AML activities. The illegitimate money can easily be laundered through financial services industry especially banks which has a significant negative impact on the economy of a nation. (Duyne, 1998) stated the risk of money laundering is constituted in various ways. It could be political, social or economic. In the recent past, there has been a dramatic upsurge in the usage of offshore financial centers which are under fewer jurisdictions and less regulated financially to perform money laundering activities with less hassles. These centers are used as an alternative facility for facilitating the money laundering process. From the above mentioned literature reviews on the subject, it implies that researchers have taken laudable and consultative efforts by taking into account the various factors so as to comprehend and weigh the Anti Money Laundering regulations of financial institutions in the international concept.

However, these studies lack merit as well as various essential factors in order to perfectly examine the effects of AML principles in the Indian financial industry more so the commercial banks of India. By studying the effectiveness and efficiency of AML measures and regulations, the research will identify and appreciate the effectiveness and efficiency of AML regulations and its consequent effects on commercial banks in India and will further identify any shortcomings and issues faced in implementing these measures. The research will further probe into the efficiency of the principal agency that is given the responsibility of prevention against terrorist financing, (Financial Intelligence Unit (FIU) of India)

Conceptual framework essentially is used by the researcher to prove that they comprehend and understand the topic that they are researching on deeply. It is a general illustration of the topic.

In this theory, there are two forces that determine an individual’s behavior. Initially, a person will act rationally and sets a goal for themselves to maximize their utility as much as possible. It is this principle that is highly looked into when an individual makes his/her decisions and criminal decisions are no exception to this principle. Also, the personal utility of an economic venture will mainly be determined both by the expected costs and revenues, which are consequently administered by the essential laws of demand and supply (Smith, 1846).

In the modern world, regulation is way past the common dichotomous manner of public authorities versus private interests. As stated by (Hancher and Moran, 1989), it is clear that the present differences seen in the national regulatory requirements have driven us into misleading results. This has in turn led into global regulations by applying multi-level governance. This is easily achieved through a dedicated discourse that includes specialist epistemic groups, advocacy groupings as well as a widened financial policy. The resultant effect of a regulative regime is that there will be discursive practices and activities that are well based on the industry players’ understanding of the menace and the solutions to it. (Tadesse, 2006)

This theory argues that increased disclosure and the resultant improved transparency is perfect ground for efficient resource allocation and disbursement by reducing informational asymmetry. (Watts and Zimmerman, 1986) argued that if information on accounting is seen as a public good and that which should be in the public domain, then it would be reasonable for banks to produce all the information to the satisfaction of the public. This also because the central banks are majorly funded by the tax money acquired from the public.

With this in mind, we can also bring into the vicinity the theory of transparency-fragility. This theory also puts it that increased information disclosure may be an indicator of increased challenges in the banking sector which consequently bring about a negative perspective about the sector such as runs on money as well as an increased concern about the susceptibility and vulnerability of the financial system.

But to counter this, as stated by (Smellie, 2004), it is almost unanimous that crime that is of a nature like money laundering needs a global collaboration in order to completely curb it.

The following chapter presents the procedure adopted to answer the study’s purpose, the effectiveness of anti-money laundering regulation in the Indian Bank Sector. It will detail the research design used in the study. Research design is a Master Plan, as defined by (Saunders, Lewis and Thornhill, 2003) that gives an account of the process and techniques for collecting and examine the information that is required.

The Study applied an Exploratory research design to explore the effectiveness of anti-money Laundering in the Indian Banking sector. The study focused on 30 commercial banks in India. Both qualitative and quantitative research approaches were used in the study. Questionnaires with closed, semi closed, and open ended questions were sent through emails, to the KYC Case Managers, KYC Checkers, Anti-Money Laundering Quality Control Team and Anti-Money Laundering Compliance team in the respective Banks. Semi closed and closed questions in the questionnaires captured the quantitative data from the respondents. On the other hand, open questions captured the qualitative data from the respondents. Open ended questions will help in taking account of the information that is hard to quantify such as perceptions, opinions and explanations.

According to (Johnson & Christensen, 2007) information that is qualitative in nature, based on individual experiences, gives us more insights and consequently a better understanding of the study. Qualitative and quantitative approaches would go a long way in ensuring that we exhaustively measure the effectiveness of the Anti-Money Laundering (AML) program. The Qualitative approach will uncover and examine characteristics that are less tangible in nature such as perceptions and insights. The two approaches, qualitative and quantitative, will analyze AML processes that are already existing and further evaluate the AML regime perception within the banking sector of India.

Convenience method of sampling was used in disseminating the questionnaires to the KYC Case Managers, KYC Checkers Team, AML Quality Control Team and the AML Compliance team for the 30 banks. Convenience sampling method is a major type of non-probability sampling techniques where the sample consists of respondents who could easily be reached out for interview. For convenience sampling, the first available sources of primary data are used for the research while disregarding additional requirements. The sample size of 30 banks was used as the sampling frame since it is large enough to Represent India’s Banking sector and produce normal results. Also, the size of the sample is considerably small and therefore the researcher would not spend much time waiting for the filled in questionnaire from a large a relatively larger sample that would be sent to India for the study.

