Microfinance and Women Empowerment: Their Space and Opportunity for Poverty Reduction

A thesis proposal

TABLE OF CONTENTS

CHAPTER I………………………………………………………

INTRODUCTION………………………………………………….

Background and Rationale of the Study…………………………………

In Context of Nepal……………………………………………….

Rational of the Study………………………………………………

Problem Statement……………………………………………..

Purpose of the Study…………………………………………….

Objective of the Study……………………………………………

Research Questions……………………………………………..

Significance of the Study………………………………………….

Limitations and de-limitations………………………………………

CHAPTER II………………………………………………………

Literature Review………………………………………………..

Thematic review……………………………………………….

Conceptual Framework…………………………………………..

Review of Theories (Theoretical review)………………………………..

Microfinance…………………………………………………..

Empowerment………………………………………………….

Women and Poverty…………………………………………….

CHAPTER III……………………………………………………..

Research Methodology…………………………………………….

Research Philosophy…………………………………………….

Methodology………………………………………………….

Research design…………………………………………………

Case Study…………………………………………………….

Methods…………………………………………………….

Data Collection………………………………………………..

Tools……………………………………………………….

Interview guidelines:…………………………………………….

Reliability and Validity of Research:…………………………………….

Data Analysis and Interpretation:………………………………………

Ethical considerations……………………………………………..

Time Scheduled………………………………………………..

references………………………………………………………

The word Microfinance is literally comprised of two words ‘micro’ and ‘finance’ which means ‘small’ ‘loan’. Microfinance goes the provision of small loan for the poor. Christen (1997) defines microfinance as the means of providing a variety of financial services to the poor based on market-driven and commercial approaches. This definition encompasses provision of other financial services like savings, money transfers, payments, remittances and insurance, among others. Microfinance is a joint liability lending means it must borrow within a group of other borrowers. Participate of microfinance must organize themselves in groups and act as security for each other’s loans. In reality, the individual is not only responsible for loan repayment to the microfinance institution. The groups use peer pressure and peer monitoring to ensure that loans acquired by members are repaid.

The United Nation proclaimed 2005 as the “Year of Micro-credit” while 2006 went a score higher to award a Nobel Peace Prize to the largely acclaimed founder of modern microfinance Prof. Muhammad Yunus and the bank he founded in the 1970s the “Grameen Bank”.

Microfinance is emerging as a powerful instrument for poverty alleviation in the new economy. Microfinance refers to a collection of banking practices built around providing small loans (typically without collateral) and accepting tiny deposits. This program aimed at providing a cost-effective mechanism for providing financial services to the “unreached poor”.

Empowerment is reflected in a person’s capability set. The capability of a person depends on a variety of factors, including personal characteristics and social arrangements. Empowerment is defined and measured in various dimensions, impact on decision-making on self confidence. Empowerment is related to the process of internal change and to the capacity and right to make decisions. It consists of change, choice and power. It is a process of change by which individuals or groups with little or no power gain the ability to make choices that affect their levels. The structure of power (i.e. who has it what its sources are, and how it is exercised) directly affect the choices that women are able to make in their lives.

The core of empowerment lies in the ability of a woman to control her own destiny. This implies that to be empowered woman must to only have equal capabilities ( such as education and health ) and equal access to resources and opportunities ( such as land and employment ) , they must also have the agency to use those rights, capabilities, resources and opportunities to make strategic choices and decisions ( such as are provided through leadership opportunities and participation in political institutions ) And to exercise agency, women must live without the fear of coercion and violence.

Ownership and control over assets such as land and housing provide economic security incentives for taking economic risks that lead to growth and important economic returns, including income. Yet women in many countries around the globe are far less likely than men to own or control these important assets. Ensuring female property and inheritance rights would help empower women both economically and socially and rectify a fundamental injustice. Rectifying this injustice will also have other positive outcomes because women’s lack of property has been teasingly linked to development related problems, including poverty.

Microfinance deals with women below the poverty line. Micro loans are available solely and entirely to this target group of women. There are several reason for this : Among the poor, the poor women are most disadvantaged-they are characterized by lack of education and access of resources, both of which is required to help them work their way out of poverty and for upward economic and social mobility.

