” The hackers guide to Arts council funding”

Abstract

This research paper will provide a thorough account of the different financial components comprising of the arts council of Ireland. An investigation will be held into how the arts council of Ireland is specifically funded and by what means it financially allocates to the arts itself. In addition, a detailed analysis of how the arts council manages its finance will be conducted, both in relation to its decision-making processes and also in relation to how finances are directed internally within the organisation. The research methodology of this paper will comprise of primary research in the form of an interview with past board member Jane Dillon Byrne which will run throughout the paper strengthening my research as well as secondary research in the form of collated broadsheet publications, the councils website and its annual financial statement report from 2016. The aim of this paper is to provide a comprehensive account as to how all finance is administered under the arts council’s control and to inform future applicants of the council’s practises and procedures for applications in 2017.

Introduction

The Arts council of Ireland was first established in 1951 by the Irish government in order to encourage interest in Irish Art. In doing so it recognised that the arts have a central and distinctive contribution to make to Irelands evolving society. The primary goals of the organisation are to stimulate public interest in and to promote the knowledge, appreciation and practise of the arts. A vast range of practises such as visual art, music, performance, dance, film and literature as well as many others such as the recent inclusions of Circus and Architecture are all included in the organisations mission and strategy every year and all are largely funded.

In order to successfully meet and finance their targets the Arts council established a voluntary body of 12 members and a chair that is appointed by the minister for Arts, Heritage and the Gaeltacht for a term of five years. In addition, a staff of 41 full-time professionals carry out the daily functions of the organisation and these individuals provide expertise and strategic advice on different aspects of the arts. (village magazine, 2016) The nature of this particular organisation is a company limited by guarantee, which means the council is not funded through share capital or shareholders. In order for each department of the arts organisation to run sufficiently it is funded by the Irish Exchequer as well as substantial income being received from the national lottery and additional sources such as disclosed trust funds which contribute to the council’s annual budget.

These large sums are annually allocated across the different creative sectors in the form of bursaries, grants, art schemes and development programmes in order to promote the development of Irish art. Arts council funding is also allocated abroad under specific programmes such as an Aosdanna in order to promote Ireland in both a traditional and contemporary manner over seas.

Having revised the financial schemes and directives of this organisation through secondary research, combined with a thorough understanding of the internal mechanics obtained through an interview with Jane Dillon Byrne, I will conclude with a comprehensive evaluation of the organisations financial structure outlining all key areas of concern.

1. Funding schemes to the Arts

The council supports a vast range of schemes and programmes across a widely diverse arts sector. In order to classify each and every segment of funding for 2017 the council has divided its allocations into three different sectors and five funding amounts. Jane Dillon Byrne stated that;

“This gives significant clarity to the enormous span of financial appropriation and provides a means of adequate accessibility to those who wish to make grant applications within their respected field for 2017 “

This section of the research paper will outline, using examples, a clear indication of some of the different areas in which funding is allocated in the form of schemes and programmes. The schemes/programmes are broken into three categories; these include (1) Art form, (2) Cross Art form practisesand (3) Strategic developments. The strategic development programme is a significant plan that comprises many elements including the funding of both previously stated art forms and cross art form practises, this plan is devised as part of the councils new 10 year strategy and will be assessed in detail in the later part of this section. In addition to these categories are the financial subcategories that are awarded to successful recipients; these are broken down into five funding allocations as seen below;

An awarded recipient(s) receives funding in the combined form of one of the three introductory categories and one adjoining subcategory sum. Examples are as follows;

1(a) = (1) Art form – (a) Subcategory – £15,000.

2(b)– (2) Cross art form practises – (b) Subcategory – £20,000.

3(c) – (3) Strategic Developments – (c) Subcategory – £450,000

Applications are made to the arts council via its website where a body of panellists assigned to each particular category make a collective decision surrounding the award or refusal of financial aid. If approved, the panel assigned to that particular art form also dictate the amount awarded to each individual(s) within that categories specific budget for that calendar year. More information relating to the panellist, decision-making and budgeting process can be found in the management of funding section of this paper.