The study covered commercial banks in the Private and Public sector of India. These banks were. Citi Bank, Axis Bank, HSBC Bank, Standard Chartered Bank, Kotak Mahindra Bank, HDFC Bank, Saraswat Cooperative Bank, TJSB Bank, Bank of Baroda, Vijaya Bank, Syndicate Bank, Dena Bank, State Bank of Indore, Canara Bank, UCO Bank, Indian Overseas Bank, Deccan Merchant Bank, Corporation Bank, Allahabad Bank, Punjab National bank, State Bank of Mysore, Union Bank Of India, State Bank of Bikaner and Jaipur, United Western Bank, ICICI Bank, IndusInd Bank, Federal Bank, UTI bank, Karur Vysya Bank, Catholic Syrian Bank. The researcher settled for this banks because they are the leading banks in India by market share.

Primary data, which included both qualitative and quantitative data was collected using questionnaires that were disseminated through emails. A total of 30 questionnaires were to the banking staff that comprised of KYC Case Managers, KYC Checkers Team, AML Quality Control Team and the AML Compliance team as stated above.

The collected data was coded and entered in SPSS statistics ready for Data analysis. The coding involved assigning of numerical values to the qualitative responses received, this made analysis of qualitative data more efficient.

The main target of the questionnaire is to capture respondent’s perception on Anti money laundering regulation. Another objective of this research study is to explore AML regulations effectiveness in India’s commercial banks. The study measured AML regulation application effectiveness.

To ascertain the study reliability, a pilot survey was conducted. This was carried out for the identification of questions that might be ambiguous to the interviewee and anticipate challenges that would arise during the actual survey. This went along away in helping the researcher modify the instruments of data collection before going live off formerly.

A copy of the questionnaire that was used is attached in the appendix.

This chapter contains the results as obtained from SPSS, graphical work from Microsoft Excel and the discussions of these results in the attempt to answer the research questions of the study.

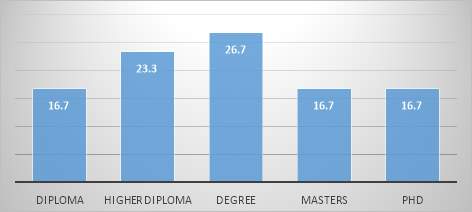

| Education | |||||

| Frequency | Percent | Valid Percent | Cumulative Percent | ||

| Valid | DIPLOMA | 5 | 14.7 | 16.7 | 16.7 |

| HIGHER DIPLOMA | 7 | 20.6 | 23.3 | 40.0 | |

| DEGREE | 8 | 23.5 | 26.7 | 66.7 | |

| MASTERS | 5 | 14.7 | 16.7 | 83.3 | |

| PHD | 5 | 14.7 | 16.7 | 100.0 | |

| Total | 30 | 88.2 | 100.0 | ||

| Missing | System | 4 | 11.8 | ||

| Total | 34 | 100.0 | |||

From the table above it is clear that there were a total of 30 valid cases with no data considered to be missing. The variable “education” has the minimum level of the respondent as diploma and the maximum level as the PhD level. On average, most of the respondents have their highest level of education as bachelor’s degree (23.5%). The bar graph below can offer more insight

The table below shows the frequency table for this particular variable

| Anti- Money Laundering unit | |||||

| Frequency | Percent | Valid Percent | Cumulative Percent | ||

| Valid | Yes | 15 | 44.1 | 50.0 | 50.0 |

| No | 15 | 44.1 | 50.0 | 100.0 | |

| Total | 30 | 88.2 | 100.0 | ||

| Missing | System | 4 | 11.8 | ||

| Total | 34 | 100.0 | |||

The mean for the variable Anti-Money Laundering is 1.50 with the exactly half of the respondent’s banks having a department that specializes with money laundering unit and the other half do not have such a separate department.

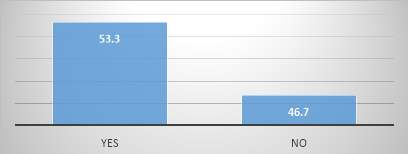

| AML Training Course | |||||

| Frequency | Percent | Valid Percent | Cumulative Percent | ||

| Valid | YES | 16 | 47.1 | 53.3 | 53.3 |

| NO | 14 | 41.2 | 46.7 | 100.0 | |

| Total | 30 | 88.2 | 100.0 | ||

| Missing | System | 4 | 11.8 | ||

| Total | 34 | 100.0 | |||

From the above table, it can be seen that only 53.3% of the respondents have undergone the AML training course with a percentage of 46.7% having not undertaken any training in regard to money laundering. A visual representation of these results are as below