In the feminist paradigm, empowerment goes beyond economic betterment and well being to strategic gender interests. Empowerment can exist at an individual level, where it is about having an agency increased autonomy, choice, self-confidence and self-esteem. It can also exist at a collection level that would include collective mobilization of women and when possible men, for the purpose of questioning and changing the subordination connected with gender. Personal and collective empowerment is intrinsically linked because without the later, the former becomes circumscribed.

The focus women’s empowerment in the context of microfinance brings to light the significance of gender relations in policy development circles more prominently than ever before. The social problems of women are due to gender stereotypes and roles that put women under enormous pressure. These gender roles have their roots in Nepal. Other problems that influence the lives of women emerge from poverty, both the poverty of individual households and the poverty of post-conflict state that has to deal with a multitude of problems in various sectors. As women can hardly participate in politics, their needs are often overlooked.

Another view of women’s empowerment argues that it needs to occur in multiple dimensions economic, socio-cultural, families/interpersonal, legal, political and psychological. These dimensions cover a broad range of factors, and thus women may be empowered within one of these sub domains. For instance, the socio-cultural dimension covers a range of empowerment sub domains, such as marriage systems norms regarding women’s physical mobility, non familial social support systems and networks available to women.

Microfinance for the poor and women has received extensive recognition as a strategy for poverty reduction and for women’s economic empowerment. These are good reasons to target women. Gender equality turns out to be good for everybody. The World Bank reports that societies that discriminate on the basis of gender have greater poverty, slower economic growth, weaker governance and a lower standard of living. Women are poorer and more disadvantaged than men. The UNDP’s Human Development Report 1995 found that 70% of the 1.3 billion people living on less than $1 a day hold are women. Studies in Latin America and elsewhere show that men typically contribute 50-68%of their salaries to the collective household fund, whereas women ‘tend to keep nothing back for themselves because “women contribute decisively to the well-being of their families” investing in women brings about a multiplies effect. Again every microfinance institution has stories of women who not only are better off economically as a result of access to financial services but who are empowered as well. Simply getting cash into the hands of women ( by way of working capital ) can lead to increased self-esteem, control and empowerment by helping them achieve greater economic independence and security which in turns gives them the chance to contribute financially to their households and communities.

The experience of empowerment and disempowerment are related not just to material means and interventions, but also to social relationship (Kabeer & Hag, 2010), Sardenberg, 2010a), narratives (Priyadarshini & Rahim, 2010) voice (Goetz & Nyamu Musembi, 2008), choice (Kabeer, 2008) and negotiations (Johnson, 2010).

Throughout the world, poor people are excluded from formal financial system. This exclusion ranges from partial exclusion in developed countries. This makes poverty an important development challenge and explains why poverty became an issue.

Nepali women are born into a patriarchal society. In all cases woman’s rights are subordinate to those of men. Married early, with little or no education, no land rights or independent income, women are a voiceless section of society dependent on men for their welfare and bearing the continued weight of cultural and social discrimination and violence against them. If a woman does not feel safe within a society then she cannot be empowered within it. The threat of violence towards women is a pervasive and unmanaged threat in Nepali society. Women face domestic violence, often unreported or violence through organized trafficking of young girls sold for sex across Asia. The general immunization, health and nutrition situation of women in Nepal remains very poor, particularly in rural areas. Statistics shows that one out of every 24 Nepali women will die during pregnancy or child birth-making reproductive health care a major focus of intervention.

Women’s empowerment is central to the empowerment and prosperity of a community. While the Nepali government, the United Nation (UN) and Non-government Organizations (NGOs) have made some impact in relation to women’s needs, there are still significant problems that need to be overcome.

At the organizational level, women’s representation in decision-making is still low among MFIs (Microfinance Institutions). Women were found to represent 31% of the governing body of MFIs. This figure paints quite a positive picture in terms of women’s representation. However, a third of them, MFIs had no women in the governing board. Similarly about 65% (17 out of 26) of the MFIs had no women in senior level management. As clients, although women represent almost 75% of the clientele of MFIs those women are rarely involved in the decision-making processes of matters such as interest rate structure or repayment schedule. The common approach of MFI is a top-down delivery system whereby women are given the details of the loan mechanism fixed by microfinance service providers.( Cited from VIN studies online.).

