Abstract

For the past decades, mathematicians have been able to crack and formulate innovative approaches towards the pricing of various financial derivatives, they still have not figure out the sure and easiest way to correctly price American options. It is still an active field of research within the quantitative finance world. As compared to European options, there exist no easy way to price American options.

Various approaches have been put forward and exist in the literature on how to solve the valuation problem for American options. They each vary from one another. We would be discussing some of them during this thesis such as the optimal stopping formulation, partial differential equations, free boundary formulations.Some are purely numerical in nature and employ finite difference schemes or binomial/trinomial tree methods while others put more emphasis on the analytical work. Some approaches end up working with integral equations, in which the early exercise boundary features as an unknown. One of the most heavily used techniques is the Longstaff-Schwartz algorithm, which is based on Monte Carlo ideas and which tries to approximate the early exercise boundary by a least squares regression of the continuation value onto a certain set of basic functions.

The aim of this thesis is to compare the different approaches and identify the easiest way that can be used in the valuation of American options. Moreover, we would be discussing what kind of future does financial derivatives (options) have. Although comparing the different approaches with one another would require a certain coverage of numerical data, this thesis would mostly be widely conveyed in a literature format with a few numerical requirements.

Table of Contents

Notations —————————————————————————————–4

2.1.4.1 Feynman-Kac Model————————————18

2.3 Other Pricing Models

2.3.1 Optimal-stopping formulation———————————–21-23

2.3.2. Free-boundary formulation————————————–23-24

2.3.3 Linear complementarity formulation—————————24

2.3.4 Stopping rules and parametric approximations—————24-26

Notations:

Chapter 1: Introduction to Financial Derivatives

The success of financial markets depends largely on educated and informed investors who know the risks they are facing and understand the potential for profit but also the probability for loss. It is mostly the financial risk undertaken by financial institutions and individuals that encourages changes in stock market prices, interest rates or exchange rates. Financial instruments for the management of such risk have been developed. They are called financial derivatives. Their values are derived from the price of underlying assets, which could include stocks, bonds, interest rates, foreign currencies and options. “The modelling of financial derivative products is a fast-growing area of applied mathematics with ‘real-world’ applications to problems originating from the industrial revolution.” Such instruments were developed to control the spread of risk caused by adverse changes in the market. They also provide the opportunity to make significant profit or loss for those prepared to accept risk.

As we will be mainly discussing pricing methods for American options, it is rightly to include this quote from the New Palgrave Dictionary of Economics where Ross (1987) says:

This does not mean, however, that there are no important gaps in the (option pricing) theory. Perhaps of most importance, beyond numerical results…, very little is known about most American options which expire in finite time…Despite such gaps, when judged by its ability to explain the empirical data, option pricing theory is the most successful theory not only in finance, but in all of economics.

The structure of this dissertation will be split into different chapters. In Chapter 1, we would give a brief introduction on Options and find out about the factors that affect them. We would also look into the various positions and types of options mainly focusing on American options. Chapter 2 would then introduce us to the various pricing approaches and their validity to the modern trading structure while again emphasising on American options. In Chapter 3, we would further discuss the Monte Carlo Simulation, its properties as well as drawbacks. Chapter 4 will provide us with some insight concerning numerical solutions for American puts. Finally, in Chapter 5, we would attempt to compare and differentiate between the different approaches. We would then conclude this thesis by summarising what we have achieved throughout our research and give a final verdict on pricing American options.

An option is a financial contract between two parties; the buyer (also known as the holder) and the seller (also known as the writer). An option gives its holder the right, but not the obligation, to buy or sell an underlying asset at a fixed price in the present. More precisely, A call option gives its holder the right to buy an underlying asset by a maturity date at a fixed price. A put option gives its holder the right to sell the underlying asset by a maturity date at a fixed price. If the price of the underlying asset moves in such a way that the price agreed by the option becomes unappealing, then the holder of the option may simply choose to disregard it. Options provide protection against negative movements while preserving the ability to gain from profitable price movements. However, these benefits of option contracts, relative to the other derivatives, must be paid for in the beginning in the form of an option premium. The Options contract can be further expanded into two categories: European and American.