The funding pool for specific awards varies in amounts from year to year as does the annual budget produced by the government along with other means of income such as trust funds and third party contributions from the national lottery. The larger the amount of funding the council receives each year the more types of awards it can then sanction.

Likewise, with cut backs, where arts funding is reduced, so are the amount of awards available. 2016’s budget amounted to £60.1M (Mackin, 2016) Evidence of the annual rise and fall in funding can be made with regard to an online statement made by the council in 2015. “For the first time in six years, the Arts Council’s own Exchequer grant was maintained at 2014 levels (£56.668 million), and, anticipating future increases in investment, the Council was mindful in its allocations to help position the arts to benefit from, and play a full part in, the national recovery ” (www.artscouncil.ie, 2015)

2. Categories

(a) Art form

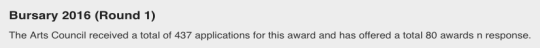

The art form category is the most expansive category and covers a range of practises such as Visual art, Circus, Opera, Street and performance, Traditional, Theatre, Music, Film, Architecture, Literature and Dance. Within each of the practises are numerous awards, bursaries and grants. The many variations of awarded grants cannot all be listed within this concise paper. However, what is apparent are the large number of applications which are completed every year. As a result, the awarding system is broken down into Round 1 and Round 2.

Below are examples of specific art form grant recipients for 2016, which are identified as bursaries, both in the form of Visual Arts and Dance.

(www.artscouncil.ie, 2016)

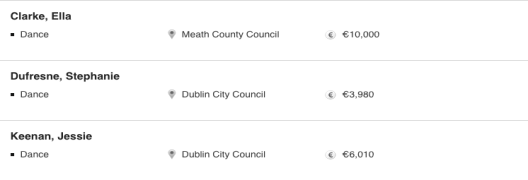

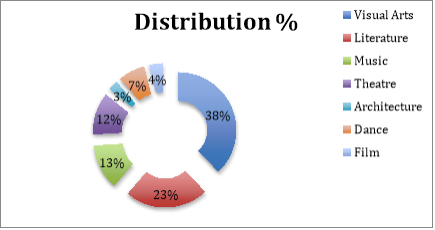

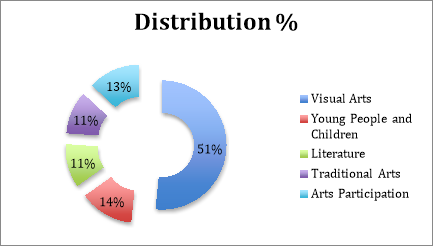

The purpose of the bursary award is to support professional artists to develop their art practice. It provides artists with the time and resources to think, research, reflect and critically engage with their art. The maximum amount awarded is £15,000. Having thoroughly analysed all the granted bursary award’s for 2016 from the arts councils website, I have collated the amount awarded to each recipient of each art form and used their data to develop a chart representing the distribution margins. See below for 2016’s round 1 and round 2 distributions.

Round 1.

Round 2.

The most evident representation of these graphs lead to the heavy percentage in favour of the visual arts. The combined % of both round bursary allocations amounts to just shy of 43% of the overall 2016 bursary budget.

In addition, the % of the total bursary allocations for 2016 as a % of 2016’s entire budget of £59.1 million was just shy of 2%.

(b) Cross Art form Practises

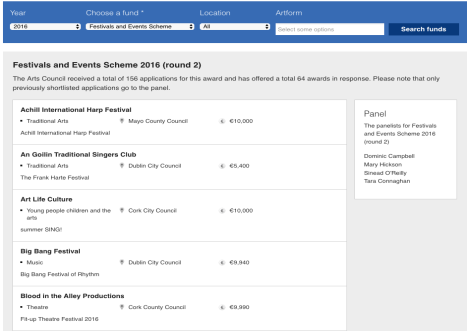

The Cross Art form practises are the second category of funding provided. It entails a more complex awarding system when contrasted to the individual artist’s bursary award and usually grants higher sums due to the larger size of organisations involved. The areas recognised within this funding initiative are Venues, Touring, Local arts, Festivals and events, Arts Participation and Young people, children and education. This funding can be applied for under Group, individual, local authority or organisation type.