The focus on women’s empowerment in the context of microfinance brings to light the significance of gender relations in policy development circles more prominently than ever before. Women are vaunted as a “weapon against poverty” (DFID, 2006, p.1)

The rationale for providing women access to microfinance services is that gender inequalities inhibit economic growth and development. (World Bank, CIDA, UNDP, UNIFEM). Hence, the Canadian International Development Agency (CIDA) provides increased access to productive assets (especially land, capital and credit) processing and marketing for women (CIDA, 1999).

Critics of the development perspective argue that the policy development approach to empowerment is extremely instrumental. As Cornwall and Edward (2010) put it “Women’s empowerment is heralded as a means that can produce extraordinary ends their empowerment extolled as the solution to a host of entrenched social and economic problems. The predominant image of empowerment in development is that women gaining (material) means to empower themselves as individuals and putting this to the service of their families and communities. This is primarily because empowerment is understood in relation to deliberate and planned interventions such as electoral quotas education, economic empowerment initiatives, legislative change and non-governmental public action.

The alternative perspective emphasizes that women’s empowerment emerges as a result of cultural, economic and other changes, such as the availability of new technologies in their lives (e.g. mobile, phones and satellite televisions) as women’s current opportunities and constraints and as a process in time, across generations (Cornwall and Edward, 2010). Since the context of women’s lives matters and the same interventions are not effective everywhere, most of the policies remain ineffective (Abdullah, Aisha and King 2010, Sardenberg 2010). The experiences of empowerment and disempowerment are related not just to material means and interventions, but also to social relationships (Kabeer and Hag, 2010, Sardenberg 2010) narratives (Priyadarshini and Rahim 2010) voice (Goetz and Nyamu Musembi 2008) choice (Kabeer 2008) and negotiations (Hug 2010, Johnson 2010).

This critique is well reflected in the three paradigms of women’s empowerment through microfinance.

(i ) Feminist empowerment paradigm,

(ii) Financial self-.sustainability paradigm, and

(iii) Poverty alleviation paradigm.

(Mayoux, 2005-2006).

It is not that MFIs do not pay attention to women’s empowerment issues however; they do not marginally by adhering to the later two paradigm. As Mayoux (2005, 2006) eloquently explains- “In the financial self sustainability paradigm, women’s empowerment strategies are seen as entailing unacceptable costs as the paradigm’s explicit aim is to develop fully financially self-sufficient MFIs. In the poverty alleviation paradigm, women’s empowerment is seen as an external imposition by Western-influenced middle class feminist elite with little relevance to the needs of poor women. It is also seen as politically sensitive and involving conflicts within households and communities that may undermine organizational sustainability. Both paradigms perceive conflicts between women’s empowerment and development rims.

The study will focus on the role of Microfinance to empower the women in Nepal. It particularly will highlight women’s perception about microfinance schemes and their experience with everyday life in post-conflict Nepal. It is against this background that the researcher intends to carry out a study in order to analyze the outreach and impact of microfinance on the poor women of Nepal. The findings will be drawn from an in-depth analysis of data obtained from microfinance issued to women beneficiaries.

The study will have its own importance. So far, there have been studies made on the situation of microfinance, impact. But there are no adequate research made to find out the specific problem that why women entrepreneurs are not improving their socio-economic activities. Without identifying the microfinance issues appropriate policies and programs for the overall development cannot be formulated. As women cover more than half of the country’s population development cannot be made without their development. In order to make their development it is necessary to empower them through microfinance. The study’s importance lies on including home and the country. The study will also explore the forms and intensity of empowering the women through microfinance that are changing over time. This will help to see the changes that are taking place to improve their socio-economic activities. The study will probe into the microfinance related issues interplaying in other aspects such as poverty elimination. If the study identifies microfinance as one of the poverty elimination factors then appropriate policy to reducing poverty by microfinance could be formulated. The study will have significance in the sense that it will be helpful for the policy makers and planners to formulate and implement the policies and programs on microfinance by addressing the poverty elimination issues.

The general objective of this study is to determine the contribution of microfinance in women empowerment to get the space and opportunity to reduce the poverty. This study is also to obtain better understanding of all relationships between women’s access to small loans and change in households as well as role and responsibilities.

