Contents

2.1 Market creating institutions- The role of property rights/ rule of law

2.2 Market regulating institutions

2.3 Market stabilising institutions

2.4 Market legitimising institutions

2.5 Institutions of conflict management

2.5 Case study: What Can Nigeria Learn from Other Countries Economic Development

Nigeria is a country with many resources and potential. Nigeria is the 12th largest producer of petroleum but yet Nigeria still has not been able to harness her economic potentials for rapid economic development (Ogbole, 2010) and has been grossly underperforming relative to their enormous resource endowment and compared to its peers. Nigeria entered a recession in 2016, its first full year of recession in 25 years shrinking by 1.5% according to the National Bureau of Statistics. This was due to a series of shocks such as a decline in oil prices, foreign exchange shortages, power shortages etc. There are many factors as to why Nigeria is not where its meant to be but, in this essay, we will be evaluating whether weak institutions are the main factors responsible. Acemoglu (2006) states that if Nigeria’s institution were to improve to the likes of a similar developing country like Chile, in the long run, they could benefit from a seven-fold increase in income.

Nigeria could be one of the greatest countries in the world. Nigeria has been listed as one of the prospects by many different economic institutions. Jim O’Neil classed Nigeria as part of the MINT countries, which are the four countries that are seen as emerging economic giants. The acronym refers to Mexico, Indonesia, Nigeria, and Turkey. Nigeria was on track to be one of the 20 largest economies in the world, being compared with emerging Asian countries such as Thailand, China and India who were behind Nigeria in terms of GDP in 1970, however, there are many factors hindering Nigeria from being a significant global players like these countries and this may be due to Nigeria’s weak institutions. Nigeria is predicted to grow at 10-12% by sorting out corruption alone. Doubling the size of the economy in six or seven years. However, even though Nigeria is among the MINT countries and a big economy in Africa, it is still difficult for economic activity to strive in Nigeria like it is in Ghana.

Nigeria suffered a full year of negative growth in 2016

Nigeria suffered a full year of negative growth in 2016

Source: Atlas Data: National Bureau of Statistics

The research aim of this study is to essentially examine why Nigeria has regressed and not reached where it is predicted to be today and whether this is mainly due to Nigeria’s weak institutions affecting its economic development.

In order to answer the study question presented, a number of primary research questions will be addressed such as ‘What are the necessary institutions required for economic development and how are these specific institutions performing in Nigeria’, ‘What did countries similar to Nigeria do that made them grow at a much higher level to Nigeria and what can Nigeria learn from these countries”.

In order to ensure the aim of this study is achieved, four research objectives are set:

Douglass North (1990) defines institutions as formal and informal rules that govern human behavior. Institutions govern and shape the interactions of human beings and help form expectations of what people should do (Lin & Nugent, 1995). Institutions are things such as; the extent of property rights’ protection, the degree to which laws and regulations are fairly enforced, the ability of governments to protect individuals against economic shocks and provide social protection and also the extent of political protection. This essay will focus on; Nigeria’s market-creating, market regulating, market stabilising, market legitimising institutions and institutions of conflict management.

Institutions help deal with important problems that occur in basic economic transactions. Institutions create constraints through law and social norms, that way reducing transaction costs which are costs associated to simple transactions such as buying or selling, borrowing money or investing in a business (Roland G 2016). Institutions have a significant effect on the development of commerce, entrepreneurship, trade, innovation, and investment. Cross-country analysis carried out highlights empirical evidence showing that there is a positive correlation between growth outcomes and an array of measures of institutional quality (Pande R and Udry C 2005)

Nigeria’s institutions can be classed as weak because they are not fulfilling their purpose, for example Nigeria’s institutions are not able to protect property rights’, laws and regulations are not enforced properly, the government is not being able to offer social support as there’s no access to a good level of medical care and mental health support. Nigeria’s institutions are weak because their institutions have failed to build infrastructures stable for development.

In order for economic development to occur, market creating institutions need to be instilled to present an incentive for investing and innovating in Nigeria. Market-creating institutions are things such as Property Rights, legally binding contracts and rule of law. Property rights protect assets held by an individual or firm from being taken by others which protects citizens from various forms of government expropriation or entry barriers that protect large firms. Market-creating institutions allow property rights to be secured ensuring that people retain their returns from their investment and resolve disputes (Djankov et al 2002). This encourages people to invest in themselves and in the physical capital which creates economic development. This security also creates confidence from firms to invest in human capital to improve the productivity of labour.

Through literature, it is evident that the quality of Nigeria’s market-creating institutions is weak. The Economist Global Outlook report ranks Nigeria at 76 out of 82 countries examined and identifies Nigeria’s business environment as “very poor”. The World Bank’s Doing Business 2010 ranks Nigeria at 125 out of 181 countries. Nigeria is placed ahead of the likes of India (133) and Brazil (129) however behind the more dynamic countries such as China (89), Ghana (92) and Indonesia (122) (World Bank, 2010). The business environment in Nigeria is weak due to the lack of market-creating institutions.