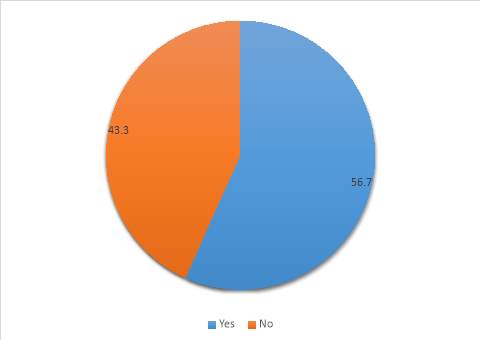

| Frequency | Percent | Valid Percent | Cumulative Percent | ||

| Valid | Yes | 17 | 50.0 | 56.7 | 56.7 |

| No | 13 | 38.2 | 43.3 | 100.0 | |

| Total | 30 | 88.2 | 100.0 | ||

| Missing | System | 4 | 11.8 | ||

| Total | 34 | 100.0 | |||

56.7% of the respondents are able to detect a suspicious transaction that are made in their banks while a percentage of 38.2 %( 13 out of 30) not being able to detect such a transaction. A graph of the frequencies of this variable is as below

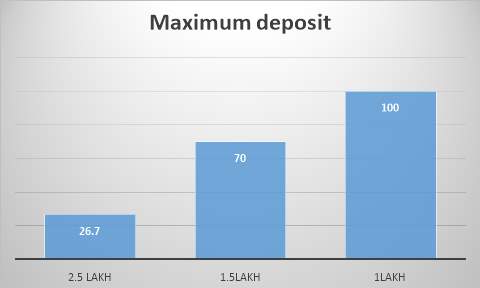

| Frequency | Percent | Valid Percent | Cumulative Percent | ||

| Valid | 2.5 Lakh | 8 | 23.5 | 26.7 | 26.7 |

| 1.5Lakh | 13 | 38.2 | 43.3 | 70.0 | |

| 1Lakh | 9 | 26.5 | 30.0 | 100.0 | |

| Total | 30 | 88.2 | 100.0 | ||

| Missing | System | 4 | 11.8 | ||

| Total | 34 | 100.0 | |||

From the table above it is clear that for most of the banks the maximum amount of deposit in their banks is 1.5 lakh, at 43.3%. Only 26.7% of the banks had their maximum deposit as 2.5Lakh.

| Frequency | Percent | Valid Percent | Cumulative Percent | ||

| Valid | Yes | 15 | 44.1 | 50.0 | 50.0 |

| No | 15 | 44.%1 | 50.0 | 100.0 | |

| Total | 30 | 88.2 | 100.0 | ||

| Missing | System | 4 | 11.8 | ||

| Total | 34 | 100.0 | |||

According to the table above there are 50% availability of money laundering policies in place and consequently there are 50% of no availability of money laundering policies.

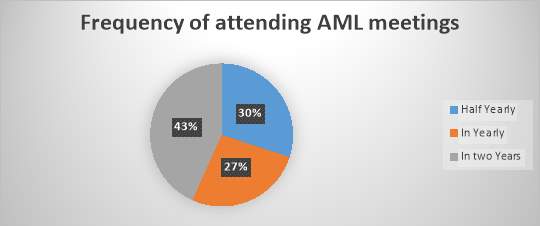

| Frequency | Percent | Valid Percent | Cumulative Percent | ||

| Valid | Half Yearly | 9 | 26.5 | 30.0 | 30.0 |

| In Yearly | 8 | 23.5 | 26.7 | 56.7 | |

| In two Years | 13 | 38.2 | 43.3 | 100.0 | |

| Total | 30 | 88.2 | 100.0 | ||

| Missing | System | 4 | 11.8 | ||

| Total | 34 | 100.0 | |||

Most of the respondents (13 out of 30), i.e. 38.2% attend the AML training every two years while 9 out of 30, 30% of the respondents attend the training every half year. Minority of the respondents (26.7%) attend such training annually. These results can further be represented graphically as below.

| Frequency | Percent | Valid Percent | Cumulative Percent | ||

| Valid | Yes | 12 | 35.3 | 40.0 | 40.0 |

| No | 18 | 52.9 | 60.0 | 100.0 | |

| Total | 30 | 88.2 | 100.0 | ||

| Missing | System | 4 | 11.8 | ||

| Total | 34 | 100.0 | |||

60% of the respondents believed that the active AML regulations available at the bank are not often followed while a minority of the respondents (40%) believed that the regulations are followed or adhered to.

From the table above, money is highly laundered through casinos (16.7%). The second highest nature of money laundering is in 4 forms: smurfing, businesses that are cash intensive, bank capture and through black salaries. The graph below gives a visual representation of these results.