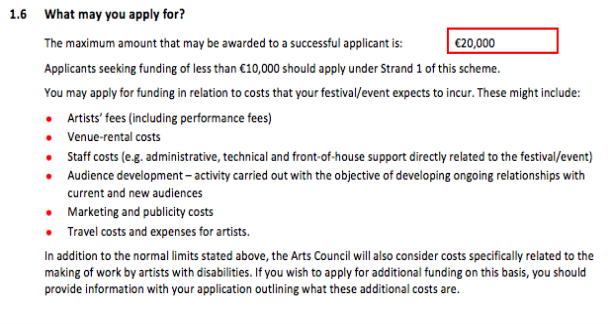

The festival and events scheme is an example of a cross art form practise award with a maximum sum of £20,000, it can only be applied for under an organisation application type. This means that the application type may be collaborative or singular but must be made in the name of the organisation at hand. An interesting financial factor surrounding this application type, which also applies to other categories within the art form practises category, are the two awarded strands of funding available.

Strand 1 funding amounts to £10,000 and strand 2 amounts to £20,000. Selection of the correct strand during applications must be adhered to; an excerpt, 1.6, taken from the second strand application form can be seen below; these strands also apply to other schemes under the same guidelines across the cross art form practises category. The strands can be defined as follows”

Section 1.6 of Strand application 2

This guideline of financial stranding is to help the council articulate who has been already funded previously and by what amount. This provides clarity not only financially but also provides an even playing field for emerging festivals who are easily overshadoweed by successful applicants from previous years. See examples of 2016 succesful reciepts and amounts awarded below:

(www.artscouncil.ie, 2017)

(c) Strategic Development

The strategic development plan is a much broader funding scheme and runs in accordance with the arts councils new strategy first outlined in September 2015. The published strategy is called:” Making Great Art Work: Leading the development of the arts in Ireland (2016-2025) ” Jane Dillon Byrne stated that:

“The strategy prioritises the artist and public engagement, and looks to develop the conditions, infrastructure and environment to enable artists and organisations to make great work and to encourage people to access and participate in that work.” (Dillon-Byrne, 2017)

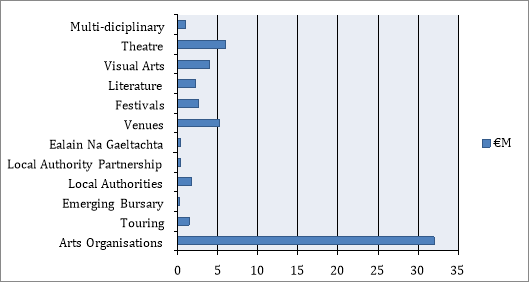

The main elements of the councils investment of £60.1m for 2016 are as follows:

£6m awarded to Theatre

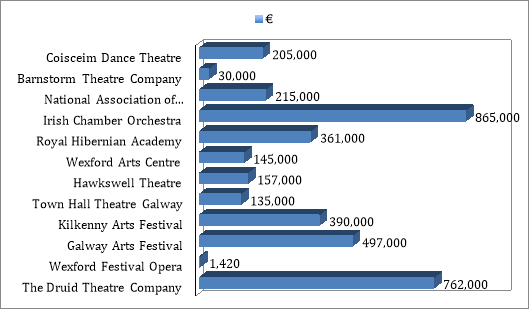

£6m awarded to TheatreBelow are two tables I have conducted which represent 2016’s data levels of expenditure. Table 1 represents the overall artistic fields and table 2 represents the individual organisations.

Table 1.

Table 2.

