper product provider to attract more customers. Lenovo’s sources of market power are vertical integration and IPR which I talked about before. According to the term, vertical integrationis a strategy to gain control over its suppliers or distributors in order to increase the firm’s power in the marketplace, reducing transaction costs and securing supplies or distribution channels. When the competitions are using out sourcing, vertical integrationis a significant source of competitive advantage of Lenovo, which is helping the supply chain more efficiently.

Lenovo’s patents from being acquired and internally developed which are covered from wireless to cloud in 20 years. Lenovo’s products are mainly in private goods like laptops, tablets and smartphones, but they also provide IT service, which is truly small part in their revenue stream. And these products are mainly in a perfect competition market with clear price information in global, that HHI is lower than 1000, which is a low concentration market. So, Lenovo to be a China based company is trying to transform their brand to a cool innovator rather than a cheaper product provider to attract more customers. Lenovo’s sources of market power are vertical integration and IPR which I talked about before. According to the term, vertical integrationis a strategy to gain control over its suppliers or distributors in order to increase the firm’s power in the marketplace, reducing transaction costs and securing supplies or distribution channels. When the competitions are using out sourcing, vertical integrationis a significant source of competitive advantage of Lenovo, which is helping the supply chain more efficiently.

Lenovo’s strengths: 1. Vertical integration 2. Strong patents portfolio 3. Competency in mergers and acquisitions. All these three points I have discussed in last paragraphs. So let’s go to weakness straightly. First, poor brand perception in US. Lenovo’s primary market is China, where it sells most of its products, but it is hard for Lenovo to access US markets as its brand perception is low here even people know IBM ThinkPad. In the future strategy, Lenovo should manage their brand in U.S. to compete with Dell, HP, Samsung and Acer. There is the other tough face Lenovo facing: The slowing growth rate of the laptops market with declining profit margin. So, Lenovo’s CEO is talking about that they will transform themselves “from a PC market-share leader into a PC-plus innovation leader” to keep sustained growth and profitability. But what PC-plus innovation means here? I think it means software and applications in laptop. Lenovo has to follow the shift of market to provide value-added products for their customer, but not always focus on the traditional manufacturing and product sales. In Wu’s “the second machine age”, he talks about computing bounty that innovations in technology and new techniques of production will lead to vast increases in productivity and wealth, and a country’s ability to improve its standard of living depends on its ability to raise productivity by raising its output per worker. It is an important point for China: China to be one of the most important economic entities in the world, but still a developing country, so it needs more wealth which is created by digital process. Because Production of goods and services in the future will rely less on physical equipment and physical structures and more on intangible assets of intellectual property, organizational capital, user generated content and human capital; in other words, Lenovo has to consider to increase the automation technology to take the place of the manual working in their manufacturing process.

AT&T’s a mainly wireless ISP in U.S market and its service is impeded goods, which is in the same category of Fiber from Google. Impeded public good which is a public good provided with the right of exclusion. This exclusion comes about by charging prices for service but this does not discriminate against any other person from wanting to use the service so that anyone in the market can use AT&T’s service by paying to become a user but this does not limit the service available to anyone else. Also, AT&T’s spectrum licenses, privately owned cell towers and other equipment provide AT&T with the ability to exclude consumers that choose not to pay their ISP service of Internet access. AT&T is in an oligopoly market with few competitors as Verizon, Sprint and T-mobile. These 4 companies occupy nearly 99% market share in the U.S market, therefore the HHI is 2964, which means a high concentration market. In the oligopoly market, since the fixed cost of infrastructure building is higher, it leads high entry barrier for outsider. So, the players in this market have ability to set price to maximize their profit. The market power is from: IPR, spectrum advantage, network effects, and price discrimination. AT&T Intellectual Property is one of the world’s largest IPR operations, with a heritage of innovation that dates back more than a century to Alexander Graham Bell. According to AT&T’s internal report, AT&T owns one of the strongest patent portfolios in the telecommunications industry and is consistently top ranked in new patents developer. And AT&T shares LTE patent pool with HP, ZTE and other operators to raise the entry barrier. The patent pool is an agreement among business to share patents, lowering the risk and litigation costs. A spectrum auction is a process whereby a government uses an auction system to sell the licenses to transmit signals carrying data over the air from your smartphone to the internet. Spectrum is often referred to as the lifeblood of the wireless industry because more spectrum means faster and more-reliable wireless service. Now, spectrum is a limited resource controlled by the US government. In the past, AT&T and Verizon Wireless, sum of their market share reach to 70%, led the country’s most profitable spectrum auction ever, helping them maintain the market advantages suppressing smaller competitors. FCC reveled that U.S wireless carriers were at the top of the heap for bids in spectrum auction. So, in Google’s Fiber plan, they are lobbying FCC to open unused spectrum to market, so they can provide alternative wireless services. Network effects are the effects that one user of a good or service has on the value of that product to other people. Here, AT&T owning the connections of the most phone users helps them to improve their service and products better. Price discrimination is the act of selling the same product at different prices to different buyers, in order to maximize sales and profits. Cell phone plans offer a limited number of phone minutes per month. These minutes are divided between peak hours and off-peak hours. Peak hours for cell phone usage are during the day of the work week and off-peak hours are during the evening and on weekends. During off-peak hours, there is excess capacity from the cellphone companies, and they can provide a cheaper supply of minutes. A discount is offered for minutes during non-peak hours, because the cellphone companies want to encourage more use at these times.

Strength:

Weakness:

Future:

Net neutrality:

Wu’s point

Conclusion:

…

Word cited

You have to be 100% sure of the quality of your product to give a money-back guarantee. This describes us perfectly. Make sure that this guarantee is totally transparent.

Read moreEach paper is composed from scratch, according to your instructions. It is then checked by our plagiarism-detection software. There is no gap where plagiarism could squeeze in.

Read moreThanks to our free revisions, there is no way for you to be unsatisfied. We will work on your paper until you are completely happy with the result.

Read moreYour email is safe, as we store it according to international data protection rules. Your bank details are secure, as we use only reliable payment systems.

Read moreBy sending us your money, you buy the service we provide. Check out our terms and conditions if you prefer business talks to be laid out in official language.

Read more