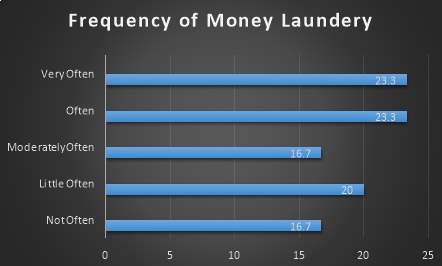

| Frequency | Percent | Valid Percent | Cumulative Percent | ||

| Valid | Not Often | 5 | 14.7 | 16.7 | 16.7 |

| Little Often | 6 | 17.6 | 20.0 | 36.7 | |

| Moderately Often | 5 | 14.7 | 16.7 | 53.3 | |

| Often | 7 | 20.6 | 23.3 | 76.7 | |

| Very Often | 7 | 20.6 | 23.3 | 100.0 | |

| Total | 30 | 88.2 | 100.0 | ||

| Missing | System | 4 | 11.8 | ||

| Total | 34 | 100.0 | |||

Using the table above, it can be seen that money is often and very often laundered since they both have the highest frequencies of 23.3%. Only 20% of the respondents believed that money is little often laundered. The results can further be put in a graph as follows.

| Frequency | Percent | Valid Percent | Cumulative Percent | ||

| Valid | Not Aware | 8 | 23.5 | 26.7 | 26.7 |

| Little Aware | 5 | 14.7 | 16.7 | 43.3 | |

| Moderately Aware | 7 | 20.6 | 23.3 | 66.7 | |

| Aware | 5 | 14.7 | 16.7 | 83.3 | |

| Very Aware | 5 | 14.7 | 16.7 | 100.0 | |

| Total | 30 | 88.2 | 100.0 | ||

| Missing | System | 4 | 11.8 | ||

| Total | 34 | 100.0 | |||

From this SPSS output we can see that majority of the respondents were not aware of anti-money laundering regulations (26.7) while the minority were little aware, aware and Very Aware all at (16.7%) of the anti-money laundering regulations awareness.

The table below shows the means, standard deviations maximum and minimum values of all the variables under study.

| N | Minimum | Maximum | Mean | Std. Deviation | |

| Education | 30 | 1 | 5 | 2.93 | 1.337 |

| Anti Money_Laundering_Unit | 30 | 1 | 2 | 1.50 | .509 |

| AML_Training_Course | 30 | 1.00 | 2.00 | 1.4667 | .50742 |

| Suspicious_Transaction_Detection | 30 | 1.00 | 2.00 | 1.4333 | .50401 |

| Maximum Deposit | 30 | 1.00 | 2.00 | 1.5333 | .50742 |

| Maximum_Depost_Amount | 30 | 1.00 | 3.00 | 2.0333 | .76489 |

| Availability_of_Money_Laundering_Policies | 30 | 1.00 | 2.00 | 1.5000 | .50855 |

| AML_Training_Frequency | 30 | 1.00 | 3.00 | 2.1333 | .86037 |

| Active Anti Money Laundering Regulation being followed | 30 | 1.00 | 2.00 | 1.6000 | .49827 |

| Actions_In_Place_For_customers_Failing_Screen_Test | 30 | 1.00 | 5.00 | 3.1333 | 1.35782 |

| Bottlenecks_In_Stewarding_AML_Regulations | 30 | 1.00 | 4.00 | 2.6333 | 1.15917 |

| Money_Laundering_Nature | 30 | 1.00 | 8.00 | 4.6000 | 2.41547 |

| Money Laundering _Frequency | 30 | 1.00 | 5.00 | 3.1667 | 1.44039 |

| AML_Awareness_Level | 30 | 1.00 | 5.00 | 2.8000 | 1.44795 |

| Effectiveness of India’s_Reserve Bank_in_Stewarding AML regulations | 30 | 1.00 | 5.00 | 2.8667 | 1.40770 |

| Banking and Financial Institutions Act Sufficiency | 30 | 1.00 | 2.00 | 1.5333 | .50742 |

| Explain_The_Sufficiency_Of_Adressing_Money Laundering Issue | 30 | 1.00 | 3.00 | 1.4333 | .56832 |

| Money_Laundering_Occurence | 30 | 1.00 | 3.00 | 2.0333 | .88992 |

| Policies in Place for Controlling Money Laundering | 30 | 1.00 | 3.00 | 2.0000 | 0.87099 |

| Frequency of Employee Training on Anti Money Laundering Issues | 30 | 1.00 | 3.00 | 2.0667 | .82768 |

| Preparation of Annual Report on Money Laundering | 30 | 1.00 | 3.00 | 1.8667 | .81931 |

| Valid N (list wise) | 30 |

Since all the variables are categorical, the means should be in percentages. From the table above, it is clear that the variable with the largest percentage on average is “money laundering nature with a percentage of 46.0% while the variables with the least percentages on average were “suspicious transaction detection” and “explain the sufficiency of addressing ML issue” with a percentage of 14.3%.