Based on the general objective, the specific objective will be on:

The research questions of the study are as follows:

Microfinance Institutions around the world have been quite creative in developing products and services that avoid barriers that have traditionally kept women from accessing formal financial services such as collateral requirements, male or salaried guarantor requirements, documents requirements, cultural barriers, limited mobility and literacy. Nevertheless in a number of countries and areas few or no institutions offer financial services under term and conditions that are favorable women. Together these findings confirm that the type of products offered their conditions of access and the distribution of an institution’s portfolio among different products and services affect women’s access to financial services. They also suggest that much more can be done to serve poor women in certain cultural and economic contexts.

Limitations will always be present when carrying out research and this thesis is no exception. Microfinance is a big topic and it is impossible to cover all aspects of it. This study focuses on the different approaches. Within the microfinance field, and its effect on empowerment, using both primary and secondary sources. The primary evidence all come from the case study, as due time and space while in the field, further case studies will not available to use. Furthermore, of other aspects of the effects microfinance such as its influence on poverty alleviation is not the focal point, once more due to time and space constraints.

A further limitation related to the people interviewed. However once in the field this will impossible to present in the field to sit down and talk because they themselves are working, which meant that it is difficult to find the time. Since it is mainly the women’s opinion of empowerment that is under scrutiny in the research paper that is more important to get their point of view.

To get the better understanding of lives of the women involved in microfinance project it’s important to interview their husbands to get their opinion on the matter an whether they erected a change in the women’s behavior or attitude. But it’s not possible for their husbands to come along as they have jobs to take care as well.

Key Terminology

Microfinance, Women Empowerment, Poverty Reduction, Financial Services, Group Guarantee, Socio-economic activities, Poor

This chapter deals with the review of different types of literature related to this study. A literature review interprets and synthesizes what has been researched and published in the area of interest. A literature review is required to be familiar with the previous research and theory in the area of the study that helps in conceptualizing the problem, conducting the study and interpreting the findings. Literature review is also done to assure whether the study that the researcher is going to do is already done or not. This study will be related to microfinance. The study will be limited to certain part of Nepal. There is an influence of location in case of microfinance. The findings of the study may be different if the study will be conducted in a different location. So, the findings of this study cannot be generalized.

Although this study is concentrated on the issue related to microfinance for women in Nepal. The researcher will make a literature review of the government policy on poverty elimination. Nepal’s overall development policy also will be reviewed in order to see its impact on microfinance project’s development. Government’s policies that address poverty issues will be reviewed as well. The purpose of the literature review is to find out the microfinance helps in poverty elimination and development in rural sector. As this study will be concentrated in Nepal literature highlighting the microfinance and its impact on development of women will be reviewed.

There have been three types of literatures will be included in this review. The theoretical review consists of review of different types of theories that are relevant of this study. The theories that researcher will have reviewed through literature are the development theories, women and poverty and impact of microfinance. Similarly, policy documents on poverty elimination will review to know the government policies on poverty eradication. The review of empirical studies will have been made to know the findings that have been so far made in the area of microfinance. Such type of review helps to know about the studies that have already made in particular area. It further enables the researcher in establishing the research to focus of her research.

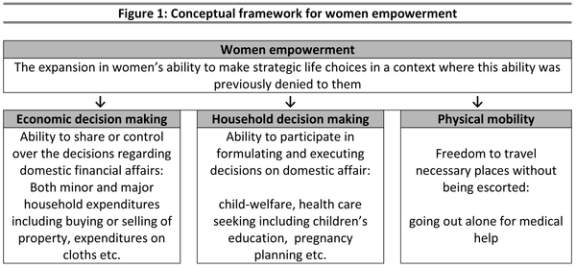

In order to understand the role of Microfinance to empower the women to reduce the poverty conceptual framework has been developed, which is shown below (Figure 1). This has been developed based on an initial literature review undertaken on the impact of Microfinance. The conceptual framework consists of six major components; the micro-credit services, saving services, non-financial services, social services clients and small business characteristics and the clients’ wellbeing.