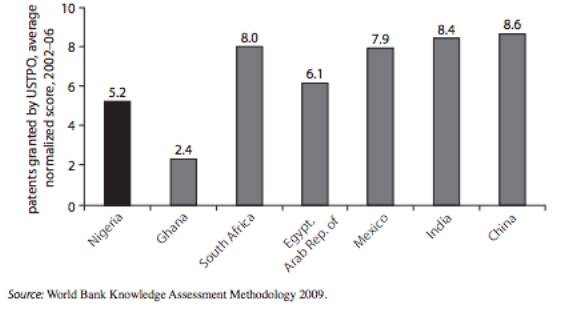

The is a lack of property rights protection in Nigeria, figure 1 displays that patents issued by the USPTO to Nigeria is lower than most countries compared to other than Ghana, highlighting that Nigeria’s market-creating institution lacks in protecting property rights.

Low levels of Patents in Research

Low levels of Patents in Research

Figure 1: Levels of Patents of developing countries

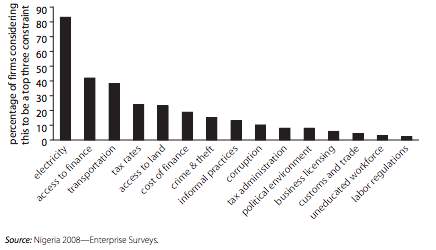

There is a lack of infrastructural development in Nigeria, there is poor electricity provision which can lead to damaged machinery and equipment because of the electricity outage and voltage fluctuations. No access to finance and poor transport links such as poor roads and train links, makes it more difficult for businesses to operate. 83% of Nigerian business owners consider lack of electricity the biggest constraint to doing business (WorldBank 2016). Poor transport links create delays in delivering and shipping products. Access to finance is vital in any economy, an efficient financial system that allocates financial resources quickly and cheaply presents an incentive for people to invest and innovate. These are major constraints to doing business in Nigeria. If Nigeria’s market-creating institutions were to improve in this area there would be a huge rise in entrepreneurship in Nigeria.

Figure 2: The major perceived constraints of entrepreneurship in Nigeria (WorldBank, 2008).

Lack of ‘Rule of law’ has hampered Nigeria’s foreign direct investment. Lack of ‘Rule of Law’ creates a fearful environment for firms as they uncertain if any disputes or cooperation and commitment problems arise, would they be solved, which could mean they have to take a loss from their investment as a result. Corruption due to a lack of values is also a constraint to investing and innovating for example when a Government contract is at stake, firms are expected to pay a percentage of its value in informal gifts or payment in order to secure it, these could be construction permits which all affects small and medium firms.

An improvement in Nigeria’s market-creating institutions will provide more opportunities for entrepreneurs especially young people. It will also make the business environment much more attractive for foreign direct investment in many other sectors, not just in oil, gas or telecom. Nigeria will also benefit from the wealth of knowledge multinational corporations bring, the employment of opportunities they provide and a development of Nigeria’s technological capabilities.

Acemoglu term property rights institutions as more important than contracting institutions for economic growth, investment and financial development- contracts can be changed and manipulated as there are loopholes in contracts especially if there are contractual imperfections.

Market regulating institutions enforce rules for the benefit and protection of investors. They help compensate for market failures and deal with any externalities arising from fraud and anti-competitive behaviour. A regulatory environment is essential for innovations to transpire as it ensures that markets are fair, efficient and transparent. The Nigerian government has put in place regulatory frameworks to ensure the growth of the market (Figure 3). However, the quality of the market regulating institutions can be questioned.

Impose penalties and address any wrongdoings

Figure 3: List of Nigeria’s market regulating agencies

| Regulatory agency | Function |

| Central bank of Nigeria | The Central Bank Of Nigeria is the lead bank regulator who is responsible for managing the country’s currency, interest rates, money supply and ensuring price stability. |

| The Corporate Affairs Commission (CAC) | Established to regulate and supervise the formation, incorporation, reregistration, and management of companies. Conduct investigations into the affairs of any company where interest of the shareholders and public are of high demand. |

| Financial Services Regulations Co-ordinating Committee. | Implemented to supervise with the regulation of the financial sector through administering strategies that promote safe, sound and efficient practices by financial intermediaries. |

| The Securities and Exchange Commision | SEC was established to ensure the capital market Is being regulated. Responsible for registration of businesses and the regulation of public companies’ securities. |

You have to be 100% sure of the quality of your product to give a money-back guarantee. This describes us perfectly. Make sure that this guarantee is totally transparent.

Read moreEach paper is composed from scratch, according to your instructions. It is then checked by our plagiarism-detection software. There is no gap where plagiarism could squeeze in.

Read moreThanks to our free revisions, there is no way for you to be unsatisfied. We will work on your paper until you are completely happy with the result.

Read moreYour email is safe, as we store it according to international data protection rules. Your bank details are secure, as we use only reliable payment systems.

Read moreBy sending us your money, you buy the service we provide. Check out our terms and conditions if you prefer business talks to be laid out in official language.

Read more