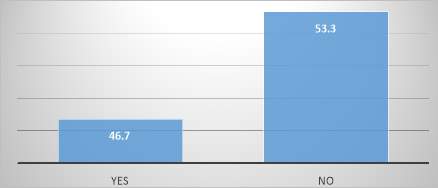

The table below shows the results of this particular variable. The results are further represented in a chart for easier understanding.

| Frequency | Percent | Valid Percent | Cumulative Percent | ||

| Valid | Yes | 14 | 41.2 | 46.7 | 46.7 |

| No | 16 | 47.1 | 53.3 | 100.0 | |

| Total | 30 | 88.2 | 100.0 | ||

From this table the researcher can read that 14 out of the 30 respondents believe that the Banking and Financial Institutions Acts (BFIA) sufficiently addressed the ML issues while the remaining percentage did not believe in these Acts to address money laundering in financial institutions. On an average only 15.33% of the respondents believed in these Acts to sufficiently address money laundering issues in the Indian banks. The graph of these frequencies is as below.

The output for this variable as produced by the SPSS software is as below.

| Frequency | Percent | Valid Percent | Cumulative Percent | ||

| Valid | Provides Policy Foundation for AML Strategies | 18 | 52.9 | 60.0 | 60.0 |

| Equipped Very Well with the Appropriate Guidelines | 12 | 35.3 | 40.0 | 100.0 | |

| Total | 30 | 88.2 | 100.0 | ||

| Missing | System | 4 | 11.8 | ||

| Total | 34 | 100.0 | |||

According to the table above, 60% of the respondents believe that the country provides policy foundation for the AML strategies while 40% of the respondents believed that sufficiency of addressing ML issues is best explained by the fact that they are equipped very well with the appropriate guidelines.

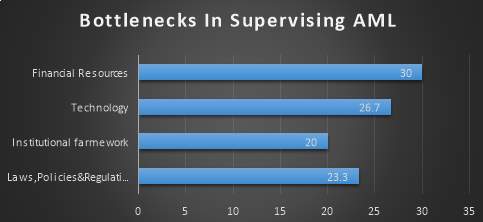

Majority of the respondents (30%) believed that financial resources as the main challenge that they experience in their banks in stewarding the AML regulations while a minority of the respondents had the main bottleneck as institutional framework. This can be seen clearly in the table below and the corresponding graph of the same.

| Frequency | Percent | Valid Percent | Cumulative Percent | ||

| Valid | Laws, Policies & Regulations | 7 | 20.6 | 23.3 | 23.3 |

| Institutional framework | 6 | 17.6 | 20.0 | 43.3 | |

| Technology | 8 | 23.5 | 26.7 | 70.0 | |

| Financial Resources | 9 | 26.5 | 30.0 | 100.0 | |

| Total | 30 | 88.2 | 100.0 | ||

| Missing | System | 4 | 11.8 | ||

| Total | 34 | 100.0 | |||

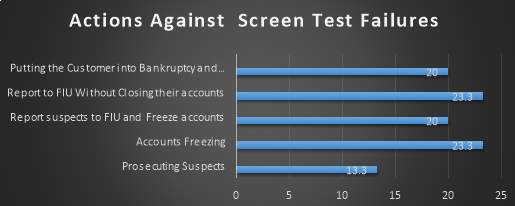

There are several actions that are put in place in the banks of India for the customers that fail the screening test. These actions are clearly outlined in the table below together with the frequencies of the respondent’s response. Majority of the respondents (23.3%) believed that the best action if the customer fails a screening test is to either freeze their accounts or report them to the FIU without closing their accounts. A minority of the respondents (4 out 30) believe that if a customer fails the screening test the best action to prosecute them. (13.3%)

| Frequency | Percent | Valid Percent | Cumulative Percent | ||

| Valid | Prosecuting Suspects | 4 | 11.8 | 13.3 | 13.3 |

| Accounts Freezing | 7 | 20.6 | 23.3 | 36.7 | |

| Report suspects to FIU and Freeze accounts | 6 | 17.6 | 20.0 | 56.7 | |

| Report to FIU Without Closing their accounts | 7 | 20.6 | 23.3 | 80.0 | |

| Putting the Customer into Bankruptcy and report them to FIU | 6 | 17.6 | 20.0 | 100.0 | |

| Total | 30 | 88.2 | 100.0 | ||

| Missing | System | 4 | 11.8 | ||

| Total | 34 | 100.0 | |||

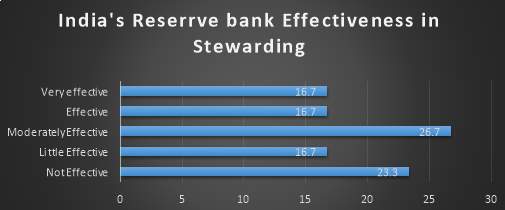

The highest percentage of the respondents believe that the Reserve Bank of India is moderately effective in stewarding among India’s financials (26.7) while the lowest percentage believed that the Reserve Bank of India is either little effective or effective or very effective in stewarding. (All have 16.7%). The results of the scale of 1-5 can been seen both graphically and in the table below.