First, the financial services are the driving force of socio-economic development of poor people and poverty reduction. The financial services of microfinance are generally known as the credit and saving, insurance, payment and repayment services (Ledgerwood, 1999). Loan is a main product of microfinance institutions which refers to small amount of credit given to poor people at reasonable interest for generating income through self-employment. The terms of the given loan are important determinants to the clients’ wellbeing and household improvement and their businesses’ performance. For example, increasing the size of the given loan is important for extend the market and the size of micro and small enterprises. The flexibility of loan disbursement which includes the facilities of easy access to services, time responsiveness and providing adequate information about the terms of service is important determinants for improving the clients’ wellbeing. Moreover, the flexibility of loan repayment policy which includes loan grace period, repayment period, and interest rate all are critical factors for determining the role of microfinance services on clients’ wellbeing (Hulme, 1996; Ledgerwood, 1999; Robinson. 2001).

The role of Microfinance to empower women in poverty reduction has attracted the policymakers’ attention in the developing countries across the globe. Yet, the clear evidence on the positive impact of microfinance is no exists. What is the role of microfinance to empower the women? This question is always repeated among the academicians and policymakers in the government and non government agencies, therefore, this research attempts to uncover the role of microfinance on women empowerment. The intervention of microfinance is consists of three major functions of financial, non-financial and social intermediation services which have significant impact on the women empowerment which is helpful to reduce poverty.

The outcomes of the study could provide clear evidence about the impact of microfinance on the women empowerment to reduce poverty which contributes to the body knowledge of the literature. It is also will hopefully provide valuable guidelines, to the policymakers in how to improve the outreach and sustainability of microfinance generally and the women empowerment to reduce poverty particularly. The research will present in this paper is a part of an ongoing PhD research at Faculty of Management in the Singhania University to develop a framework of the role of microfinance intervention services to the women entrepreneurs.

Figure 1. ……….. (Source: “Conceptual Framework: The Role of Microfinance on the Wellbeing of Poor People. Cases Studies from Malaysia and Yemen.” Article: December, 2013)

There are different theories propounded in the area of social science. “Theory means different things to different people. Its role in research and case study research in particular can be better understood if we recognize how theory is being defined and what type of theory we are referring to” ( Merriam, 1988, p.57 ). In research theories are the ideas that are defined and applied in course of defending the information collected from different sources. Facts do not speak for themselves, they have to be explained, and it is theory that enables us to understand them (Abbot and Wallace, 1996, p.26).

This study is related to empowering the women through microfinance. In this area microfinance is the best instrument to help empowering the women.

Microfinance gives emphasis to improve the life style of the poor family. The role of women in society in development aspects will be identified. Feminists expect that development theories address to the issues regarding women’s development. The central thrust of the feminist debate on development is contained in the issue of women’s subordination to men. In this area microfinance supports to earn money through these projects.

When examining Microfinance it is important to take closer look at the theories behind the term empowerment. It is therefore necessary to scrutinize what is meant by the term empowerment before applying it to the analysis and examination of whether microfinance does indeed generate it. While there are many different ways that one can view empowerment, this thesis will limit it to the ideas postulated by Kabeer and Rowlands in order to better analysis it, and over-expanding the focus.

Secondly the capabilities approach is applied. The capabilities approach is closely related to theories of empowerment focusing on assets also important when considering latter flowerer, the capabilities approach presents its aspects differently than the empowerment theories used and gives rise to applying contrasting forms of discussion in connection with the examination of the effects of microfinance. There by allowing further investigation into the effects of microfinance on women. The capabilities approach will be viewed mainly through Amarty Sen and Martha C. Nassbaum’s ideas.

The third and final concept applies is that of participation. In relation to the practice of microfinance participation also plays on important role as the very process of microfinance activities is to include people actively participation in the development scheme. Similar to the other theories used, this paper cannot look at all aspects of participatory development, therefore presenting a general view of it the theory section.

When women are poor, their rights are not protected. They face obstacles that may be extraordinarily difficult to overcome. This results in deprivation in their own lives and losses for the broader society and economy, as women’s productivity is well known as one of the greatest generators of economic dynamism.

While both men and women suffer in poverty, gender discrimination means that women have far fewer resources to cope. They are likely to be the last to eat, the ones least likely to access healthcare, and routinely trapped in time-consuming unpaid domestic tasks. They have more limited options to work or build businesses. Adequate education may lie out of reach. Some end up forced into sexual exploitation as part of a basic struggle to survive.