It is a distinction which has nothing to do with the geography of the world. A European call option is one which at a prescribed time in the future (the expiry date) the holder of the option may purchase the underlying asset, for a fixed amount (the strike price). Likewise, a holder can exercise a European put option to sell an underlying asset for a future price at a fixed time. Such an option is usually termed as a ‘standard derivative’. American options can be exercised at any time up to the expiry date, whereas European options can only be exercised on the expiry date itself. Apart from the traditional European and American options, other options have also been developed known as the exotic options.

Since the early 1980’s, banks and other financial institutions have been creative in designing non-standard derivatives to meet the needs of clients. Such an example is the non-standard American option in which early exercise is restricted to certain dates known as the Bermudan option. As a matter of fact, the Bermudan option is the combination of both the European and American option. The Bermudan option can be exercised on the maturity date and any specified dates between the day of purchase and the maturity date. Other than the Bermudan options, we also have the Asian options whose payoff is determined by the average underlying price of an asset over a pre-determined time rather than on the maturity date. It also known as the Average option.

One would expect to make significant return from their trading which is not always the case. Since the option confers on its holder a right with no obligation it has some value. This must be paid for at the time of opening the trade. Conversely, the writer of the option must be compensated for the obligation he has undertaken. The questions to be asked here are:

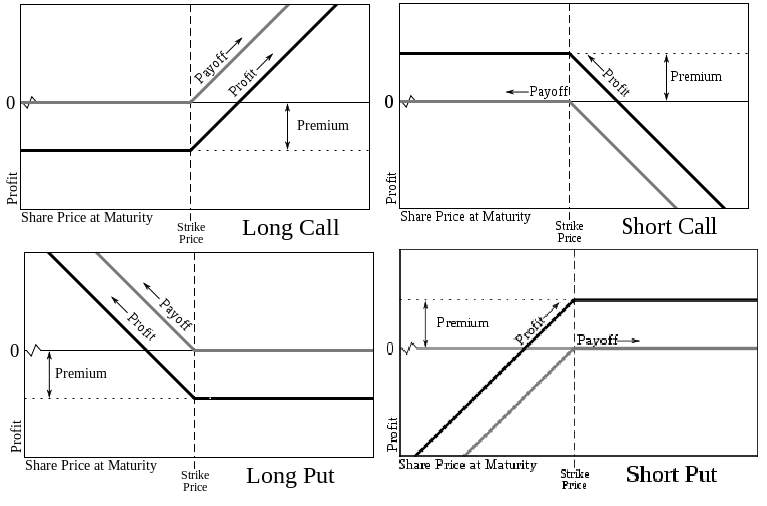

There are two sides to every option contract. On one side is the holder who has taken a long position (i.e., has bought the option) while on the other side is the writer who has taken a short position (i.e., has sold the option). There are four types of option positions:

A long call signifies that the holder owns the underlying asset. On the other hand, when an investor buys a call option, he does not own the underlying asset.

A short call means the sale of a call option that gives the holder the right, but not the obligation, to buy an option at a given price.

The long put is one where the investor buy put options hoping that the price of the underlying asset will go significantly below the strike price before the expiration date.

A short put happens when if an investor writes a put option, then the latter is in the obligation to buy the shares of the underlying stock if the put option holder exercises the option, or if the option expires.

Figure1

Speculative traders make money while taking advantage in the options markets by using options as tools to exploit views about economic factors. In order to successfully manage the options, we need to have a minimum knowledge about the factors affecting the options such as:

| Factors affecting Option Prices | Notation |

| Price of underlying asset/stock | S |

| Strike price of the option | K |

| Time to Maturity | T-t |

| Volatility | σ |

| Riskless interest rate | R |

| Present value of dividends from |

You have to be 100% sure of the quality of your product to give a money-back guarantee. This describes us perfectly. Make sure that this guarantee is totally transparent.

Read moreEach paper is composed from scratch, according to your instructions. It is then checked by our plagiarism-detection software. There is no gap where plagiarism could squeeze in.

Read moreThanks to our free revisions, there is no way for you to be unsatisfied. We will work on your paper until you are completely happy with the result.

Read moreYour email is safe, as we store it according to international data protection rules. Your bank details are secure, as we use only reliable payment systems.

Read moreBy sending us your money, you buy the service we provide. Check out our terms and conditions if you prefer business talks to be laid out in official language.

Read more