| Frequency | Percent | Valid Percent | Cumulative Percent | ||

| Valid | Not Effective | 7 | 20.6 | 23.3 | 23.3 |

| Little Effective | 5 | 14.7 | 16.7 | 40.0 | |

| Moderately Effective | 8 | 23.5 | 26.7 | 66.7 | |

| Effective | 5 | 14.7 | 16.7 | 83.3 | |

| Very effective | 5 | 14.7 | 16.7 | 100.0 | |

| Total | 30 | 88.2 | 100.0 | ||

| Missing | System | 4 | 11.8 | ||

| Total | 34 | 100.0 | |||

The majority of the respondents either believed that there are policies that control money laundering in their banks or they were not sure if these policies really exist (All 36.7%). 8 of the 30 respondents believed that there were no polices that control money laundering through their banks (26.7%). This can be seen in the output table below.

| Frequency | Percent | Valid Percent | Cumulative Percent | ||

| Valid | Yes | 11 | 32.4 | 36.7 | 36.7 |

| No | 8 | 23.5 | 26.7 | 63.3 | |

| Not Sure | 11 | 32.4 | 36.7 | 100.0 | |

| Total | 30 | 88.2 | 100.0 | ||

| Missing | System | 4 | 11.8 | ||

| Total | 34 | 100.0 | |||

40% of the banks of the respondents prepared annual report on money laundering while a minority of the respondents i.e. 26.7% of the respondents were not sure if their banks really prepared annual reports on the laundering of money through their banks. 33.3% of the banks where the respondents worked did not prepare any reports on money laundry at the end of their financial year. This is evident in the table below produced by the SPSS software.

| Frequency | Percent | Valid Percent | Cumulative Percent | ||

| Valid | Yes | 12 | 35.3 | 40.0 | 40.0 |

| No | 10 | 29.4 | 33.3 | 73.3 | |

| Not Sure | 8 | 23.5 | 26.7 | 100.0 | |

| Total | 30 | 88.2 | 100.0 | ||

| Missing | System | 4 | 11.8 | ||

| Total | 34 | 100.0 | |||

Using the results obtained, the researcher can conclude the following

The researcher made the following recommendations that can be put in place to aid in the fight against money laundering in India and the whole world in general

Abdullahi, H.W. (2013). Assessment of The Adherence and Effectiveness of Anti Money Laundering Regulations Among Banking Institutions

Adenkule, A., 2016. Effects of Money Laundering on the Economy. [Online] Available at: https://file.scirp.org/pdf/BLR_2016062811044265.pdf

Agarwal, J. D. and Aman Agarwal (2002). Liberalization of Capital Flows, Banking System & Trade:

Focus on Crisis Situations; Invited paper for International Review of Comparative Public Policy, titled International Financial Systems and Stock Volatility Volume 13,pages 151-212.

Bagenda, P. (2003). Combating Money Laundering in the SADC Sub-Region: The Case of Tanzania. In Profiling Money Laundering in Eastern and Southern Africa: Monograph No 90, December 2003.

Barrett, R. (1997). Confronting tax havens, the offshore phenomenon, and money laundering.

International Tax Journal, Vol. 23 No.2, pp.12-42.

Bearie, E.M. (2007). Money Laundering in Canada: Chasing Dirty and Dangerous Dollars, University of Toronto Press, pp 200

Becker, G.S. (1968). Crime and Punishment: An Economic Approach, Journal of Political

Economy, Vol 76, pp. 169-217

B, H. (2005). The Attractions of risk based regulation. Accounting for the emergence of risk ideas in regulation, London School of Economics and Political Science, Economic & Social Research Council Centre for Analysis of Risk and Regulation, London, Discussion Paper, (No.33).

B, J. and L, C. (2007). Educational Research: Quantitative, Qualitative, and Mixed Approaches,. 3rd ed. London: Sage Publication.

Berendt, A., Healy, B., Mainelli, M. and Yeandle, M. (2005). Anti-Money laundering Requirements:Costs, Benefits And Perceptions institute Of Chartered Accountants In England And Wales And the Corporation of London City Research. London.

Camdessus, M. (1998). Money Laundering: the importance of International Countermeasures,

Plenary meeting of the FATF, Paris

Claessens, R., 2017. Anti-Money Laundering & MIFID. [Online]

Available at: http://rogerclaessens.be/activities/finance/anti-money-laundering-mifid/

Controlling Money Laundering in India – Problems and Perspectives. (2009). [ebook] Available at: Available at: http://www.igidr.ac.in/conf/money/mfc-11/Singh_Vijay.pdf [ [Accessed 22 Oct. 2017].

CRDB Anti Money Laundering Manual

Criminal Justice(Money laundering And Terrorist Financing)Act 2010. (2017). [ebook] Available at: http://www.irishstatutebook.ie/eli/2010/act/6/section/2/enacted/en/html [Accessed 20 October. 2017]. [Accessed 22 Nov. 2017].