Women who are trying to support their family in development are actually are not free from the cultural taboos. They get motivated in credit through microfinance that helps to perform better to improve their lifestyle. Positive reinforcement also helps in performing high in credit area which is provided by microfinance institutions to empower the poor women. In this thesis how the physical facilities helps women in performing high in credit area through microfinance will be reviewed.

Thesis review

Journal review

This chapter presents methodological considerations of this study. The researcher begins discussion with methodological orientation of this research.

Ontology is concern with the reality of the society. It is about the form and nature of the reality of society and its concerned with the questions like what is there that can be known, how they are and how they work (Parajuli, 2005). The researcher should be clear about her position while doing the research. She also should understand the way of translating her knowledge and understanding into the research.

Positive views that reality is there and it is single. Research unfolds the reality through the use of scientific methods. The reality that the positivists think is objective which is only one and that could be observed. In contrary, the non-positivist believes that reality is context-specific and multiple. Researcher constructs the reality through the use of narrative methods. The researcher will try to see the reality from the perspective of a social scientist. So, the reality that she will try to find may be multiple i.e. based on various sources. Reality is subjective that could be perceived differently by different persons. The researcher will try to find out the reality through the subjective approach. Here her stand will be that the reality that one person perceives is different to another.

Epistemology is concerned with the nature of knowledge. It is about the reality of society or knowing this world and the foundation, scope and validity of the knowledge as well as the relationship between the knower and the known (Parajuli, 2005). How we are going to know this world (Burrell and Morgan, 1979) say that epistemology is how knowledge could be acquired or it is something that has to be personally experienced as cited in (Cohen, Manikin & Morrison, 2000, p.6).

According to the humanists the social world can be understand from the stand point of the individuals who are part of the on-going action being investigated, and that then model of a person is an autonomous one, not the plastic version favored by the positivist researchers ( Cohen, et.al 2000, p.19 ). Considering such a humanist research approach by applying the subjective and interpretive approach in this research study.

Methodology is concerned with “knowing the world”. It says within the basic premises of ontology and epistemology. It is the procedure about knowing the knowledge by asking questions like what are the ways of finding out knowledge. It is the theoretical and philosophical framework that is constructed in order to acquire the knowledge about the world (Parajuli, 2005). Methodology is used to know the reality. In this context, the following methods will be followed to know the reality.

This is a qualitative study. Qualitative means data conveyed through words (Merriam, 1988, p.67). Case study makes extensive use of qualitative data. “Qualitative data consist detailed descriptions of situations, events,people,interactions and observed behaviours,direct quotations from people about their experiences,attitudes,beliefs and thoughts and excerpts or entire passages from documents,correspondens,records and case histories ( Patton, 1980, p.22 as cited in Merriam, 1988. p.67-68 ). This study will follow all these requirements of qualitative data.

Case study gives a unique example of real people in real situations, which enables readers to understand ideas more clearly. This study will be conducted in a real setting i.e. field area where the microfinance project is running. It will try to find out the causes of microfinance and its effect in society. The characteristics of case studies as pointed out by (Hitchcock and Hughes, 1995) are its rich and vivid description of events, chronological narrative of events and binding of description of events with analysis. It focuses on individual actors or groups of actors and seeks to understand their perceptions of events, being a researcher this research’s involvement in the case study will be high in order to understand the reality from the local perspectives. The perspective of the relevant groups of actors also will be included in this study. It is necessary to include the perspectives not only of those who are included but also of those who are excluded (Subedi, 2005, p.2).

Method is general mode or wider level plan of generating and encompassing specific tools and techniques for the purpose. It is the operational procedure of the research process (Parajuli, 2005). Method is technique (tools, observation, guidelines etc). Methods mean the range of approaches used in educational research to gather data which are to be used as a basis for inference and interpretation for explanation and prediction

(Cohen, et al, 2000).