In addition, regarding the most prolific individual organisations, the council have largely kept their funding similar if not the same to 2015’s budget. The Druid Theatre Company saw its grant maintained at £762,000, as did the Opera Theatre Company with £680,000, Music Network at £515,000 and Rough Magic at £480,000. The Project Arts Centre was given a small rise as it celebrates its 50th year, its funding was increased by £26,250 to £675,250. (Mackin, 2016).

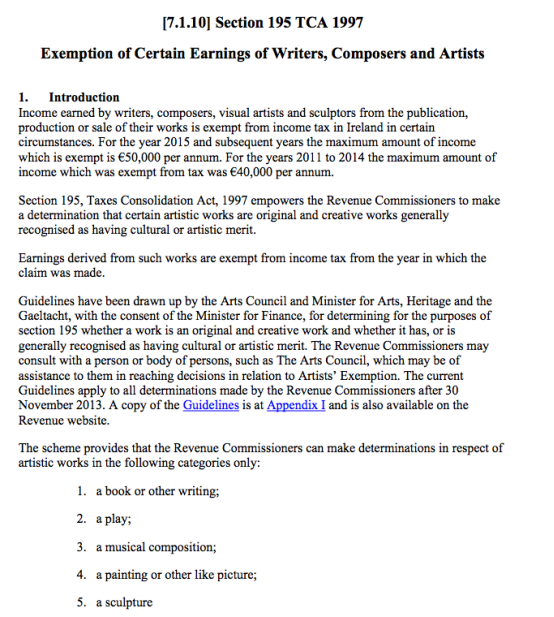

3. Tax exemption and appeals

One of the most important advances, and one which undoubtedly receives attention in this paper, is how the artist tax exemption is currently being reviewed, and how it will continue to be reviewed in the future.

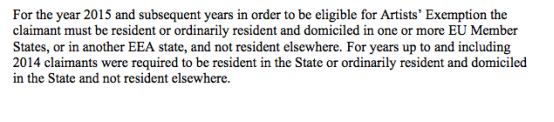

Charles Haughey brought the guidelines for the artist’s exemption into place in 1973 to support local talent and to attract artists to settle in Ireland. They exempt artists from paying tax on the proceeds of original works. Likewise, all awards given in aid of artistic development from the council, similar to that of earnings, are also tax-free. Having conducted much research into the field of artist taxation some interesting findings have come to surface, the tax exemption may well be in line for future tweaking. The Irish Times states in a publication late last year that;

” In 2011, a cap of £40,000 was placed on the amount of artists’ income exempt from tax every year. This was increased to £50,000 from January 1st, 2015 and it is described in the report as a “more targeted” scheme, aimed at supporting artists on low incomes.” (Hancock, 2016)

Jane Dillon Byrne added “The legislation allows the Revenue Commissioners to make determinations in respect of a range of artistic works, including a book or other writing, a play, a musical composition, a painting or a sculpture. It must be noted that the intervention of revenue in the artistic decision making process is a sensitive matter for the arts council” (Dillon-Byrne, 2017)Further information regarding this can be found in theappeals section under this heading.

Information published by the Irish Times, stated that in 2014, which is the most recent year for which data is currently available regarding artist taxation, states that;” 2,640 artists availed of the exemption at a cost of £5.8 million to the exchequer. That’s an average of just under £2,200 each ” (Hancock, 2016)

A review was undertaken for last year’s budget, with a recommendation from the Department of Finance to review the scheme, with a view to possibly introducing income averaging for artists. The budget document stated it recognises where the profit level is increasing, and that income averaging would reduce the amount of tax to be paid and improve cash flow in the short term, similar to that of farmers, who utilise from a current system, under the common agricultural policy (CAP).

Having personally assessed the value of such a change I would have to argue as to what would happen if profit levels reduce and tax liability is increased when compared with the actual liability for that year alone. How will artists respond to this, as well as being thrown into the same pen as farmers. (Hancock, 2016)

Appeals

Arts council applicants can appeal against a funding decision on the basis of unfair application, alleged infringement or a deviation from the councils published procedures. Like all financial processes there is an application format that must be adhered to. Firstly applicants must show that they have reasons to believe that their application was dealt in an incompatible manner. Secondly the applicant must contact the head of the team or service dealt with previously.