Dan, M. (2009). The Illegal Sector, Money Laundering and Legal Economy: A Macroeconomic

Analysis, Journal of Financial Crime, Vol.4, No.2, pp.103-112

DIXIT, 1991. Anti Money laundering laws in India. [Online] Available at: http://moneylaundering.legal/news.php?page=2

D, K., T, G. and s, C. (2002). E-Finance In Emerging Markets. Is Reap Frogging Possible, pp.3-7.

Duyne, P. and Van, C. (2003). Money. Money Laundering, Fears and Facts. in Duyne, P.C. Van, Lampe, K..

Edward, E. (2007). The Scale and Impacts of Money Laundering. pp.16

Edward, E. (2007). The Scale and Impacts of Money Laundering. pp.19

Ernesto S. (1997) Money Laundering: International perspectives, pp1

FATF, (2001). Review to Identify Non-Cooperative Countries or Territories. 22 June.Paris:FATF.

FATF, (2002-2006). Financial Action Task Force on Money Laundering, the Mutual Evaluation:

Reports on Anti-Money Laundering and Combating the Financing of Terrorism of Australia

and United States of America (May 2006), published on the FATF

website: www.fatf-gafi.org

Genzman, S. (1997), Evidence Composition Model: Digital Evidence Composition in Fraud Detection, pp3

Giunio, D. (2007), Money Laundering: Journal of Money Laundering control, Vol. 10 No. 4, pp 406 – 411.

Goredema, C, F. (2000) Effective Control of Money Laundering: Some Practical

Dilemmas, pp.1

Gururaj, F (1982). Money Laundering: Issues and Perspectives. Hyderbad: ICFAI University Press.

Haemala, T and Bala, S. (2007) International Trade – Based Money Laundering:

Malaysian Perspective, Journal of Money Laundering Control Volume

10, No. 4, pp.429- 437.

Hancher, L., Moran, L. (1989). Organizing regulatory space, in Hancher, L., Moran,

M. (Eds),Capitalism, Culture and Economic Regulation, OUP, Oxford, pp271-4

Kris Hinterseer, (2002) “An Economic Analysis of Money Laundering“, Journal of Money Laundering Control, Vol. 1 Issue: 2, pp.154-164, https://doi.org/10.1108/eb027132

Hutter, B. (2005). The attractions of risk-based regulation: accounting for the emergence of

risk ideas in regulation, London School of Economics and Political Science, Economic &

Social Research Council Centre for Analysis of Risk and Regulation, London, Discussion

Paper No. 33, .

I, C. (2006). Protecting the financial system from abuse: challenges to banks in implementing AML/CFT standards. Journal of Money Laundering Control,, 9(1), pp.48-61.

India. (2012). Anti Money laundering Survey 2012.

J.D, A. and Aman, A. (2002). ). Liberalization of Capital Flows, Banking System & Trade: Focus on Crisis Situations; Invited paper for International Review of Comparative Public Policy, titled International Financial Systems and Stock Volatility. pp.151-122.

Johnson, J. (2017). Is The Global Financial System AML/CFT Prepared?. Journal Of Financial Crime, 15(1), pp.7-21.

Johnson, P. and Christensen, J. (2016). Qualitative Research in Organizations and Management: An International Journal. Evaluating qualitative research:, 10(4), pp.320-324.

Laundryman, 2000. Money Laundering Links. [Online]

Available at: http://www.dirtydealing.org/pages/fatf_blacklist.htm

Lilley, P (2003). Dirty dealing, the untold truth about Global money laundering international

Crime and terrorism. Stylus Pub 2003 pp51-52

M, D. (2009). The Illegal Sector, Money Laundering and Legal Economy: A Macroeconomic Analysis,. Journal of Financial Crime, 4(2), pp.103-112.

Morgan J. S. (2003), Dirty names, Dangerous Money: Alleged Unilaterism in US Policy on Money Laundering. Journal of International Law, 21(3), pp.771-803.

Okogbule, N. (2007). Regulation of money laundering in Africa: The Nigerian and Zambian approaches. Journal of Money Laundering Control, 10(4), pp.449-463.

Philippsohn, S. (2001). The dangers of new technology – laundering on the internet, Journal of

Money Laundering Control, Vol. 5 No.1

Proceeds From Crime Convention on Laundering,Search, Seizure and Confiscation. (1991). Criminal Law Forum, 2(3), pp.443-465.

Ross, S., Hannan, M. (2007). Money laundering regulation and risk-based decision-making,

Journal of Money Laundering Control, Vol. 10 pp.106-15.

Saunders, M., Lewis, P. and Thornhill, A. (2003). Research Methods for Business Students. Pearson Education, 2003.

Scott, F. and M, B. (2017). Money Laundering In Canada:Chasing Dirty Dollars. Canada: University Of Toronto Press Inc

Schott, P. (2006). Combating Financing of Terrorism Anti-Money Laundering Reference Guide Second Edition and Supplement On special Recommendation. 20th ed. [ebook] Washington, Dc: The World Bank, pp.5-20. Available at: http://Worldbank.org/handle/10986/6977. [Accessed 22 Nov. 2017].

