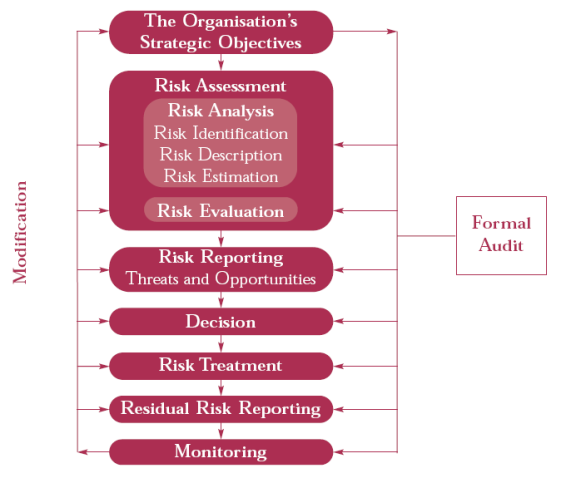

Risk this is defined as the combination of the probability of an event and its consequences. In all types of undertaking, there is the potential for events and consequences that constitute opportunities for benefit (upside) or threats to success (downside). Risk Management is increasingly recognised as being concerned with both positive and negative aspects of risk. Therefore this policy considers risk from both perspectives.

Risk management is a central part of the B & W Plant Hire and Sales Ltd strategic management. It is the process whereby we methodically address the risks attaching to their activities with the goal of achieving sustained benefit within each activity and across the portfolio of all activities. The focus of good risk management is the identification and treatment of these risks. Its objective is to add maximum sustainable value to all the activities of the organisation. It marshals the understanding of the potential upside and downside of all those factors which can affect the organisation. It increases the probability of success, and reduces both the probability of failure and the uncertainty of achieving our overall objectives.

The risks facing an organisation and its operations can result from factors both external and internal to the organisation. Risk identification is the process whereby B & W Plant Hire and Sales Ltd sets out to identify its exposure to uncertainty. Risk identification is approached in a methodical way as part of the annual strategic review process to ensure that all significant activities within the organisation have been identified and all the risks flowing from these activities also defined. All associated volatility related to these activities is identified and categorised. Business activities and decisions are classified as:

Strategic – These concern the long-term strategic objectives of the organisation. They can be affected by such areas as capital availability, sovereign and political risks, legal and regulatory changes, reputation and changes in the physical environment.

Operational – These concern the day-today issues that the organisation is confronted with as it strives to deliver its strategic objectives.

Financial – These concern the effective management and control of the finances of the organisation and the effects of external factors such as availability of credit, foreign exchange rates, interest rate movement and other market exposures.

Knowledge Based – These concern the effective management and control of the knowledge resources, the production, protection and communication thereof. External factors might include the unauthorised use or abuse of intellectual property, area power failures, and competitive technology. Internal factors might be system malfunction or loss of key staff.

Compliance – These concern such issues as health & safety, environmental, trade descriptions, consumer protection, data protection, employment practices and regulatory issues.

As part of the annual strategic review each identified risk is described in a structured format is necessary to ensure a comprehensive risk identification, description and assessment process. Risk estimation is assessed as high, medium or low using the guidelines shown in the tables below.

Risk identification & Categorisation

|

1. Name of Risk |

|

|

2. Impact of Risk |

Qualitative description of the events, their size, type number and dependencies |

|

3. Quantification of Risk |

Probability and Significance |

|

4. Potential Action for Improvement |

Recommendations to reduce risk |

Risk Consequences – Threats and Opportunities

|

High: |

Financial impact on the organisation is likely to exceed £250,000 |

|

Significant impact on the organisation’s strategy or operational activities |

|

|

Significant stakeholder concern |

|

|

Medium |

Financial impact on the organisation likely to be between £150,000 and £350,000 |

|

Moderate impact on the organisation’s strategy or operational activities |

|

|

Moderate stakeholder concern |

|

|

Low |

Financial impact on the organisation likely to be less that £150,000 |

|

Low impact on the organisation’s strategy or operational activities |

|

|

Low stakeholder concern |

You have to be 100% sure of the quality of your product to give a money-back guarantee. This describes us perfectly. Make sure that this guarantee is totally transparent.

Read moreEach paper is composed from scratch, according to your instructions. It is then checked by our plagiarism-detection software. There is no gap where plagiarism could squeeze in.

Read moreThanks to our free revisions, there is no way for you to be unsatisfied. We will work on your paper until you are completely happy with the result.

Read moreYour email is safe, as we store it according to international data protection rules. Your bank details are secure, as we use only reliable payment systems.

Read moreBy sending us your money, you buy the service we provide. Check out our terms and conditions if you prefer business talks to be laid out in official language.

Read more