In the case of a second financial rejection, the applicant has an additional opportunity to appeal the decision; this must be made directly to the director of the arts council.

Having spoken with Jane she made it apparent that in the past there has been controversy surrounding the appeals decisions and processes, particularly in the field of literature where taxation, or tax evasion has come into question. Disputes between revenue and the arts council, where the arts council has argued that the latter has undermined its role in the artistic assessment of works has come to surface in recent years.

New correspondence released under the Freedom of Information Act has revealed the level of exasperation within the Arts Council about both the number and type of non-fiction books that are granted the artist’s exemption. The revenue commissioner’s guidelines state that non-fiction books should be considered if they are on an artistic or cultural theme such as a biography or autobiography of a writer or painter. (See section 195 of taxes consolidation act in appendices) However a past publication from the Irish times states that:

” Sportspeople including Irish rugby out-half Ronan O’Gara, Kilkenny manager Brian Cody, GAA manager Mick O’Dwyer and pundit George Hook have also received the exemption, though the Arts Council does not believe sports books should qualify ” (www.irishtimes.com, 2013)

In addition, the arts council advises the revenue commissioners on whether a book should be eligible. It claims to provide expert advice in the event of an appeal by an author, yet during my research I came across an additional excerpt from the Irish times which puts the credibility of its assessment further into question;

” Between 2004 and last year there were 46 appeals by writers who were judged to be ineligible for the tax exemption by the Arts Council and the majority (56 per cent) succeeded in their appeals ” (www.irishtimes.com, 2013)

From this guideline, I would advise anyone who has applied in the literacy category and who has been refused in 2017 to appeal their decision. You have a 56% chance that you will be awarded your desired funding. In addition, literature is the second highest percentage bursary allocation. If we refer to my graphs in the art form section we can come to the conclusion that literature makes up (172,550+43,420)/(739,353+397,005) x100=18.9% of 2016’s Bursary award.

5. Conclusion

Having researched this topic thoroughly some very interesting conclusions can be drawn. First and foremost the annual budget presented by the department of Arts, Heritage and Culture is the deciding factor regarding allocation amounts to the different sectors of the arts. This budget rises and falls every year. A huge emphasis today is put on the strategic development plan titled creating good artwork (2016-2025).

This plan holds the councils best interest at heart and this can be seen in its allocations last year of over £31 million to organisations across the country totalling 54.1% of the overall budget. In addition the artist’s bursary is still a huge element of the councils funding and decision making process with 1.9% being allocated across the arts to individual artists. This is a significant sum considering the diversity of the councils awarding system. Visual arts still remains the primary area of funding regarding the bursary amounting to 42.6% with literature coming in as the second most popular at 18.9%.

What are also very interesting are the examples of controversy surrounding revenues relationship with the arts council. When one considers the arts council they are led to believe that it is an organisation who are fully committed and effectively competent in performing their duties, and for the most part they are just that, however in the past instances such as Bertie Ahern’s tax exempt biography as well as many others show that there still can be elements of political will creeping through what appears to be a well run organisation.

As long as the artists tax exemption exists under section 195 of the taxes consolidation act, I believe there will always be a clash of interest between the exchequer amounting pressure on the council and the council defending its position as the governing body for the arts.

Appendices

1. Taxes consolidation act 1997 for the Artists Exemption Scheme.

(www.revenue.ie, 1997)

(www.revenue.ie, 1997)

2. Management of funding

Having spoken to Jane Dillon Byrne, and in particular about her position as a past board member for the arts council from 2002-2007 I gained a valuable insight into how the management delegates funding within the organisation. The annual report gives evidence to where exactly past funding has been allocated, however, it does not give an account of the decision making process and the individuals involved who are responsible for the funding reaching its final destination.