The study will make use of both the primary and secondary data for its qualitative study. According to Merriam (1988, p.67) data conveyed through words are “qualitative” and data presented in number form are “quantitative”. The writer further says that qualitative data consist of detailed descriptions of situation, events, people, interactions and observed behaviors, direct quotations from people about their experiences, attitudes, beliefs and thoughts, and excerpts or entire passage from documents, correspondence, records and case histories (Patton, 1980, p.22) as cited in (Merriam, 1988, p.67-68). Qualitative case studies rely upon qualitative data collected from different sources such as interviews, observations and documents. This study will be based on the qualitative data collected from different sources. Qualitative data are more unstructured and critical than quantitative data. Most qualitative data for a case study are collected in natural and unconstructed observational settings over a considerable period of time before the researcher can trace evidences of any pattern of behavior (Subedi, 2005, p.3). The researcher will make use of the triangulation methods in collection of the data required for this study. (Denzin, 1970, p.30) has given the name triangulation for using the multiple methods in collection of data. In triangulation the dissimilar methods such as interviews, observations and physical evidence are combined to study the same unit (Merriam, 1988)

Secondary data will be mainly based on the literature review. Different types of published documents on microfinance will be reviewed. The source of secondary information for the study will be websites, documents published by different organizations (inside and outside the country), research papers, journal articles, books and research reports etc.

This study will make use of the following tools for the collection of primary data.

Focus Group Discussion Guidelines:

Focus group discussion (FGDs) will conducted in order to get the perception of different people on a particular theme. Interaction takes place within the group on a topic supplied by the researcher. Morgan (1988) says that in a focus group the participants interact with each other rather than with the interviewer so that the views of the participants emerge. Here, the participants rather than the researcher’s agenda emerge (Cohen, et. Al. 2005 p.288). This is only captured by the researcher.

In this study there will be focus group of women enjoying micro-credit and women not enjoying micro-credit product will conducted. The focus group with women enjoying micro-credit and women not enjoying micro-credit both will be included.

Interview is collecting information from person to person. The meaning of interview as given by Webb and Webb is a conversation with a purpose (as cited in Merriam, 1988, p.71-72). Merriam further says that the main purpose of interview is to find out what is “in and on someone else’s mind”. Interviews are taken to find out the things that we cannot directly observe for example, feelings, thoughts and intentions cannot be observed. Interview helps to know others perspective in particular field.

There will be interview guidelines developed for the collection of information from the interviewees. The interviews will be unstructured so that counter questions could be asked to the participants. Unstructured interviews are particularly useful when the researcher does not know enough about a phenomenon to ask relevant questions (ibid, 1988, p.74). While taking the interview the researcher talk less and listen more in order to acquire more information from the interviewees.

The interview guideline will include questions based on the research questions of the study. It will be just a guideline and the researcher will have right to add and subtract the questions. Counter questions also will be asked to the interviewees. There will be interviews taken with the project manager, female employee of micro-credit project, micro-credit enjoyer and local females. There will be in-depth interviews taken with the women and the related persons. All the interviews will be recorded with the permission of the participants.

The researcher will work as a research participant in the microfinance project class observation. The meaning of research participant as given by (Merriam, 1988, p.93) is one who participates in a social situation but is personally only partially involved, so that s/he can function as a researcher. The researcher will play such a research participant role while observing the urban area.

The reliability and validity of the collected information will be checked in different ways. Reliability of the data will be checked through consistency and variance of response. If the responses are same when checked over and over it will create a base for reliability. If there will be variance of responses then the data collected will be unreliable. The responses collected from various sources in different intervals of time will be analyzed to examine the consistency of the responses.

Validity of the data could be maintained following different strategies. First of all, the researcher will make use of triangulation using multiple investigators, multiple sources of data and multiple methods to confirm the emerging findings. Triangulation is often thought of as a way of checking out insights gleaned from different informants or different sources of data (Taylor & Bogdan, 1998, p.80). The data collected from different sources will be triangulated. For example, information collected on the same topic from different sources will be triangulated for maintaining its validity. As mentioned above, the number of participants high in particular topic will be considered valid. Member checking or organizing a workshop on the findings of the study at the field level is another way of triangulation. Diary writing also helps in this matter. The validity of data could be checked through long-term observation. The long-term observation at the research site one repeated observations of the same phenomenon helps to increase the validity of the collected data (Merriam, 1988, p.169). Another strategy that the researcher will apply for the validity of the collected data is through member checking which means taking the data and interpretations back to the people from whom they were derived and asking them if the results are plausible.