Shanmugam, B. and Thanasegaran, H. (2007). International trade‐based money laundering: The Malaysian perspective. Journal of Money Laundering Control, 10(4), pp.429-437.

Singh, V.K. (2009) Controlling Money Laundering in India – Problems and Perspectives: Hidayatullah National Law University Raipur, Chhattisgarh pp.8

Singh, V.K. (2009) Controlling Money Laundering in India – Problems and Perspectives: Hidayatullah National Law University Raipur, Chhattisgarh pp.19

Smellie, A. (2004). Prosecutorial challenges in freezing and forfeiting proceeds of transnational

crime and the use of international asset sharing to promote international cooperation,

Journal of Money Laundering Control, Vol. 8 No.2, pp.104.

Smith, 2017. Anti-Money Laundering. [Online] Available at: https://www.herbertsmithfreehills.com/our-expertise/services/anti-money-laundering

Sturman, K. (2002) The African Union Plan on Terrorism: Joining The Global War

or Leading an African Battle? Pp.104

Subbotina, N. (2009) “Challenges that Russian banks face implementing the AML regulations”, Journal of Money Laundering Control, Vol. 12 Issue: 1, pp.19-32, https://doi.org/10.1108/13685200910922624

Tadesse, S. (2006). Economic value of regulated disclosure: evidence from the banking sector, Journal of Accounting & Public Policy, Vol. 25 pp. 32-70.

The Prevention of Money Laundering Act (2013)

United States Accounting Office (2008)

Verhage, A. (2009). Compliance and AML in Belgium: a booming sector with growing pains. Journal of Money Laundering Control,, 12(2), pp.113-133.

Viritha, B., Mariappan, V. and Venkatachalapathy, V. (2015). Combating money laundering by the banks in India: compliance and challenges. Journal of Investment Compliance, 16(4), pp.78-95.

Vaithilingam, S. (2007) Factors Affecting Money Laundering: Lesson for

Developing Countries Journal of Money Laundering Control Volume 10,

No. 3, pp. 352 – 366

Watts, R., Zimmerman, J. (1986). Positive Accounting Theory, Prentice-Hall, Engle wood Cliffs,

Wolfsberg Questionnaire. (2017). [ebook] Available at: http://www.clearstream.com/clearstream-en/about-clearstream/regulation–1-/wolfsberg-questionnaire. [Accessed 6 Nov. 2017].

Yeandle, M., Mainelli, M., Berendt, A., and Healy, B. (2005). Anti-Money Laundering

, Prentice-Hall, Engle wood Cliffs, Requirements: Costs, Benefits and Perceptions Institute of Chartered Accountants In England and Wales and the Corporation of London City: Research Series No. 6.

Zeldin, M (1998) “Money Laundering”, Journal of Money Laundering Control, Vol. 1 Issue: 4, pp.295-302, https://doi.org/10.1108/eb027152

A. AML

Laundering?

Yes……………No……………

…… ……………………………..

Have you ever undertaken any training course on AML?

Yes ……….b) No……..

Are there mechanisms in place for the detection of transactions that are suspicious? ….. ………….

Yes ……….b) No……..

Yes……………No…………

If your answer to question 5 above is yes, what is the maximum value of deposit?

……………………..

B. AML FIGHTING CHALLENGES

C. Effectiveness of AML

1. Which are the most frequent nature of money Laundering (tick where appropriate).

Not often………..Little often………. Moderately often……….Often……Very often……….

On a five point scale.

Not aware……. little aware….. Moderately aware…… Aware….. very aware……

Not effective……. little effective….. Moderately effective….. Effective…. Very effective

.

Sufficiently address AML issue in institutions?

a) Yes…….. b) No……..

Please explain,

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

| Particulars | Yes | No | Not Sure |

| Are there any occurrences of money laundering in your bank? | |||

| IS there any effects of money laundering on your banks | |||

| Does your bank have policies in place for controlling Money laundering | |||

| Does you ban frequently train employees on Anti money laundering issues | |||

| Does your bank prepare an annual report on money laundry | |||

D. Policy recommendations

1. In your own opinion, what measures should be adopted to reduce money laundering and improve banks adherence and other financial institutions to AMLs

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

2. What is your recommendations for the improvement of anti-money laundering in India’s financial institutions?

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

********************END********************

You have to be 100% sure of the quality of your product to give a money-back guarantee. This describes us perfectly. Make sure that this guarantee is totally transparent.

Read moreEach paper is composed from scratch, according to your instructions. It is then checked by our plagiarism-detection software. There is no gap where plagiarism could squeeze in.

Read moreThanks to our free revisions, there is no way for you to be unsatisfied. We will work on your paper until you are completely happy with the result.

Read moreYour email is safe, as we store it according to international data protection rules. Your bank details are secure, as we use only reliable payment systems.

Read moreBy sending us your money, you buy the service we provide. Check out our terms and conditions if you prefer business talks to be laid out in official language.

Read more