Jane described the organisational structure of the company and used this as a template to further expand on the financial decision making elements of the organisation. Similar to most businesses there is a director of the organisation, the director divides the council into a number of committees and each committee appoints an arts officer, 11 in total, one for each art form. There is an additional officer, the finance officer, who takes into consideration the expertise of the other 11 officers and essentially pushes the red button when the final financial decisions are made.

Within these committees panellists are chosen for each art category and art form, there can be any number of panellists for each art form, which can include invited guests, however there generally is around 5 panellists. Jane went on to describe how the funding is then decided amongst the organisational structure.

” The annual budget which has been assigned by the department of Arts, Heritage and Culture is presented to the board, the board members along side the 11 arts officers, the finance officer and the director decide the sector allocations. From this point the panellists assigned to each art form then decide on the individual artist/organisation allocations.” (Dillon-Byrne, 2017)

In addition, Jane continued to talk about how the council currently employs 41 full time staff who are all paid via the exchequer. I went on to ask Jane were the board members, the arts officers and the director paid, Jane stated that”

“Board members are not on salaries, however they do receive perks such as transport, accommodation, lunch, dinner, drinks and so forth, essentially board members are well looked after surrounding the dates that they are working within and for the council. The director however does receive a complementary fee of in around £5,000-10,000 euros depending on the year” (Dillon-Byrne, 2017)

3. Payment templates

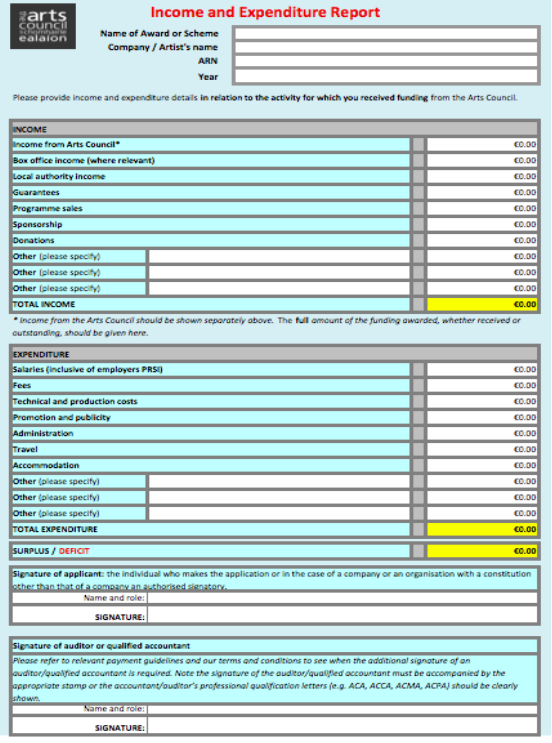

One of the conditions of being a successful applicant to council awards such as bursary awards, commissions awards and project awards is that the recipients must report on their award and supply receipts and other financial information regarding their expenditure to the council.

If we take for example the artists bursary award, a recipient will receive two documents along with their letter of offer, which clearly outlines a payment guide and the terms and conditions of the arts councils funding.

This process ensures that the council is fully up to date with how the artist manages their financial award and prevents misconduct on the behalf of the artist where the may use the finance for means not related to their work.

The appendices section of this paper provides an example of an income and expenditure report. Similarities can be drawn between this income and expenditure form to the profit and loss balance sheets our class as arts management students have worked with over the last 4 years on excel.

3. Income and expenditure report

You have to be 100% sure of the quality of your product to give a money-back guarantee. This describes us perfectly. Make sure that this guarantee is totally transparent.

Read moreEach paper is composed from scratch, according to your instructions. It is then checked by our plagiarism-detection software. There is no gap where plagiarism could squeeze in.

Read moreThanks to our free revisions, there is no way for you to be unsatisfied. We will work on your paper until you are completely happy with the result.

Read moreYour email is safe, as we store it according to international data protection rules. Your bank details are secure, as we use only reliable payment systems.

Read moreBy sending us your money, you buy the service we provide. Check out our terms and conditions if you prefer business talks to be laid out in official language.

Read more