This is a qualitative study so there will be use of rich descriptive data, people own written of spoken words, their artifacts, and their observable activities. “Descriptive studies are communicated through concepts illustrated by data” (Taylor & Bogdan, 1998, p.135).

Glaser and Strauss (1968) argue that qualitative and other social science researchers should direct their attention to developing or generating social theory and concepts (Glaser and Strauss, 1968 as cited in Taylor & Bogdan, 1998, p.136). Most qualitative studies are directed toward building theory. Since this study is a qualitative one, the researcher will try to generate social theory and concepts while analyzing the data. The purpose of the theoretical studies is understanding or explanation of features of social life beyond the particular people and setting studies (Taylor & Bogdan, 1998, p.136). There will be theme developed while analyzing the data. The data will be analyzed and interpreted theme wise and participant wise. Consideration will be made to research questions of the study while categorizing and analyzing the data.

Since it is qualitative study, data collection and analysis will go side by side. Through the data collection in the field the researcher will go on theorizing data and making sense of it. There will be coding after the data been collected. It helps to refine the researcher’s understanding of the subject matter. The coding will start as soon as the field work will be completed. This will help to clarify the points that are not clear to the researcher. The final activity of data analysis will be to discount findings, i, e., understanding the data in the context in which they were collected.

“Getting into a setting usually involves some sort of bargain-explicit or implicit assurances that nobody will violate informants “privacy or confidentiality, expose them to harm, or interfere in their activities”(Taylor & Bogdan, 1998, p.82). In order to maintain ethics in the field the researcher will keep everything that she has known about the participant confidential. Moreover, the researcher will make use of pseudonym in this thesis to keep everything about the participants confidential. If it is necessary to expose their name or reality then the researcher will take consent of the participants of the field study.

It will take one year to finish the data collection and another one year to complete the thesis. It’s only assumption but it’s depends on the situation. If there is any unfavorable situation will occur then it may take some more time.

2010, K. a. (2010).

Bogdan, S. a. (1988). Techniqyes and Methods of Investigation of Qualitative Data.

Christan. (1997). Micro finance .

CIDA. (1999). Processing and Marketing for Women. CIDA Report .

Denzin, N. K. (1970). ‘Triangulation’ Research Method. Aldine Pub.Co. Chicago .

DFID. (2006). Weapon against Poverty. DFID Report , 1.

Hag, K. a. (2010). Microfinance and Women’s empowerment: Evidence from the field 15..to social relationships. Microfinance .

Hughes, G. H. (1995). Researching Teacherand Learning. Psychology Press.

Johnson, S. (2010). Assesing the impact of Microcredit. The Journal of Development Studies .

Khadka, S. (2016). Principles of Management. Kathmandu: Nima.

Louis Cohen, L. M. (2000). Research Methods in Education. Amazon Co. UK: RoutledgeFalmer .

Merriam, S. B. (September 21, 1988). Case study as Qualitative Research. Bloomington: Indiana University.

Morgan, G. B. (1979). Sociological Paradigms and Organizational Analysis. UK: Aldershot.

Nyamu-Musembi, G. a. (2008). Feminism activism refers to principled interventions with the intention of challenging and changing gender power structures.

P.Subedi, S. (2005). Policy and Law. UK: Oxford University Press.

Patton, M. (1980). Qualititative Evaluation Methods. CA: Sage.

Rahim, P. a. (2010). Feminisms, Empowerment and Development: Changing women’s lives.

Sardenberg, C. M. (March 1, 2010). Family, Households and Women’s Empowerment in Bahia, Brazil. Microfinance .

Wallace, P. A. (1996). An Introduction to Sociology: Feminist Perspective. UK: Amazon.com.

You have to be 100% sure of the quality of your product to give a money-back guarantee. This describes us perfectly. Make sure that this guarantee is totally transparent.

Read moreEach paper is composed from scratch, according to your instructions. It is then checked by our plagiarism-detection software. There is no gap where plagiarism could squeeze in.

Read moreThanks to our free revisions, there is no way for you to be unsatisfied. We will work on your paper until you are completely happy with the result.

Read moreYour email is safe, as we store it according to international data protection rules. Your bank details are secure, as we use only reliable payment systems.

Read moreBy sending us your money, you buy the service we provide. Check out our terms and conditions if you prefer business talks to be laid out in official language.

Read more